Form 1040X for IRS: Sign Personal Income Tax eForm

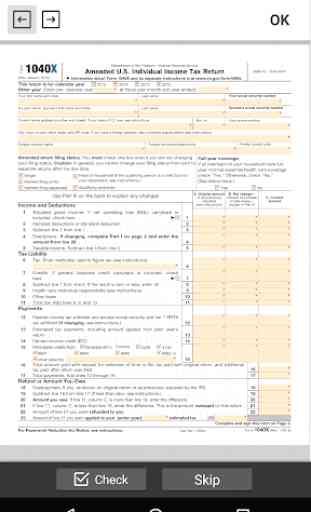

This tax management application opens the sample’s editing and sending features. It's also free of charge. The software contains a powerful toolkit for income tax management and is user-friendly. All you have to do is install the application and choose one of the form variants available in the program. It won't take a lot of time to fill out the 1040X template if you become more familiar with the features the app has.

With the 1040X PDF form filler you can:

✓ Type in any text, completing all the required and additional fields.

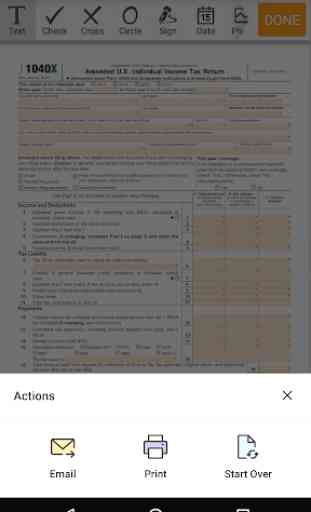

✓ Answer the questions the sample contains by adding checkmarks, cross signs or graphics lines or even add images.

✓ Add the date to the document automatically or manually.

✓ Add text to the template, making the font bold or changing its color.

✓ Navigate between the parts of the document using the “Pages” option.

✓ Sign the template with your legally binding initials by drawing them in the app.

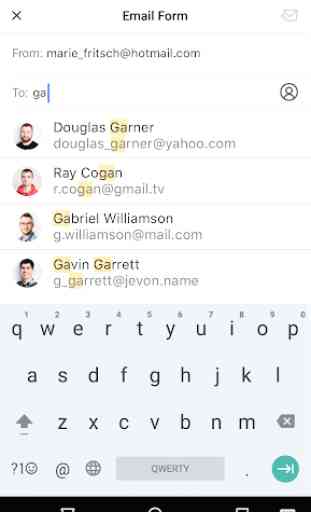

✓ E-file forms to any individual receiver or organization just by adding his or her email from your contacts list.

If you make a small mistake on your form, the IRS will notify you about it. But if you forgot to include a big earnings sum on your report or claimed for the wrong deductions, then you have to file the sample again. If you are lacking money or time, then make a request for an extension. That will give you the opportunity to report your taxes up to April 15.

Use the following recommendations to notify IRS about any mistake in the income taxes report:

✓ Select the 1040X form variant you prefer and click on the “Fill Now” option.

✓ Type in the needed text. Include your corrections.

✓ To add a circle, checkmark or cross sign, use your finger to tap on the answer area.

✓ To uncheck an item, click on the answer area one more time and the mark will be removed automatically.

✓ When you complete all changes, save them and share the document by email or print it out and send the copy by regular mail.

Category : Business

Reviews (8)

I had to Amend my 2019 taxes which was my first time ever having to do so. Upon researching how to file a tax Amendment (1040X), I was ecstatic come across this easy download. The 1040X easily downloads to your smartphone or computer, includes easy to follow and clear instructions. You may print the form and fill out manually or do as I did, just edit the document and typed my information. Lastly, don't forget to mail it to uncle Sam!

I'm so happy to have found this APP to help with amending my 2019 taxes. The process is VERY SIMPLE and user friendly. In fact, I completed everything right on my cell phone. I highly recommend this app!

This is App is really convenient and easy to use!!!!

Awesome they have everything

So far this has been great.

Love it

I need 2015. For whatever reason, it is not available

This would be great if it did the math for you. Also it needs some work done on it because Line 6 requires you to write how you figured the tax. This app won't let you do that. Plus it jumps all the way to the bottom of the page when you are just going to the next box. It would be better if it was designed to work with an spreadsheet program.