Credit Score Report - Credit Score Check Guide

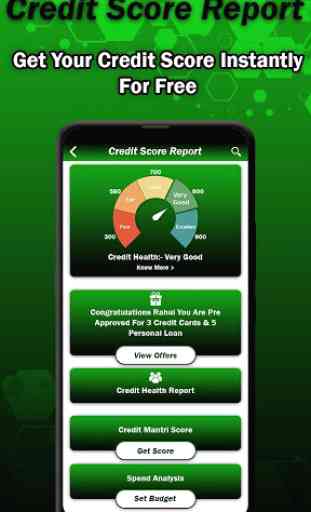

A Cibil Score or Credit Score is generated by credit bureaus and is a 3 digit numeric representation of an individual’s credit worthiness, which is the likelihood of a person defaults on a loan repayments or credit card due payments. Typically rang between 300 & 900, a high Cibil Score indicates that a person is more likely to use credit responsibly & therefore lenders tend to look more favourably at applications for loans or credit cards made by such people.

Cibil score | Free Cibil Score Check, Free Credit Score Check & Guide | Credit Score | Free Credit Score

Want to check what your credit score is? Having a high score can benefit you in many different ways like rent an apartment, making it much easier for you to get a loan, and even lower your insurance rates. A good credit score is the way for low interest rates for loans, mortgages, cars, insurance premiums, credit card offers, and more.

A Cibil Score is nothing but a credit score of you financial behavior generated by CIBIL, which is India’s oldest bureau. In addition, Equifax, Experian and CRIF High Mark are other players.

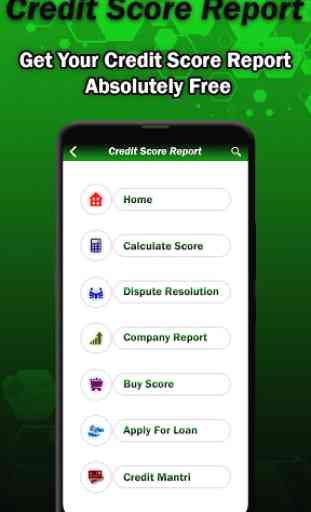

With Cibil Score Check, Free Credit Score Check & Guide App for Credit Score Report you can regularly review your credit score so that it remains in good ranking.

Cibil score | Free Cibil Score Check, Free Credit Score Check & Guide | Credit Score | Free Credit Score

In india 86% of the loans approved are for individuals with a score greater than 750. CIBIL Score ranges between 300 and 900.

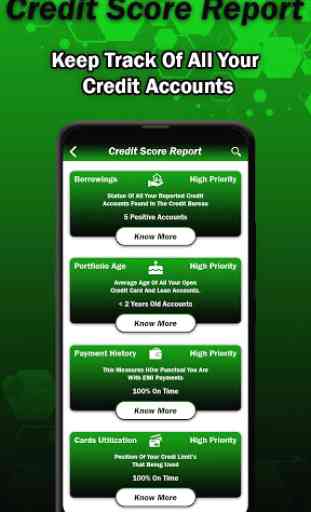

A Cibil Score or Credit Score is important in loan approval process because it is the first things that a lender refers when evaluating an application for loan. Using this filter, it is typically believed that a higher credit score increases the chances of loan approval, other factors being in place. However, the decision of whether to lend or decline an application rests solely with the concerned lender, and CIBIL plays no role in the process itself.

Cibil score | Free Cibil Score Check, Free Credit Score Check & Guide | Credit Score | Free Credit Score

Want to check what your credit score is? Having a high score can benefit you in many different ways like rent an apartment, making it much easier for you to get a loan, and even lower your insurance rates. A good credit score is the way for low interest rates for loans, mortgages, cars, insurance premiums, credit card offers, and more.

A Cibil Score is nothing but a credit score of you financial behavior generated by CIBIL, which is India’s oldest bureau. In addition, Equifax, Experian and CRIF High Mark are other players.

With Cibil Score Check, Free Credit Score Check & Guide App for Credit Score Report you can regularly review your credit score so that it remains in good ranking.

Cibil score | Free Cibil Score Check, Free Credit Score Check & Guide | Credit Score | Free Credit Score

In india 86% of the loans approved are for individuals with a score greater than 750. CIBIL Score ranges between 300 and 900.

A Cibil Score or Credit Score is important in loan approval process because it is the first things that a lender refers when evaluating an application for loan. Using this filter, it is typically believed that a higher credit score increases the chances of loan approval, other factors being in place. However, the decision of whether to lend or decline an application rests solely with the concerned lender, and CIBIL plays no role in the process itself.

Category : Finance

Related searches

Fraud app only asking money