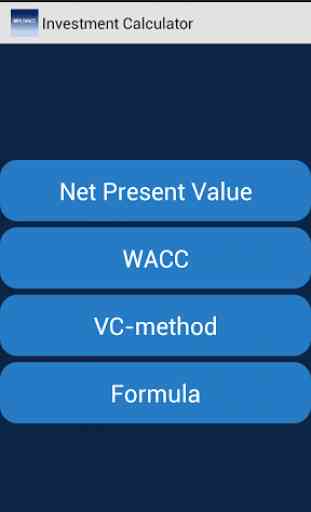

Investment Calculator

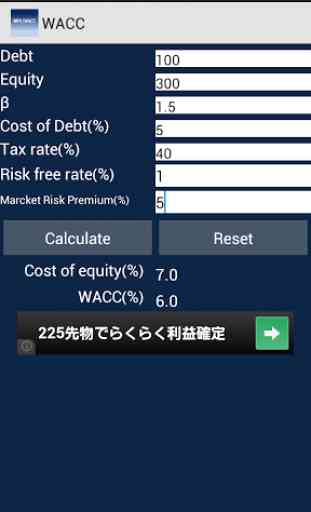

This is calculator to calculate the net present value, Weighted Averaged Cost of Capital and Value of Venture Business.・NPVThe formula for determining the present value of a perpetuity is as follows:NPV = -Investment +ΣCF_lastyear / (1+Discount rate) ^lastyear +TV / (1+Discount rate) ^lastyearTV=CF_lastyear (1 + Growth rate) / (Discount rate

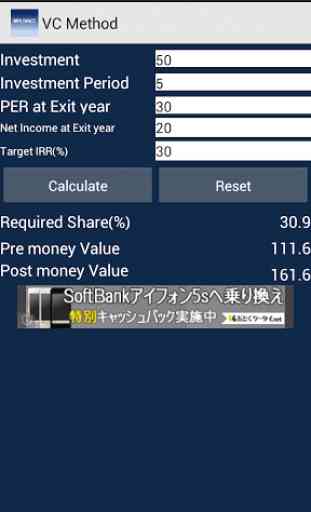

- Growth rate)CF_lastyear=Cash flow of the last year of projection periodGuess IRR(%) is a number that you guess is close to the result of IRR.・VC-methodThe value of the whole company before the transaction, called the “Pre-money valuation” is just the share price times the number of shares outstanding before the transaction.And the value of "Post-money valuation " is as follows:Post-money Valuation = Pre-money Valuation + Investment(Investment=Share Price

* Shares Issued) The relation between Target IRR and EXIT Value is as follows,Net income

* PER

* Ratio of Shareholding (at Exit year )= (1+ IRR)^year

* InvestmentTo achieve Target IRR,Required share ratio = (1+Target IRR)^investment period

* Investment / Net income *PER This is calculator to calculate the net present value, Weighted Averaged Cost of Capital and Value of Venture Business.· NPVThe formula for determining the present value of a perpetuity is as follows:NPV =-Investment + ΣCF_lastyear / (1 + Discount rate) ^ lastyear + TV / (1 + Discount rate) ^ lastyearTV = CF_lastyear (1 + Growth rate) / (Discount rate

- Growth rate)CF_lastyear = Cash flow of the last year of projection periodGuess IRR (%) is a number that you guess is close to the result of IRR. · VC-methodThe value of the whole company before the transaction, called the "Pre-money valuation" is just the share price times the number of shares outstanding before the transaction.And the value of "Post-money valuation" is as follows:Post-money Valuation = Pre-money Valuation + Investment(Investment = Share Price

* Shares Issued) The relation between Target IRR and EXIT Value is as follows,Net income

* PER

* Ratio of Shareholding (at Exit year) = (1 + IRR) ^ year

* InvestmentTo achieve Target IRR,Required share ratio = (1 + Target IRR) ^ investment period

* Investment / Net income

* PER

・NPVThe formula for determining the present value of a perpetuity is as follows:

NPV = -Investment +ΣCF_lastyear / (1+Discount rate) ^lastyear +TV / (1+Discount rate) ^lastyear

TV=CF_lastyear (1 + Growth rate) / (Discount rate

- Growth rate)CF_lastyear=Cash flow of the last year of projection period

Guess IRR(%) is a number that you guess is close to the result of IRR.

・VC-method

The value of the whole company before the transaction, called the “Pre-money valuation” is just the share price times the number of shares outstanding before the transaction.

And the value of "Post-money valuation " is as follows:

Post-money Valuation = Pre-money Valuation + Investment(Investment=Share Price

* Shares Issued)

The relation between Target IRR and EXIT Value is as follows,

Net income

* PER

* Ratio of Shareholding (at Exit year )= (1+ IRR)^year

* Investment

To achieve Target IRR,

Required share ratio = (1+Target IRR)^investment period

* Investment / Net income *PER

· NPVThe formula for determining the present value of a perpetuity is as follows:

NPV =-Investment + ΣCF_lastyear / (1 + Discount rate) ^ lastyear + TV / (1 + Discount rate) ^ lastyear

TV = CF_lastyear (1 + Growth rate) / (Discount rate

- Growth rate)CF_lastyear = Cash flow of the last year of projection period

Guess IRR (%) is a number that you guess is close to the result of IRR.

· VC-method

The value of the whole company before the transaction, called the "Pre-money valuation" is just the share price times the number of shares outstanding before the transaction.

And the value of "Post-money valuation" is as follows:

Post-money Valuation = Pre-money Valuation + Investment(Investment = Share Price

* Shares Issued)

The relation between Target IRR and EXIT Value is as follows,

Net income

* PER

* Ratio of Shareholding (at Exit year) = (1 + IRR) ^ year

* Investment

To achieve Target IRR,

Required share ratio = (1 + Target IRR) ^ investment period

* Investment / Net income

* PER

- Growth rate)CF_lastyear=Cash flow of the last year of projection periodGuess IRR(%) is a number that you guess is close to the result of IRR.・VC-methodThe value of the whole company before the transaction, called the “Pre-money valuation” is just the share price times the number of shares outstanding before the transaction.And the value of "Post-money valuation " is as follows:Post-money Valuation = Pre-money Valuation + Investment(Investment=Share Price

* Shares Issued) The relation between Target IRR and EXIT Value is as follows,Net income

* PER

* Ratio of Shareholding (at Exit year )= (1+ IRR)^year

* InvestmentTo achieve Target IRR,Required share ratio = (1+Target IRR)^investment period

* Investment / Net income *PER This is calculator to calculate the net present value, Weighted Averaged Cost of Capital and Value of Venture Business.· NPVThe formula for determining the present value of a perpetuity is as follows:NPV =-Investment + ΣCF_lastyear / (1 + Discount rate) ^ lastyear + TV / (1 + Discount rate) ^ lastyearTV = CF_lastyear (1 + Growth rate) / (Discount rate

- Growth rate)CF_lastyear = Cash flow of the last year of projection periodGuess IRR (%) is a number that you guess is close to the result of IRR. · VC-methodThe value of the whole company before the transaction, called the "Pre-money valuation" is just the share price times the number of shares outstanding before the transaction.And the value of "Post-money valuation" is as follows:Post-money Valuation = Pre-money Valuation + Investment(Investment = Share Price

* Shares Issued) The relation between Target IRR and EXIT Value is as follows,Net income

* PER

* Ratio of Shareholding (at Exit year) = (1 + IRR) ^ year

* InvestmentTo achieve Target IRR,Required share ratio = (1 + Target IRR) ^ investment period

* Investment / Net income

* PER

・NPVThe formula for determining the present value of a perpetuity is as follows:

NPV = -Investment +ΣCF_lastyear / (1+Discount rate) ^lastyear +TV / (1+Discount rate) ^lastyear

TV=CF_lastyear (1 + Growth rate) / (Discount rate

- Growth rate)CF_lastyear=Cash flow of the last year of projection period

Guess IRR(%) is a number that you guess is close to the result of IRR.

・VC-method

The value of the whole company before the transaction, called the “Pre-money valuation” is just the share price times the number of shares outstanding before the transaction.

And the value of "Post-money valuation " is as follows:

Post-money Valuation = Pre-money Valuation + Investment(Investment=Share Price

* Shares Issued)

The relation between Target IRR and EXIT Value is as follows,

Net income

* PER

* Ratio of Shareholding (at Exit year )= (1+ IRR)^year

* Investment

To achieve Target IRR,

Required share ratio = (1+Target IRR)^investment period

* Investment / Net income *PER

· NPVThe formula for determining the present value of a perpetuity is as follows:

NPV =-Investment + ΣCF_lastyear / (1 + Discount rate) ^ lastyear + TV / (1 + Discount rate) ^ lastyear

TV = CF_lastyear (1 + Growth rate) / (Discount rate

- Growth rate)CF_lastyear = Cash flow of the last year of projection period

Guess IRR (%) is a number that you guess is close to the result of IRR.

· VC-method

The value of the whole company before the transaction, called the "Pre-money valuation" is just the share price times the number of shares outstanding before the transaction.

And the value of "Post-money valuation" is as follows:

Post-money Valuation = Pre-money Valuation + Investment(Investment = Share Price

* Shares Issued)

The relation between Target IRR and EXIT Value is as follows,

Net income

* PER

* Ratio of Shareholding (at Exit year) = (1 + IRR) ^ year

* Investment

To achieve Target IRR,

Required share ratio = (1 + Target IRR) ^ investment period

* Investment / Net income

* PER

Category : Finance

Related searches