Camarilla Calculator

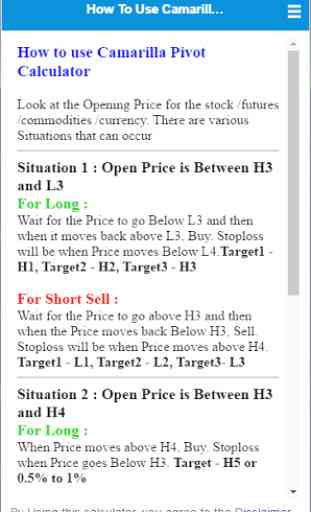

Stop level at S4/R4 is only a suggested stop, you’ll learn why below, traders are encouraged to find their own stops according to the money management rules and risk appetite.

Should one immediately place an order once price hits S3/R3 level? Yes, if you trade aggressively, No, if you like to see confirmation first. For confirmation price have to hit S3/R3 level, find support or resistance there and clearly demonstrate an intention to reverse. Traders may want to learn about reversal candlestick formation patterns in order to be able to spot a confirmation of a turning market.

The second way to trade stocks, indices, forex with the Camarilla Equation is to look at S4/R4 levels to be breached, which would signal of a breakout trade setup and allowing traders trade breakout in the direction of a trend. For, example, if price pushes up through the higher S4/R4 level, the chances are it is going to keep on running that way. Breakout trading outside S4/R4 level expects to capture sharp directional market moves.

While running with the breakout outside S4/R4, use either suggested S5/R5 level or your own target.

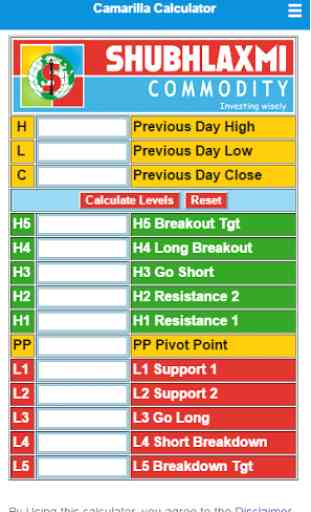

After setting Camarilla levels on the charts, traders look at where the market has opened regarding the levels.

Market Open INSIDE S3/R3:

If the market opens inside the S3/R3 levels, you must wait for price to approach either of these two levels. Whichever it hits first determines a trade: if the higher R3 is hit, Short against the trend in theexpectation that the market is going to reverse. Initial SL above R4.

The opposite, applies when the Lower S3 level is hit first – go Long against the trend. Set SL below S4.

Market Open OUTSIDE S3/R3:

Taking profits is a matter of personal judgment – just be aware that you will want to take profits at some time during the day, because the market is unlikely to “behave” and stay right-sided for your trade. These reversals from S3/R3 appear to happen as often as 4 times out of 5 during intra-day trading.

Camarilla combined with Pivot Points:

Sometimes you may have also noticed that Pivot supports and resistances and the beauty of price reversal at it. You may use both Camarilla levels and Pivot levels to achieve better trading results.

Category : Finance

Reviews (15)

very simple use to findout pivot value,etc.,

Very useful for intraday trading when used with correct identification of candle sticks.

GOOD, I GIVE 4 STAR ONLY BECAUSE IT WORKED NICELY ON HCL STOCK ON 15 JULY, MOVED H1 TO H5 RANGE, BUT IT FAILED FOR CIPLA STOCK ON 16 JULY 2020, THE STOCK PRICE SPURT ABNORMALLY, AND CAMARILLA NOT BEEN SO USEFUL, PRICE MOVED ABOVE THE RANGE ABNORMALLY. I HAD BIG LOSS.

Used with 15 min candle chart in nifty and bank nifty for 24 jun20 I used values of yesterday only it's not working properly

Good service Thanks This software good

Good very useful for self traders .

Very useful for day traders

Unable calculated fx properly

Very useful for trading for me

Very good Application

It is a good application for day traders. The levels given as per my observation are accurate.

Worsted

u should know how to use this calculator it is good

West

Thanks... Very good applicatin... Good work level... Need More accuracy....Thanks