Clarity Money - Manage Your Budget

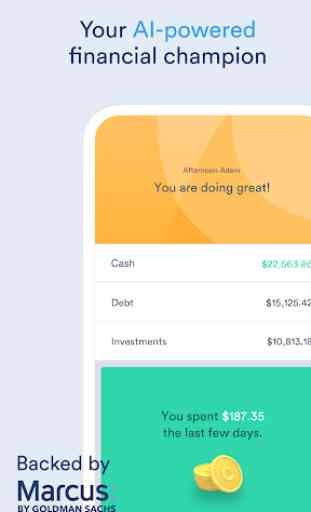

Our free app uses machine learning to analyze your personal finances and help you make smart decisions about your money. Take control of your budget and expenses and discover ways to save more with help from Clarity Money.

Clarity Money can help you...

- Save time: Organize your bills with automated expense tracking

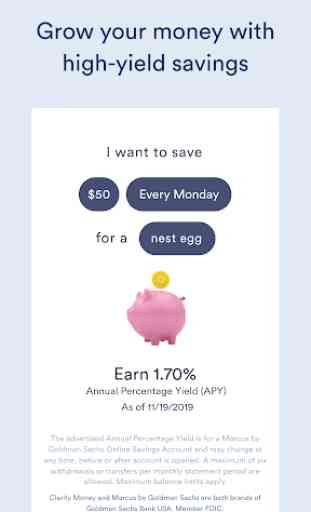

- Save money: Cancel subscriptions & automate your savings with a Marcus Online Savings Account

- Stay organized: Track your budget, spending, savings, debt and investment accounts in one place

How our AI powered financial management app works:

- Quickly link your financial accounts to Clarity Money. Thousands of financial institutions are supported, including Chase, Bank of America, Capital One, Wells Fargo, Citi, and American Express.

- The app uses data to give you a clear view into your financial choices and tools to help take control of your financial life.

- Your information and data is protected by multi-level safeguards.

Clarity Money User Testimonials:

-"I feel that it really helps keep me accountable for my spending…it's rewarding to see the progress that I make in changing my spending habits."

-"Love being able to save money without thinking about it.”

-"You all are a much better alternative to my actual banking app....this greatly impacts my spending habits as I now have more of an idea where my money has been going..."

Clarity Money’s Press Accolades:

-"Clarity Money is an accurate name for this handy app that provides a literal sense of clarity as it helps you save money, plan budgets, track all of your expenses, monitor your credit score, and more." – Buzzfeed

-“Clarity Money is [a] nicely designed budgeting app that makes routine financial tasks easy to execute.” Time.com

-"Clarity Money is a budgeting app that not only helps you put aside money into a savings account, but will also help you cancel any subscriptions you're not using..." -Mashable

-Featured as Apple’s “App of the Day” on 7/10/18

Download Clarity Money today!

By downloading and using Clarity Money, you agree to our current Terms of Use (claritymoney.com/terms) and Privacy Policy (claritymoney.com/privacy).

Category : Finance

Reviews (30)

Great app for keeping track of my finances! Helps me see where I'm overspending, as well as keeping an eye on my credit debt; love that I can also keep a quick eye on my credit score (just one but makes me happy when it goes up, slowly but surely). I did have an issue previously with transactions showing up twice, like stating that I was earning double than what I actually do. But once I uninstalled then reinstalled the app it worked just fine with the correct amounts.

This is just what I was looking for! I wanted an app where I could see all of my spending from multiple different credit cards and bank accounts in one spot. It's a very simple and clean interface and easy to see your most recent transactions in one consolidated list from all accounts! It's also easy to exclude/hide accounts you don't want to be included in the calculations which I really like. I have some joint accounts under the same login and didn't want those to show as part of my summary.

The idea is solid but the functionality isn't there. I like that it links to accounts and tracks, but the information is inaccurate. I repeatedly change categories, they don't stay changed, for example. It counts some transactions twice, so it shows by balances to be twice what they are. It's too bad the functionality isn't there because the idea is good.

Very helpful to use as a supplement to our normal Excel budget spreadsheet - a lot of the manual entry work we used to do is done for us. The layout makes sense and is useful. Over time, and as we learn to trust the software, I can see us gradually letting go of our old system. There are two revisions/updates that would make Clarity much more useful for us: 1. The ability to rename accounts, and create/rename spending categories. 2. The ability to rearrange windows on the dashboard with a drag/drop action. Overall, I would recommend it, and I think all of these programs will continue to evolve into very useful tools. Thanks!

Love the spending categories, amounts and habits. Overall a neat and interesting app. My income varies so it would be nice if the income for the month automatically loaded into the income pie chart where you can see how much you have left or have overspent. Also would be nice to be able to put in a budget easily for everything, the way I do in a list format in Microsoft Word.

So far, a huge quality of life improvement for me. I think it also has a great look which is what made me choose this over other money manager apps. I do feel like there could be more features. The pie charts are awesome, but an overall pie chart that puts all the categories together is missing. It'd be easier to see and compare things in one chart. I hope to continue to see updates! I'm rooting for this one. EDIT: stopped working. crash on startup

Great concept, but poor execution for one reason: duplicate entries. I have both my PayPal account and various credit card accounts linked to the app. When I make a payment with PayPal, it shows up in the app twice: once as the PayPal entry and again for whatever credit card I used to make the purchase. As a result, Clarity Money reports my spending as nearly 2x actual. You're probably thinking, "Well, then just unlink your PayPal account," but it's not as simple as that. I also receive money via PayPal and make many purchases using my PayPal balance, and those transactions wouldn't show up if I unlink/ignore the account. The whole point is accurate, complete reporting and budgeting, so excluding an account defeats the purpose. If they could fix this, it would be a five-star app. Until then, however, I can't trust it for any meaningful purpose without scrutinizing every line and excluding transactions one by one.

great concept, helps track everything in one place while giving you the option to invest or save money through other companies. when it comes to certain details it's not that great. it told me I played for a bill 3 times on the same day but my bank account says differently. the app could use some tweaks but it does help me realize how much I'm spending throughout the month.

I was excited to use this app, but my experience has been very frustrating. Adding my first two accounts was fine. Beyond that, after multiple tries for each account, I was unable to add any others due to error messages even when my login information was correct. Also, it doesn't seem to let you set up budgets or bill reminders in the traditional way or set your own savings goals without applying for an account with another bank. Some features were nice, but overall disappointing and unusable.

Has potential, but needs to be speedier with updating accounts. Took two days after getting paid for that info to make it to the app. I want to track my finances in real time. Also, it seems to duplicate spending reports. If I spend $500 with my credit card and then pay it off, the app thinks I spent $1000. I have to manually exclude those CC payments. Hope the app gets faster and smarter.

It is so easy to use, those graphics and how they show all your accounts also debts in one page. Then you dont have to access multiple accounts to see what you got, manage it right away when you log in the apps. I just use it, and still cant find one of my bank to sync the information, waiting for answer from their service.

I recently downloaded a different budget planner app by Intuit, and had absolutely no issues linking all my accounts. Clarity was my first choice to download, unfortunately, the app kept giving me issues when trying to link my bank account that was on the list. I tried throughout the day. Sent a message to support and was told to go to my bank online and select an option to allow access. I wasn't going through all that knowing other apps can get through no problem. Bad first impression.

Really close, but a dead miss I got this app hoping it would be a good place to actually build a budget and manage my finances in a nice automated way. The first step to that would be accurate and timely updates, and so far the app says Ive earned about 1/3rd of what I have been paid. Second of all, there are no options to add payments it doesnt automatically categorize. I pay a video game subscription, which it wont recognize as a recurring payment. The app is perfect, but it doesnt work.

The app is useful but the only thing that's not is the fact that when I change transactions to different categories, every month I have to do it again. For example with my income I changed all transactions and every month it's back under "other expenses" and makes my spending higher than it actually is. It's actually really annoying!

Love this app! So much better than anything Intuit has to offer. We've paid for QuickBooks and Mint they pale in comparison to Clarity Money. The design is beautiful, easy to use and update. Customer service is also very responsive and helpful if I'm having trouble in the app. That is something quickbooks and mint also lack. Now all we have left to do is actually stick to our budget.

Great UI but I don't like that I can't edit the names of transactions although it is possible to edit each transaction's categories. It would be great if the ability to edit the names of transactions was included in a future update. And I did notice that I had issues logging in with my fingerprint. Luckily, logging in via pin works. For now, I'll stick with Truebill.

An awesome app if you have a savings account with Marcus by Goldman Sachs. Wonderful UI. It's really easy to categorize every transaction; most of the time each transaction will already have been automatically put in the right category. However, the app should work on faster transaction updates. It can sometimes take a few days for the latest transactions to pop up in the app which can be frustrating at times when you are trying to figure out how much you have *actually* spent in the last week.

I love the app. Love how I can oversee my Wells Fargo and Discover accounts. One issue I have started seeing though is that almost all my purchases made with my discover debit card come up as "Debit Purchase" which makes it difficult for the app to categorize the transactions. For instance whenever I use it to get gas, it doesn't register it as a Shell or Chevron transaction so it isnt categorized as a travel expense or if I buy something from a store, it isn't categorized as a shopping expense. This makes it rather difficult to see how much you have spent on each category cuz it isn't accurate.

It's a decent way of tracking some expenses. There is however one minor fault with the app, which is that it groups deposits into my account with all the expenses drawn from the account, as if they were kisses rather than gains. This can be fixed using the category options to make the app ignore those transactions altogether, which is an acceptable workaround. The recurring expense cancellation feature is also really nice.

Great app! I love that I can keep track of where my money is going with minimal effort because it is mostly automated. I love the charts and graphs. They are very helpful. It is also very good at categorizing expenditures. only complaints are that I can't connect my Beehive FCU account. I wish I could add more categories, especially since I didn't see a gift category. Also, I would love to be able to split an expense into two or more categories like I could in the Every Dollar app.

great app! I love that I can look at all of my finances including my student loans balance in one place with a really nice, smooth UI. Would love if i could integrate it with venmo or otherwise reconcile when amounts that i have paid are paid back to me by friends, so it doesnt factor into my totals. If this is already possible I haven't figured out yet how to do it.

the app is meant to track your budget, but can't properly categorize the allocated funds. cant remember a deposit is income even after correcting it over and over. app has a great interface and is a great concept but functionally it just doesnt work for what it says it's meant to do, making it practically useless. contacted customer service, they kmow its an issue but ive had this for months now and it isnt corrected. I'd come back to it if it worked but I'm going to look for a new budgeting app

I really love the simplicity, look and ease of using this app. Some other apps almost have too much information that it can be overwhelming. I love the logos that the app automatically uses for things like Kroger, Chic-fil-a, etc. Those make it a lot easier to remember what that transaction was without having to read each transaction in detail. The main thing I wish it had is a budget area for each month that I can manually set, and then something for your financial goals or planning a vacation

This app is very useful and well designed. I use it as a way to view transactions and monitor my balance across card/bank accounts. I prefer this to mint/Nerdwallet as it is focused on being useful and intuitive rather than selling me things. One thing I wish it could do is show when accounts were last updated and possibly offer a way to refresh accounts. Also sometimes it gets confused and shows the same account twice for a while. I'm sure goldman sachs is harvesting my card transaction data (along with the credit card companies), but dang, this is an awesome app!

Not for me. That "C" icon on the bottom right side of the screen that pops up on the app and the web is too annoying for me. The help section didnt contain any parts about hiding the "C" popup. Its like going to a site for the first time then getting asked for feedback before you can even try it out. When/if you guys decide to put in an option on the app and web to hide the conversation ("C") popup button I would be able to use it. Great start though.

this is a very good app, it has a great user interface and shows your finances in a simple format. it does a great job of tracking finances and provides a great snapshot of all of your accounts, from banking, to credit, to loans, to investing. the only issue i have is that sometimes you may assign a certain place to always be in a certain category, and the app will place it another category the next time that expense occurs. Not a big deal to place it in its proper category though

Seemed like a pretty good app. I liked the minimalistic interface and colorful informational graphs with just the right amount of info and customizations. The only factor that led me to stop using it was the account integration options. They dont support a lot of cards. I have a PayPal Cashback Mastercard but when i connected my Paypal account it didn't connect the card too, and there wasnt any option to connect that card separately.

This app is great for checking your weekly and monthly transactions. The graphs help understand where cutbacks might be needed. Only thing that would make this even better is if it gave access to all of the previous months and possibly a year chart of expenses in certain categories. Sad to see it go.

Looked nice and colorful, but lacking in some features. Wish you could rearrange the order of the 'cards' so I see what's most important to me first. Also cannot create budgets for certain recurring bills. Disappointed that there isn't a widget like Mint so I can see a quick snapshot of my balance and spending without opening the full app.

It's a great idea. But has several issues that defeat the purpose of the app. I downloaded the app to see all my finances in one place opposed to having to open several different apps. I love the layout and the charts they provide. BUT the information takes too long to update. My debit account takes days, sometimes weeks to show new transactions on here and my credit card takes months (currently it hasn't updated since July). So it's a great idea and tool, but definitely not reliable as most of the time I still have to open up my other apps.