Cours Analyse financière

financial analysis courses and corrected exercises pdf

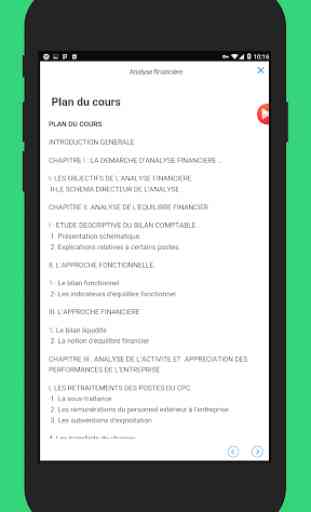

COURSE MAP

GENERAL INTRODUCTION

CHAPTER I: THE FINANCIAL ANALYSIS APPROACH

I- OBJECTIVES OF THE FINANCIAL ANALYSIS II-THE SCHEME DIRECTEUR OF THE ANALYSIS.

CHAPTER II: ANALYSIS OF FINANCIAL EQUILIBRIUM

I - DESCRIPTIVE STUDY OF ACCOUNTING BALANCE SHEET. 1. Schematic presentation. 2. Explanations for certain positions.

II. THE FUNCTIONAL APPROACH.

1-. Functional assessment 2- Functional balance indicators

III. FINANCIAL APPROACH

1. The liquidity balance sheet 2. The concept of financial equilibrium

CHAPTER III: ANALYSIS OF THE ACTIVITY AND APPRAISAL OF THE PERFORMANCE OF THE COMPANY

I. RETIREMENT OF CPC POSITIONS 1. Subcontracting 2. Remuneration of non-company staff. 3. Operating subsidies.

4. Transfers of charges

5. Leasing fees 6. Restatements related to the nature of the activity

II. STATEMENT OF MANAGEMENT BALANCES AND RESULTS TRAINING CHART 1. Activity indicators

2. Profitability indicators III. AUTOFINANCING CAPACITY and AUTOFINANCING

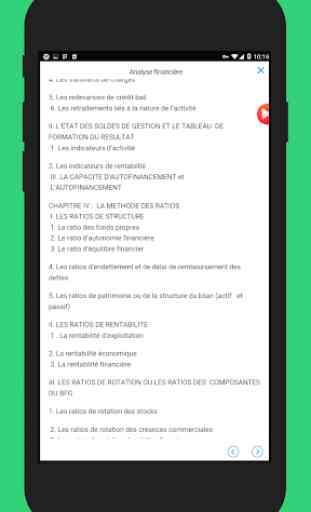

CHAPTER IV: THE RATIOS METHOD I. THE STRUCTURE RATIOS 1. The capital ratio 2. The financial autonomy ratio 3. The financial equilibrium ratio

4. Debt and debt repayment ratios

5. Asset ratios or balance sheet structure (assets and liabilities)

II. PROFITABILITY RATIOS 1. Operating profitability

2. Economic profitability 3. Financial profitability

III. ROTATIONAL RATIOS OR RATIOS OF BFG COMPONENTS

1. Turnover ratios of inventories

2. Turnover ratios 3. Turnover ratios of trade payables

IV. LIQUIDITY OR CASH RATIOS

114 V. Case of synthesis

COURSE MAP

GENERAL INTRODUCTION

CHAPTER I: THE FINANCIAL ANALYSIS APPROACH

I- OBJECTIVES OF THE FINANCIAL ANALYSIS II-THE SCHEME DIRECTEUR OF THE ANALYSIS.

CHAPTER II: ANALYSIS OF FINANCIAL EQUILIBRIUM

I - DESCRIPTIVE STUDY OF ACCOUNTING BALANCE SHEET. 1. Schematic presentation. 2. Explanations for certain positions.

II. THE FUNCTIONAL APPROACH.

1-. Functional assessment 2- Functional balance indicators

III. FINANCIAL APPROACH

1. The liquidity balance sheet 2. The concept of financial equilibrium

CHAPTER III: ANALYSIS OF THE ACTIVITY AND APPRAISAL OF THE PERFORMANCE OF THE COMPANY

I. RETIREMENT OF CPC POSITIONS 1. Subcontracting 2. Remuneration of non-company staff. 3. Operating subsidies.

4. Transfers of charges

5. Leasing fees 6. Restatements related to the nature of the activity

II. STATEMENT OF MANAGEMENT BALANCES AND RESULTS TRAINING CHART 1. Activity indicators

2. Profitability indicators III. AUTOFINANCING CAPACITY and AUTOFINANCING

CHAPTER IV: THE RATIOS METHOD I. THE STRUCTURE RATIOS 1. The capital ratio 2. The financial autonomy ratio 3. The financial equilibrium ratio

4. Debt and debt repayment ratios

5. Asset ratios or balance sheet structure (assets and liabilities)

II. PROFITABILITY RATIOS 1. Operating profitability

2. Economic profitability 3. Financial profitability

III. ROTATIONAL RATIOS OR RATIOS OF BFG COMPONENTS

1. Turnover ratios of inventories

2. Turnover ratios 3. Turnover ratios of trade payables

IV. LIQUIDITY OR CASH RATIOS

114 V. Case of synthesis

Category : Books & Reference

Related searches