Buy Repair Rent Refinance Real Estate Enterprise

The application BRRR Enterprise Calculator is used when deciding to invest in rental real estate. The main distinction of the application from other similar is that the investment decision is taken on the basis of income, the investment will bring, not the price demanded by the seller. The app store and process data for multiple properties in a database, which differs from the application BRRR_Calculator.

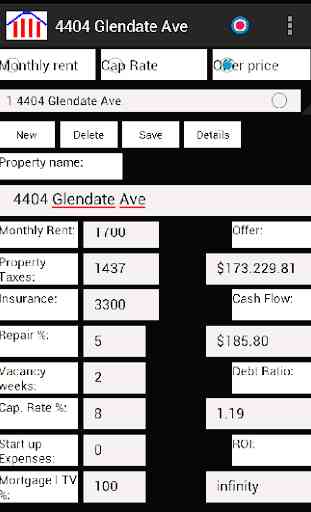

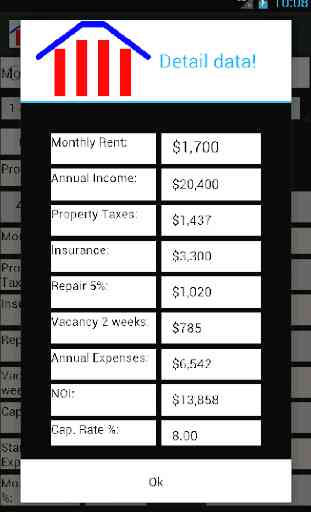

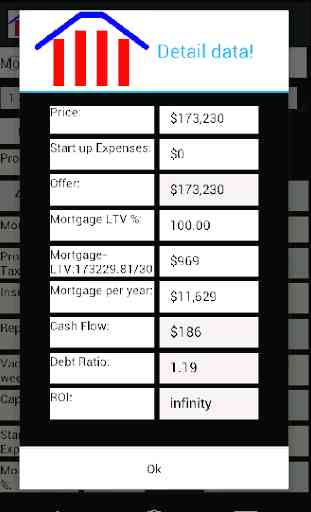

To calculate investment property return provide Monthly Rent - rental income, Property Taxes per year, Property Insurance per year, Annual Repairs - a percentage of annual income (e.g. 5%), Vacancy - estimated number of weeks property is not occupied by tenants (e.g. 2 weeks). Based on these data are calculated Total Annual Income and Total Annual Expenses. Offer Price that make sense to buy this property is calculated as Net Operating Income (NOI) which is equal to Total Annual Income minus Total Annual Expenses divided by Capital Rate - a selected value around 8% or more. The offer price is reduced by the initial cost – Start Up Expenses of restoring the property rental condition. Entering a percentage what part of that price is a loan - Mortgage LTV in %, shall determine the monthly cash flow income (Cash Flow) as NOI minus Annual Mortgage Payment - annual payment for servicing the loan to purchase the property. If Cash Flow is below a amount provided by the user (e.g. $200 ) it is not worth making a deal. Another indicator is the Debt Servicing Ratio ratio of NOI to the annual payment for servicing the loan Mortgage Per Year. If this figure is less than 1.25 also is not worth doing a deal. The Return On Investment (ROI) is calculated as annual cash flow divided to the own capital invested in the property (100 - LTV %). The great ROI the better to invest in this property. If the investment is 100% financed with a loan, the ROI is infinity.

The app allows you to perform calculations on one of the following three parameters: monthly income; Cap Rate ; and Offer Price of the property to the depositor when set two of them and the others. For example, how much must be the monthly income if set Offer Price, Cap Rate and other parameters.

The application has localization on the Bulgarian and English. The app stores the data in a database of type SQLit with file identification propInvDes.db.

The database can be exported to Phonstorage of device the application is performing, by the function of menu item “Export DB” or imported by the function of menu item “Import DB”. Then can be opened by browser of SQLit on device or on desktop. The stored data for property ready for printing in the table cashFlow can be exported by function of SQLit in .csv format and sent to print, to Skype or to GoogleDrive. Also the data base can by saved to PC or to Google Drive.

To calculate investment property return provide Monthly Rent - rental income, Property Taxes per year, Property Insurance per year, Annual Repairs - a percentage of annual income (e.g. 5%), Vacancy - estimated number of weeks property is not occupied by tenants (e.g. 2 weeks). Based on these data are calculated Total Annual Income and Total Annual Expenses. Offer Price that make sense to buy this property is calculated as Net Operating Income (NOI) which is equal to Total Annual Income minus Total Annual Expenses divided by Capital Rate - a selected value around 8% or more. The offer price is reduced by the initial cost – Start Up Expenses of restoring the property rental condition. Entering a percentage what part of that price is a loan - Mortgage LTV in %, shall determine the monthly cash flow income (Cash Flow) as NOI minus Annual Mortgage Payment - annual payment for servicing the loan to purchase the property. If Cash Flow is below a amount provided by the user (e.g. $200 ) it is not worth making a deal. Another indicator is the Debt Servicing Ratio ratio of NOI to the annual payment for servicing the loan Mortgage Per Year. If this figure is less than 1.25 also is not worth doing a deal. The Return On Investment (ROI) is calculated as annual cash flow divided to the own capital invested in the property (100 - LTV %). The great ROI the better to invest in this property. If the investment is 100% financed with a loan, the ROI is infinity.

The app allows you to perform calculations on one of the following three parameters: monthly income; Cap Rate ; and Offer Price of the property to the depositor when set two of them and the others. For example, how much must be the monthly income if set Offer Price, Cap Rate and other parameters.

The application has localization on the Bulgarian and English. The app stores the data in a database of type SQLit with file identification propInvDes.db.

The database can be exported to Phonstorage of device the application is performing, by the function of menu item “Export DB” or imported by the function of menu item “Import DB”. Then can be opened by browser of SQLit on device or on desktop. The stored data for property ready for printing in the table cashFlow can be exported by function of SQLit in .csv format and sent to print, to Skype or to GoogleDrive. Also the data base can by saved to PC or to Google Drive.

Category : Finance

Related searches