1Tap Receipts HMRC Tax Scanner

Self employed workers – Tax season is almost here. 1Tap Receipts makes your self employed HMRC tax return as easy as one quick snap with its convenient auto-populate feature.

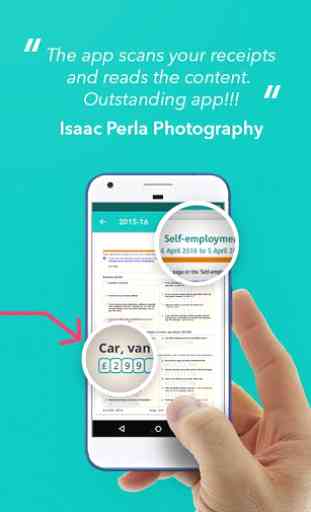

Scan receipts and invoices by snapping a photo. 1Tap will extract the supplier, date, amount and self assessment tax category for you with UNBELIEVABLE accuracy. Expenses and receipt data will be used to pre-populate your HMRC Self Assessment. You can even see what types of purchases you can make with your tax savings! How high can your savings go?

Remember a £100 receipt is £20 less to pay at tax time for many self employed people in the UK, so snapping receipts boosts your income just like working longer hours!

1TAP RECEIPTS FEATURES:

Self Employment Tax Calculator

- Self employed? Tax time doesn’t have to be painful. Simply snap your receipts to get started

- Our scanner extracts key information and automatically updates your Self Assessment

Receipt Tracker & Invoice App

- Receipt scanner instantly finds and logs relevant information from your receipts

- Invoice data is scanned right to your HMRC pre-assessment for fast filing

HMRC Tax Categorisation

- HMRC tax calculator automatically fills out your pre-assessment, saving you time

- Come back to make manual changes if needed

- HMRC now accepts photos as proof of your business expenses. Simply snap your expense receipts to make sure you’re getting the most money back

- 1Tap Receipts even checks for deductions to get you the best tax return

Turn Expenses Into Cash

- See how much money you’ve saved on your HMRC taxes

- 1Tap will even suggest rewards that you could buy with your newfound cash. Treat yourself!

1Tap is Perfect For:

- Sole Traders

- Contractors

BUDGETING YOUR TAX RETURN IS EASIER WITH 1TAP PRIME:

- Unlimited receipt scanning

- Invoice your past expenses with comprehensive CSV reports

- Save receipt data with up to 50GB storage

- Receipt processing is up to 2x as fast

Self employed and sole trader individuals have some serious responsibilities. Nobody goes into business to spend endless hours mired in stressful accounting work. 1Tap Receipts offers a smart, fun, and easy alternative that makes budgeting your tax return and finances for tax time hassle-free.

HOW IT WORKS:

1. SNAP A PHOTO: Open 1Tap Receipts and snap your receipt or invoice.2. EXTRACT EXPENSES: Data from your receipts and invoices will be automatically extracted and placed in the correct HMRC expense category.3. VIEW YOUR HMRC FORM ANY TIME: Your HMRC Self Assessment is always on hand so you can see how your tax deduction is shaping up.4. SAVE AND SHARE RECEIPTS: Your receipts and invoices are safely stored, so you can share them with your accountant or whoever else may need to see them.

Check out the reviews or better yet, try it out right now with the worst receipt you can find and see how it goes!

Category : Business

Reviews (26)

This app use to be great. Now all I have are issues. I don't get my unlimited scans that I paid for. Customer service solution was for me to cancel my plan and repay my membership fee through their website instead of the app. I'm not paying twice for the service. Also, it sometimes just won't work at all. I can't even input my expenses. Waste of money.

Super practical as a concept. The only thing that is far from perfect is the camera function. My phone camera is not the best but it is decent and never gives me problems outside of this app. When I take a photo of a receipt I must make sure that it is dark and close so that the flash goes off. Otherwise the picture is completely blurry and fails to get processed.

Generally works well, but very disappointed that they have dropped the ability to do a manual entry. Something I use a lot. And no, doing it from a browser, although possible is not convenient 'on the go'. Unless they sort it out won't be renewing my subscription in January. Edit: In response to your comment to email you. I already did that. Hence the review. In your email you state "as of the moment, we don't have much information when or will this feature is gonna placed back to 1tap."

Working well so far. One of my transcribe did duplicate and when I deleted one of them, both were removed. This is something I will keep an eye on as I input each receipt and is something other users have experienced. Forwarding emails from any email address is super useful, other apps only allow receipts to be forwarded from one specific email address. I really like the ability to edit the tabs also, just what I need.

Extremely useful, easy to use, quick and simple. If you have a lot of fiddly little expenses e.g. buying stamps it's great to take a photo of the receipt and send it in straight away. The email function is great too, now when I buy online e.g eBay I can easily forward the email and that's it in my books! I've got the 1tap Tax app too, so I can see my business balance straight away.

This is a great app and has transformed my book-keeping. My only criticism is that there seems to be a glitch where sometimes after a receipt is scanned, it is listed twice. If you try to delete one, they both go. However, it doesn't seem to add the value twice which is good. Otherwise excellent.

This App is OK - the pricing is a bit confusing, my year just renewed I was charged twice for this year's subscription, £24.99 and then £49.99 the following day. One tweak I would suggest would make this app awesome would be being able to scan Credit Notes, i.e. refunds. I e. if I return one item of a receipt and I've already scanned the receipt it would be great to be able to scan a credit note rather than have to delete and add up manually.

I have a paid plan. Obviously. And initially this worked well. But there are problems 1 receipts are getting stuck and not processing. Today, snapshot I took with the app was stuck for about 3h processing. The receipt I emailed at the same time isn't even processing yet. This has been happening on and off and is really annoying. Tickets opened with 1tap are not making a difference. 2 vat extraction is more money. So I can't even capture this manually 3 no image cropping Should I expensify???

This app no longer allows me to upload digital receipts. I used to be able to that . Now I don't have any options when I click the camera. It does not allow to add the digital receipts in my gallery . It just wants me to take a picture . You need to be aware of this glitch and correct it

Ok, I used to love this app. But now I can't do manual expenses entries and all I can do is email it which half of the time comes back as failed. I do not want to be waisting my time with this. Fix it!! Another thing when I make a manual earning entry by photo the photo used to be the first one, now for some reason it has flipped and the photo I need is all the way down at the bottom which means I have to scroll for way too long until I reach the photo I need.

Ok so when I first installed app worked well ... A year on and it's nothing but a headache..... Receipts duplicating, missing reports and when i download reports it says it can't open files ..... What went wrong 1st tap. I was told to logout and in again which helped about 70% of the duplicates but now all my reports are missing and all I get is...."oopps we encountered a problem" and eventually logs in but again no report....HELP!!!

Everything seemed to be working fine. I've got an appointment with the accountant in a few days and going through everything I've noticed many duplicate entries. I've been deleting them and it's taken loads of both entries off! Now I'm lost as to how many receipts I've deleted. I'm really starting to panic now.

My subscription was renewed with no reminder that it was upcoming. I contacted the company to cancel and get a refund the day the money came out my account and they agreed. Over 2 weeks later I am yet to receive the refund and any emails regarding the case are being ignored by the app. I have had to open a dispute with PayPal in an attempt to get my money back.

It is the absolute best software for digitalizing receipt and easy accounting - very simple to use and fast to scan in. The download is an absolute treat! It really puts fun into tax preparation! It takes no time to prepare and one click to download account when you need it! Voila! I would recommend this to everyone! Happy accounting!

Was working fine but now unable to upload receipts or image. Paid via Google pay hoping it would then work but just the same. You know it needs updating but nothing has been done. Now using QuickBooks & that works great.

Been using this app 4 over a year now & pay 4 unlimited scans. The past few months photos have not been uploading. Left with a huge pile of receipts in reserve. I recently contacted the help line 2 be told 2 uninstall & reinstall the app. Having done this it now won't let me log back into my account. Have been waiting four days for a response from the help team and heard nothing. I'm not sure if I have now lost all previously logged expenses. This could cost me thousands in my tax return.

Latest version no longer compatible with Android 4.1. This is the last version of Android for slide out keyboards. These devices are *very popular* in the disabled community which is why we don't upgrade. Back port it to Android 4.1. Android developers that drop support for Android 4.1 are practicing discrimination against the disabled community.

I use this app every day to keep up with my fuel and maintenance receipts. So far I have not had one issue. Even on more confusing receipts it had do e a great job. My only wish is to have a way to enter the mileage per receipt. Other than that I enjoy all of its features.

didnt like the app, wasnt using it. recent problem just proves it its a cone! app has no cancelation option at all in app or either on pc when log in to the account. no card edit option at all etc.I was charged for next year subsctiption...without any warning reminder this would be charged....you will have no access to this settings of payment for this app or subsctiption of this app... no control at all!

When the app works then it's quite simple but most of the time the app doesn't work. I have tried deleting cache and restarting phone and sometimes works but not most of the time. Very annoying as apart from that it seems quite good

Exactly what I have been looking for so long. It reads the receipts, and organize it, alert you when it's out the norm. I am so glad I found it. I feel like a super hero now when facing piles of receipts, never frustrated anymore.

I removed the app as it wasn't working, I got refund but now 1 year later they took £49.99 from my bank acc?????? F scammers. It's possible thanks to googlepay ! I haven't purchased any other subscription (if so were is any confirmation of the 2nd subscriprion?), I had two email addresses connected to 1 googlepay app! So far I have't got any reply from you, any refund.

Used to be good. But the customer service dep takes forever to get back to you. For something simple like 'Checking when my account expires, or what type of account I've got (prime etc), when payment is due', I've been waiting nearly 2 weeks and still not heard. 'investigation is ongoing'.. Frustrating to say the least. Would be handy if there was a way to check all these details by yourself too.

I have searched for months for an app that does simply what 1tap does. I want to scan Receipts, extract data and allow editing. You did it. Just did monthly expenses in under 15 minutes. tThis app is amazing!!!! Well done 1tap!

I've been using one tap for quite a long time now and oh my god you still have not added any search function on the mobile app. I need to find an expense from a retailer and I can't Even search for the retailers name on the app. I won't be paying for another yeah of this service until I actually see simple features finally get added.

Ongoing technical problem with it and very poor customer service. I've had an unresolved issue (it's not possible to upload receipts manually) which I've repeatedly contacted the company about for the last two years. They do not deal with the issue and are very poor in communicating. I would therefore not recommended 1tap to anyone, which is a pity, since in other ways it would be a useful way of keeping on top of your accounts. FOLLOWING YOUR REPLY TO THIS REVIEW, I EMAILED & IT BOUNCED BACK!!