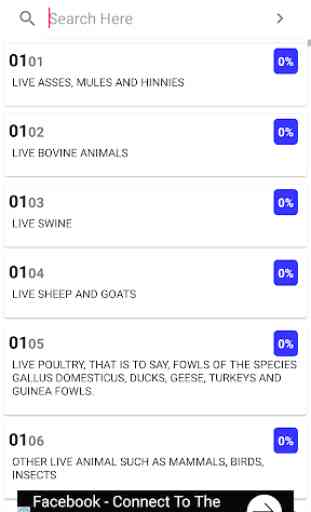

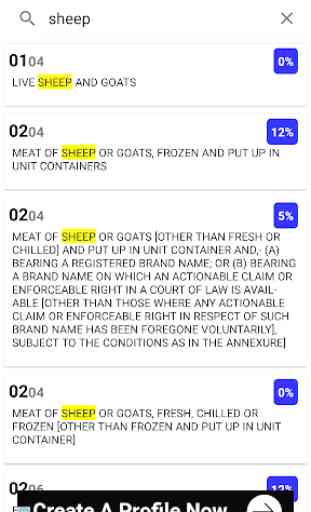

HSN GST Rate Finder

What is HSN Code in the first place?

Harmonized System of Nomenclature, or HSN, was conceived and developed by the World Customs Organization (WCO) with the vision of classifying goods from all over the World in a systematic and logical manner. It is a six digit uniform code that classifies more than 5,000 products and is accepted worldwide. These set of defined rules is used for taxation purposes in identifying the rate of tax applicable to a product in a country. It is also used to determine the quantum of product exported or imported in and out of a country. It is a crucial feature to analyze the movement of goods across the World. It is a combination of different sections, further drilled down to chapters, which are further classified into headings and sub-headings. The resultant figure is the six-digit code.

HSN is widespread and is adopted in more than 200 countries, covering a staggering 98% of goods in the World. It is by far, the best logical system of classification and identification adopted in International Trade. It has helped in reducing efforts and costs related to complex procedures of International Trade.

HSN in India

Now that we have been through the concept of HSN, we now move on to understanding HSN from the Indian context.

India is all set to have its very own Goods & Services Tax or GST, which applies to all goods and services alike. It shall subsume many indirect taxes and reduce the burden on the end consumer. India has already been using HSN system since 1986 in the Central Excise and Customs regime. It is a much more detailed classification that added another two digits to the 6-digit structure. Indian manufacturers under GST shall be required to follow a 3-tiered structure of HSN.

Those with a turnover of less than INR 1.5 Crores need not follow HSN

Those with a turnover exceeding INR 1.5 Crores but less than INR 5 Crores shall be using the 2 digit HSN codes

Those with a turnover exceeding INR 5 Crores shall be using the 4 digit HSN codes

Those dealers who are into imports or exports shall mandatory follow the 8 digit HSN codes

Harmonized System of Nomenclature, or HSN, was conceived and developed by the World Customs Organization (WCO) with the vision of classifying goods from all over the World in a systematic and logical manner. It is a six digit uniform code that classifies more than 5,000 products and is accepted worldwide. These set of defined rules is used for taxation purposes in identifying the rate of tax applicable to a product in a country. It is also used to determine the quantum of product exported or imported in and out of a country. It is a crucial feature to analyze the movement of goods across the World. It is a combination of different sections, further drilled down to chapters, which are further classified into headings and sub-headings. The resultant figure is the six-digit code.

HSN is widespread and is adopted in more than 200 countries, covering a staggering 98% of goods in the World. It is by far, the best logical system of classification and identification adopted in International Trade. It has helped in reducing efforts and costs related to complex procedures of International Trade.

HSN in India

Now that we have been through the concept of HSN, we now move on to understanding HSN from the Indian context.

India is all set to have its very own Goods & Services Tax or GST, which applies to all goods and services alike. It shall subsume many indirect taxes and reduce the burden on the end consumer. India has already been using HSN system since 1986 in the Central Excise and Customs regime. It is a much more detailed classification that added another two digits to the 6-digit structure. Indian manufacturers under GST shall be required to follow a 3-tiered structure of HSN.

Those with a turnover of less than INR 1.5 Crores need not follow HSN

Those with a turnover exceeding INR 1.5 Crores but less than INR 5 Crores shall be using the 2 digit HSN codes

Those with a turnover exceeding INR 5 Crores shall be using the 4 digit HSN codes

Those dealers who are into imports or exports shall mandatory follow the 8 digit HSN codes

Category : Business

Related searches

Reviews (4)

Sha. S.

Apr 13, 2022

Worst app uninstall in 2 minutes after checking.

Dia. S.

Oct 18, 2019

Okay. Preferred google browse and search.

Eun. T.

Sep 5, 2018

I love to shopping here

Love it, some items are not good they don't last. Out side company's want work with you to replace the item.