Accurate Paycheck Calculator

-

- PLEASE CHECK OUT OUR APP WEEKLY SALES FLYERS HIGHLIGHTS, FREEBIES OFFERS AND BIRTHDAY ACTIVITY . -

- Also check out our Create Happy Birthday Activity app, to have a fun birthday.-

- PLEASE SUPPORT US. PLEASE GIVE A GOOD REVIEW SO WE CAN KEEP THIS UPDATED-

- Also checkout NO ADS version of Accurate Paycheck Calculator by us.-

- App DOES NOT TRACK USER OR USER LOCATION for privacy reasons..-

- NO NEED TO ENTER ANY PERSONAL INFORMATION.-

- NO NEED TO SIGN UP OR OPEN AN ACCOUNT.-

- EASY TO USE AND SIMPLE INTERFACE.

Capture screen and save on gallery image then text, email or print.Depending on your device you can use the following triggers to capture screen:

• Hold 'Power button' and 'Volume-down button' for 2 seconds

• Hold 'Power button' and 'Home button' for 2 seconds

On some devices Hold the power button and volume low button for 2 seconds to capture the screen.

Category : Finance

Reviews (30)

We use this every week and our accountant says it's very close. Only thing we don't like is it would be nice to save your settings so you don't have to do the state and filing status everytime also would be nice if it had a spot where you could put the paydate

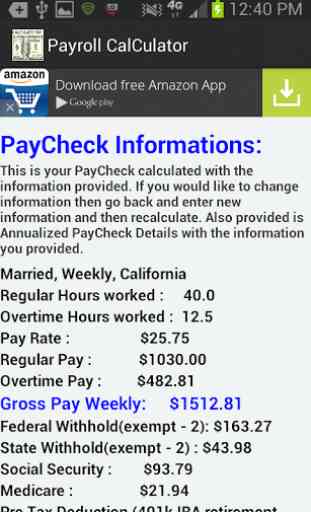

This gives you a bird's eye view of your overall distribution of how much money you're making or will be making weekly, twice a week, semi monthly and annually. gross and net earning, your tax deductions and even pre and post 401k, Dental, Health, garnishment and child support. The ads is very minimal and less annoying. I am willing to pay for a none advertisement and there is none available. All in all, I am a happy camper. Thanks!!! 🤑👌🙂

Not bad. The overall amount wasnt correct. But the information i needed to adjust it was right on screen. So a lil easy addition and i got what i needed. Not tje best. But it deserves a decent rating. It gave me what i needed

it doesnot allow to add pat rates. where I work I have 3 pay rates, this app does not accommodate that need to add additional rates. it works well if you only have a single rate.

Not even remotely accurate. Theres also no where to enter your dependents. My weekly pay here in ohio is around $1,800 I get taxed close to 400 dollars in just federal taxes. This app had it at 290

Great app! It lets you enter all your tax info and deductions.

Somewhat accurate few dollars off here and there but it comes to a round about conclusion. So its helpful

Very ugly app. Need to enter multiple hours and payrates.

The app is not completely accurate but it does give you a general idea.

It keeps crashing I don't think the update worked

I think florida taxes need to be updated its always off by something

Calculated several paychecks and its correct.👌

Quuck and Accurate! Always within a few dollars!

It was spot on when I first downloaded now its horribly off.....

total nonsense kept freezing

This app is always accurate...it is my go to!

Easy to use app

This app is right on point for my state of MA

Do not download it is a waste of time

so far its accurate to me

Way off on its calculations

Easy to use

Upgrade the app please

I had high hopes for this app but it was off by way too much when compared to an old pay stub... Also needs to have an option to save your settings. Some things aren't going to change often like rate of pay state pre-tax deduction etc. Not sure why it was off but my check and your calculations where $60 off.

Terrible app. Does the wing calculations and makes it look like you'll get paid triple of what you'll actually get paid. The calculations are off by a lot

I love this App, for Wisconsin it works. It might be a little off, but it's always less then what I do actually get paid.. which is fine with me.

I like this app. It is off by about $20 for Florida's federal taxes but, it was definitely worth the download.

This app is very helpful to add up your mouthly or weekly paycheck. .

It was almost $30 off everytime

Not even remotely accurate, doesn't use current taxable income tables. I have gone behind it and checked myself and had a CPA go back and check my math and the apps math as a just in case and the app was way off. Needs quite a bit of fine tuning.