Cara daftar dan Cek NPWP 2020

Routinely paying taxes is the obligation of citizens who have a TIN (Taxpayer Identification Number). Provisions for taxpayers are regulated in law number 16 of 2009. Taxpayers are individuals or business entities that have income and have NPWP. Every taxpayer can check the NPWP number online to find out the completeness of the data and the amount that must be paid.

Indeed, few people understand about NPWP. In fact, most do not have it. In fact, making NPWP is free of charge or free. In addition, NPWP provides many benefits, such as facilitating administrative requirements in public services and as a means of taking care of taxation.

However, not everyone has to pay taxes. This provision applies if your income is less than the nominal PTKP (Non-Taxable Income). On the other hand, an individual whose income exceeds the PTKP calculation, must be taxed and make a tax ID. PTKP is calculated based on your status and adjusted by PTKP codes.

The PTKP code is divided into 3 groups, namely single status (TK), marriage (K), and PTKP combined (K / I). Note, each family must have only one TIN. If you already have 2 NPWPs, only the husband's NPWP is used. Meanwhile, the wife's NPWP is considered to have no dependents.

What happens if the income is above the PTKP, but does not have a NPWP? In accordance with Law number 28 of 2007, people who violate the NPWP ownership rules will be subject to sanctions. The sentence is imprisoned for 6 months to 6 years or having to pay a fine of at least double the tax debt.

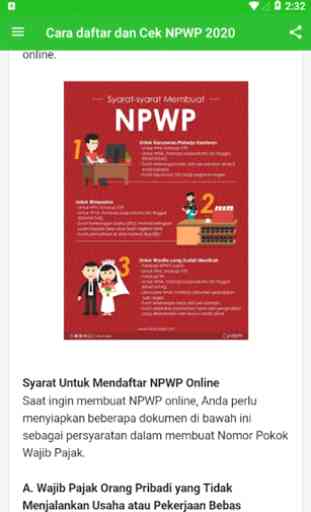

Quite heavy, right, sanctions? Therefore, immediately make a TIN card at the Directorate General of Taxes. If you are reluctant to queue, you can register online through the Director General of Taxes website. All that is left is to fill out the form and sign it, then send it by post with a photocopy of KTP, certificate from the company (for employees), a business certificate (especially for entrepreneurs), and a family card (if married).

To ensure the documents are received properly, please check the status on the Tax Directorate General's website. The status is rejected, indicating that there was an error filling out the form so you have to correct it.

If your TIN is active, it will automatically be visible in the taxpayer's directory. You can visit the tax office to ensure its activity or by checking online.

Indeed, few people understand about NPWP. In fact, most do not have it. In fact, making NPWP is free of charge or free. In addition, NPWP provides many benefits, such as facilitating administrative requirements in public services and as a means of taking care of taxation.

However, not everyone has to pay taxes. This provision applies if your income is less than the nominal PTKP (Non-Taxable Income). On the other hand, an individual whose income exceeds the PTKP calculation, must be taxed and make a tax ID. PTKP is calculated based on your status and adjusted by PTKP codes.

The PTKP code is divided into 3 groups, namely single status (TK), marriage (K), and PTKP combined (K / I). Note, each family must have only one TIN. If you already have 2 NPWPs, only the husband's NPWP is used. Meanwhile, the wife's NPWP is considered to have no dependents.

What happens if the income is above the PTKP, but does not have a NPWP? In accordance with Law number 28 of 2007, people who violate the NPWP ownership rules will be subject to sanctions. The sentence is imprisoned for 6 months to 6 years or having to pay a fine of at least double the tax debt.

Quite heavy, right, sanctions? Therefore, immediately make a TIN card at the Directorate General of Taxes. If you are reluctant to queue, you can register online through the Director General of Taxes website. All that is left is to fill out the form and sign it, then send it by post with a photocopy of KTP, certificate from the company (for employees), a business certificate (especially for entrepreneurs), and a family card (if married).

To ensure the documents are received properly, please check the status on the Tax Directorate General's website. The status is rejected, indicating that there was an error filling out the form so you have to correct it.

If your TIN is active, it will automatically be visible in the taxpayer's directory. You can visit the tax office to ensure its activity or by checking online.

Category : Tools

Related searches