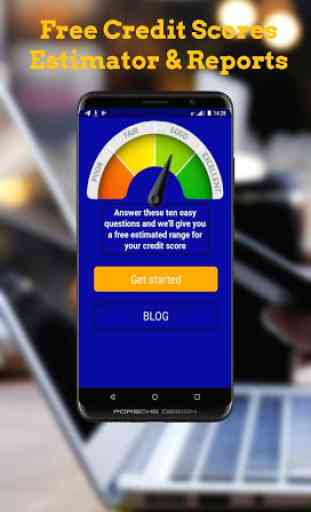

Free Credit Scores Estimator & Credit report check

Credit score, which indicates your credit level, is essential for different financial institutions when making a decision on your loan/credit card application.

Reviewing your credit score in addition to your credit report will give you a better idea of where your credit stands.

Estimate your score based with "Free Credit Scores Estimator & Reports" Credit Score Calculator Check without registration without entering personal data.

Using a "Free Credit Scores Estimator & Reports"

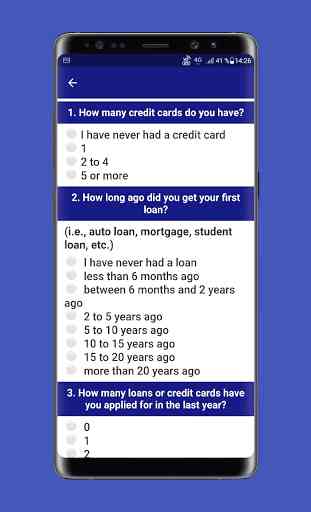

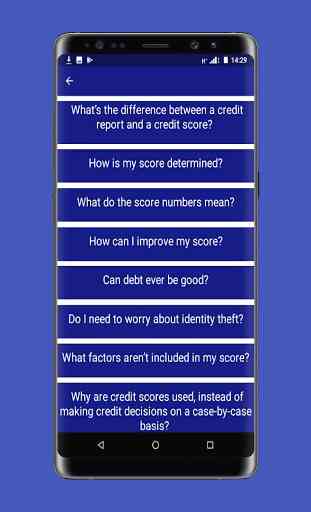

"Free Credit Scores Estimator & Reports" score estimators ask you a 10 of multiple-choice questions about your credit history and use that information to provide a range that your score should fall into. The questions are based on the categories of information that are used to calculate your score - payment history, level of debt, the age of credit history, the mix of credit, and recent credit applications.

Your score is based on five basic things:

Payment history (this accounts for roughly 35% of your score).

How much you owe (this accounts for about 10%).

How many types of debts and credit lines you have right now (this accounts for approximately 10% of your score).

Credit history length (about 15% of your score is related to this).

The number of times your credit score and report have been pulled and examined recently (accounts for about 10%).

As you can see, how much you earn is not taken into account.

Having a Good Credit Score

Credit scores range from 300 to 850. Scores of 750 and over are considered best and are most likely to get you prime rates. Scores of under 500 can mean you get rejected for credit line increases and loans.

Your credit score is most often used when you apply for financing, such as a new loan or credit card. However, some employers will look at it when deciding whether you can handle a job related to money, and even some landlords will consider credit when deciding whether to rent to you. Your three-digit number, therefore, can have a big impact on where you work, where you live and how you live.

What you need to know when you take a payday loan?

If you’ve applied for a payday loan, you know that all you need to “qualify” for a payday loan is a bank account, a source of income, and some form of identification (i.e., a license). Payday lenders don’t run a credit check before approving loans. They don’t do much leg work at all to ensure a borrower can actually repay the loan. Therefore, we recommend checking your scoring score yourself. Check scoring score without registration without entering personal data in app "Free Credit Scores Estimator & Reports"

Since a payday lender won’t run your credit when getting approved for a loan, taking out a payday loan won’t necessarily affect your credit. Instead, payday loan companies use your income verification as their credit check.

How Payday Loans Affect Your Credit

The fact that you applied for a payday loan will not necessarily affect your credit, but there are several ways a payday loan can harm your credit. How you handle the payday loan and whether or not you stay on track with payments and fees will determine whether or not a payday loan affects your credit.

What You Need to Know

Getting a good estimate of your "Free Credit Scores Estimator & Reports" score means knowing your credit history. You'll need to know how many open credit cards you have, the balances on those cards, how many recent credit applications you've made, the total amount of your loan balances, etc.

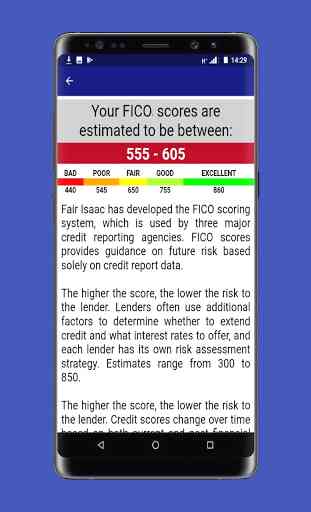

At the end of the questionnaire, the "Free Credit Scores Estimator & Reports" score estimator gives you a range where your score would fall based on your answers to the questions. Of course, the estimator isn't foolproof. Your real score could fall outside the range, either above it or below it. If you just want to have a general idea of your score, an estimator is a quick, easy, and free way to get it.

Reviewing your credit score in addition to your credit report will give you a better idea of where your credit stands.

Estimate your score based with "Free Credit Scores Estimator & Reports" Credit Score Calculator Check without registration without entering personal data.

Using a "Free Credit Scores Estimator & Reports"

"Free Credit Scores Estimator & Reports" score estimators ask you a 10 of multiple-choice questions about your credit history and use that information to provide a range that your score should fall into. The questions are based on the categories of information that are used to calculate your score - payment history, level of debt, the age of credit history, the mix of credit, and recent credit applications.

Your score is based on five basic things:

Payment history (this accounts for roughly 35% of your score).

How much you owe (this accounts for about 10%).

How many types of debts and credit lines you have right now (this accounts for approximately 10% of your score).

Credit history length (about 15% of your score is related to this).

The number of times your credit score and report have been pulled and examined recently (accounts for about 10%).

As you can see, how much you earn is not taken into account.

Having a Good Credit Score

Credit scores range from 300 to 850. Scores of 750 and over are considered best and are most likely to get you prime rates. Scores of under 500 can mean you get rejected for credit line increases and loans.

Your credit score is most often used when you apply for financing, such as a new loan or credit card. However, some employers will look at it when deciding whether you can handle a job related to money, and even some landlords will consider credit when deciding whether to rent to you. Your three-digit number, therefore, can have a big impact on where you work, where you live and how you live.

What you need to know when you take a payday loan?

If you’ve applied for a payday loan, you know that all you need to “qualify” for a payday loan is a bank account, a source of income, and some form of identification (i.e., a license). Payday lenders don’t run a credit check before approving loans. They don’t do much leg work at all to ensure a borrower can actually repay the loan. Therefore, we recommend checking your scoring score yourself. Check scoring score without registration without entering personal data in app "Free Credit Scores Estimator & Reports"

Since a payday lender won’t run your credit when getting approved for a loan, taking out a payday loan won’t necessarily affect your credit. Instead, payday loan companies use your income verification as their credit check.

How Payday Loans Affect Your Credit

The fact that you applied for a payday loan will not necessarily affect your credit, but there are several ways a payday loan can harm your credit. How you handle the payday loan and whether or not you stay on track with payments and fees will determine whether or not a payday loan affects your credit.

What You Need to Know

Getting a good estimate of your "Free Credit Scores Estimator & Reports" score means knowing your credit history. You'll need to know how many open credit cards you have, the balances on those cards, how many recent credit applications you've made, the total amount of your loan balances, etc.

At the end of the questionnaire, the "Free Credit Scores Estimator & Reports" score estimator gives you a range where your score would fall based on your answers to the questions. Of course, the estimator isn't foolproof. Your real score could fall outside the range, either above it or below it. If you just want to have a general idea of your score, an estimator is a quick, easy, and free way to get it.

Category : Finance

Related searches

Reviews (8)

Gab. N.

Nov 4, 2019

Crashes as soon as I click ckeck after having completed all questions...

And. B.

Sep 16, 2020

Excellent service and screen quality and experience

Tho. N.

Sep 27, 2020

This is not a good at all, if i try to the questions ,it keeps telling me me error.

Ais. G.

Aug 30, 2020

Keep saying ERROR!. I just downloaded the app. How is it an ERROR?

sha. k.

Jul 27, 2020

Not work ☹️😒😒😒😒☹️☹️☹️😒 don't instal waste of time

Jan. P.

Apr 5, 2021

It's so no amazing it's stupid Haha

Mic. H.

Apr 24, 2021

What the fact

It just waste of data why it always say error all the time if you click let get started. I don't recommend it.