Credit Score Report Check: Loan Credit Score

Credit Score Report Check: Loan Credit Score

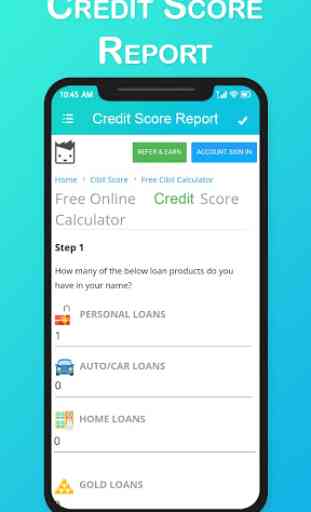

Can Calculate your Credit Score for free (just a approximation of Credit Score will be provided not exact Credit Score will be provided here).

A credit report is a crucial element nowadays simply because there is a lot of risk involved in lending money, and banks are very cautious with it. Before lending money the bank needs to make sure that you don't have any unpaid bills or bad debts. So for that reason they check your credit ratings.

What is a credit score?

A credit score is an indicator of a borrower’s ability to make credit payments on time. It is calculated after evaluating multiple information patterns such as your past credit report, loan payment history, current income level, etc. A higher credit scores increases your chances of getting a low interest loan from a financial institution.

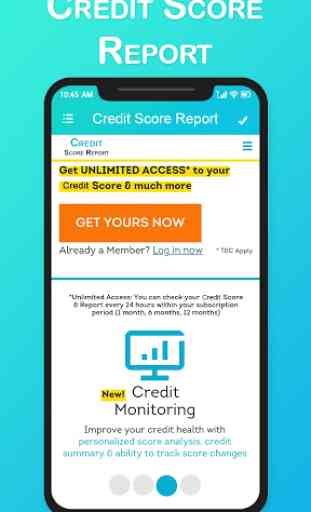

. Is this Credit Report and Score a free service?

Yes. Your entire credit report is available to you for free without any freemium or hidden costs.

. Will accessing and viewing my credit report affect my current credit score?

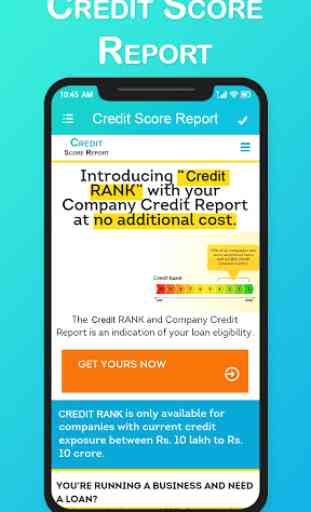

IN INDIA 79% OF THE LOANS APPROVED ARE FOR INDIVIDUALS WITH A SCORE GREATER THAN 750. Your Credit Information Report (CIR) is an evidence of your credit worthiness. Credit Score ranges between 300 and 900. All lenders check your Credit Score before approving your loan application.

- Watch the credit card balances. Make the payments on a monthly basis and don’t let it spill over by paying just the minimum amount due. - - You will be charged a heavy interest on the remaining balance.

- Eliminate nuisance balances. If you have credit cards with small balances due, then clear them off at the earliest or transfer it to another existing card. This way you are not polluting your credit report with a lot of balances.

- If you have diligently paid off a debt, then leave the record in your credit report.

This way future lenders will know that you are serious about making a commitment to paying off a loan and you do so in an orderly manner. This makes you an ideal customer.

Absolutely not! Accessing and viewing your credit report repetitively does not influence your credit score.

The number of times you have applied for credit

Your previous track-record of making timely credit payments

The number of new credit lines opened recently

Your professional details such as income level, employment status etc.

Thank You……..!!!

Can Calculate your Credit Score for free (just a approximation of Credit Score will be provided not exact Credit Score will be provided here).

A credit report is a crucial element nowadays simply because there is a lot of risk involved in lending money, and banks are very cautious with it. Before lending money the bank needs to make sure that you don't have any unpaid bills or bad debts. So for that reason they check your credit ratings.

What is a credit score?

A credit score is an indicator of a borrower’s ability to make credit payments on time. It is calculated after evaluating multiple information patterns such as your past credit report, loan payment history, current income level, etc. A higher credit scores increases your chances of getting a low interest loan from a financial institution.

. Is this Credit Report and Score a free service?

Yes. Your entire credit report is available to you for free without any freemium or hidden costs.

. Will accessing and viewing my credit report affect my current credit score?

IN INDIA 79% OF THE LOANS APPROVED ARE FOR INDIVIDUALS WITH A SCORE GREATER THAN 750. Your Credit Information Report (CIR) is an evidence of your credit worthiness. Credit Score ranges between 300 and 900. All lenders check your Credit Score before approving your loan application.

- Watch the credit card balances. Make the payments on a monthly basis and don’t let it spill over by paying just the minimum amount due. - - You will be charged a heavy interest on the remaining balance.

- Eliminate nuisance balances. If you have credit cards with small balances due, then clear them off at the earliest or transfer it to another existing card. This way you are not polluting your credit report with a lot of balances.

- If you have diligently paid off a debt, then leave the record in your credit report.

This way future lenders will know that you are serious about making a commitment to paying off a loan and you do so in an orderly manner. This makes you an ideal customer.

Absolutely not! Accessing and viewing your credit report repetitively does not influence your credit score.

The number of times you have applied for credit

Your previous track-record of making timely credit payments

The number of new credit lines opened recently

Your professional details such as income level, employment status etc.

Thank You……..!!!

Category : Finance

Related searches

stupid among all