Cut Taxes. Track Miles, Expenses, Receipts. Free.

There are many tax apps that track miles, expenses and receipts. What is the best app for you? If you care about privacy, you should try My1040.

My1040 is unique. My1040 stores your data on your device. Other tracking apps store your data on their servers. They then make money by using your data or sharing your data with other businesses. My1040 is different. We don't collect or use your data. You -- and only you -- control your data.

My1040 is completely free. There are no fees or ads.

Why is My1040 free? My1040 was built by folks who volunteer with free tax preparation programs ("VITA") and legal clinics that offer free tax advice to low-income taxpayers ("LITCs"). We believe in making our tax system work better for all of us. We also believe that tax data should be kept private.

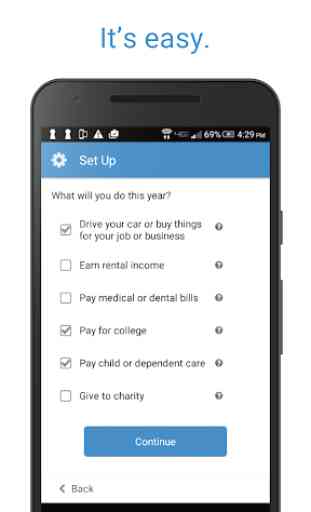

My1040 simplifies your taxes by tracking everything in one place. My1040 can track everything for your taxes and more:

• miles for business, donations and health care

• all personal expenses including donations, education, health care and dependent care

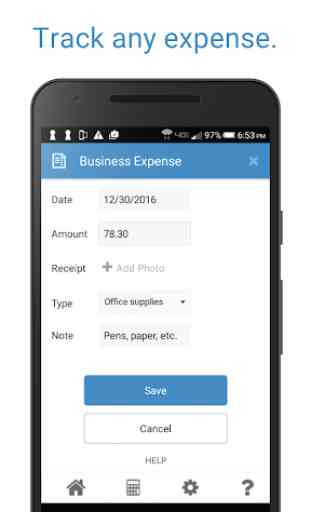

• all business expenses of freelancers and microbusinesses

• anything else that you want to track

My 1040 can help everyone save money, especially independent contractors. If you work for yourself, it is critical that you track all your miles and expenses. We have seen too many Uber/Lyft drivers who pay too much tax because they have poor records. My1040 works great for Uber/Lyft drivers, Postmate couriers, TaskRabbit taskers, Airbnb hosts, realtors, tutors and anyone else who files a Schedule C with Form 1040.

My1040 works. We have decades of experience in tax and software development with companies such as Microsoft and Ernst & Young.

My1040 incorporates the tax reform changes of December 2017. You can use My1040 with confidence for all your 2019 expenses.

Help us make My1040 even better. Visit our website to learn more and provide feedback.

Category : Finance

Reviews (8)

This app/tool is fantastic! Being that I graduated college not too long ago and even more recent moved out of my parents house, this app has really helped me get right into adulthood! Its extremely user friendly for people who may not be strong with technology or people who don't understand the focus the app presents. Definitely recommend this app for anyone who needs assistance!

Great app. If possible the ability to upload screenshots, and files would be superb, since most of my receipts are through email on my smartphone.

As a tax professional, I recommend this app to all my clients. It makes everyone's lives much easier!

lets try this app

The app was helpful

It's simple. Great for documentation. But it's a no go for pictures. You can only take picture in app the it blurrs the photo to the point where you can't get any legible numbers. Neither can you upload your own pictures. Might as well use another app that can include picture in same entry.

Extremely user friendly and helpful! This will be very helpful to me. It is amazing that it is free!

Worthless The mileage tracker section is NOT IRS compliant. There's no way to enter starting and ending mileage for a given trip. There's also no way to upload a receipt. Odd because I saw an older review referencing the quality of the photo uploaded, but there's no place to upload a photo and/or add it to a trip. Worthless.