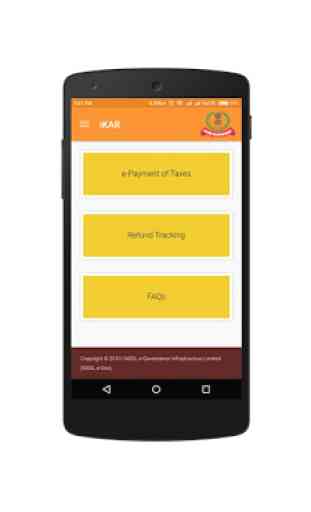

iKAR by ITD - e-Tax & Refunds

Key Features:-

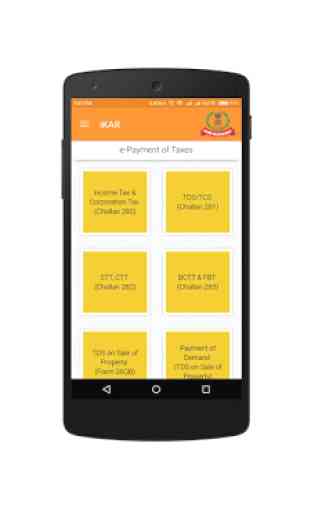

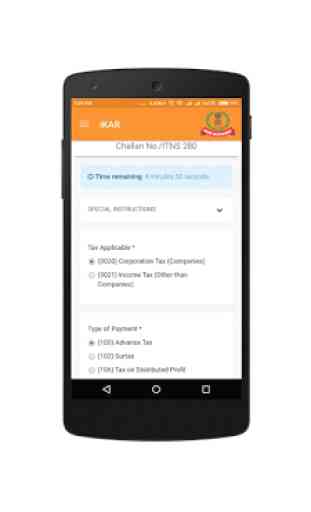

● Payment of various direct taxes using PAN/TAN such as Advance Tax, Self-Assessment Tax, TDS/TCS, etc. The taxpayer is required to have a net-banking account with any of the Authorized Banks or a debit card in case of some banks.

● Status tracking of your Income Tax and TDS Refunds.

Category : Finance

Reviews (26)

App is not usefull. Only net banking facility provisioned to pay e-tax. Cannot pay etax using debit card. This app is just like one more useless service from govt. dept. It seems programme developer is not so professional. This app does not deserve even single star.

Superb Application 1. Please provide UPI payment option 2.For Advance Tax there is no need to select assessment year ,as advance tax is always for current F.Y. 3.Just to write PAN Card number and amount . 4.please give option to download 26As

The app works good It Can be much better If you provide an UPI option for payment of Tax as it is most widely used by people and they prefer paying through that when using Mobile Phone instead of Net Banking.

Preserve every state's language and culture.. Don't force HINDI everywhere... Besides found nothing useful in this app

good app. more improvement needs. Pls add return filing system I.e app based return filing. add more bank on the app for payment of tax like payments banks .

App seems to be like an old one.. developed for old android version and not updated

Timepass app...even the version is supporting old android only

Form 26QC and Form 26QD is not available in the app and also payment of demand on the same is also not available.

No improvement , lack of response time

Worst app with Hindi name in English. What a .....

Cant find previous records. Payment challan is not downloading

I was not able to download the challan after paying 26QB form. Procedure got delayed worst app.

Good application & Good information..

my tax refund year 2016_17 pending this software not support pl help

Good application supper and wellth ❤️

option for saving clients data should be given

Hi...plz make a vdo for how to use iKAR app

Nice app to know refund status

TDS refund of ramkumarmandal 1890 of 2017 2018

It can be more user friendly, if there is a provision to save data in the app, like Pan number, address, mail and phone number. After its launch it is untouched no development nothing.

A good initiative by ITD and good work by NSDL eGov. Looking forward for next update.!

Easy for Income tax paid by all banks and check status of refund.

The challan no and other details are not visible on the screen on receiving the Successful payment confirmation and sms confirmation is also not being received from NSDL site

A very simple and easy to use app.

it's better to use it's website

This is a very good and handy app for payment of income tax easily. Not yet checked by doing a complete cycle. Hope this will work perfectly. Expecting an app for ITR1 return filling through mobile. Which will give only fields to fill up and final thing will come out.