Income Tax Calculator for Salaried and Pensioners

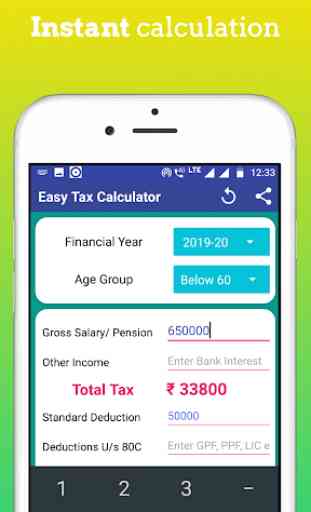

Not only that, the Easy Tax Calculator is a useful tool where you can find Income Tax Slab Rates for Financial Year 2018-19, 2019-20 (Assessment Year 2019-20, 2020-21 respectively).

Besides you can find here a number of guidelines on how to file your Income Tax Return online in ITR Filing Guide section. There are various easy to follow guide on "How to register in e-filing portal for online submission of ITR", "How to login to the income tax portal", "How to choose ITR Forms", "How to e-Verify your Return" etc.

Key Features:

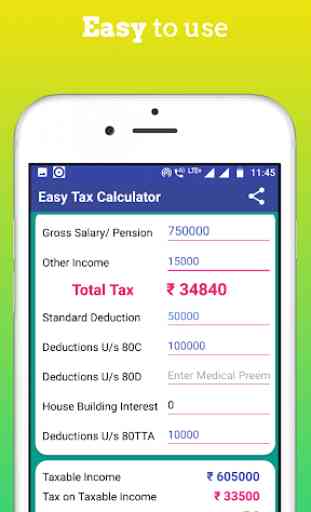

» Fastest and quickest way to calculate your income tax easily.

» Calculate tax for your Income earned during Financial Year 2018-19 and 2019-20.

» Enjoy the Sandard Deduction.

» Enter amount fo availing deduction under section 80TTA and 80TTB for Employees and Pensioners respectively..

» Income Tax Slabs at a glance.

» How to Save Tax.

» Guide on Income Tax Return Filing Online.

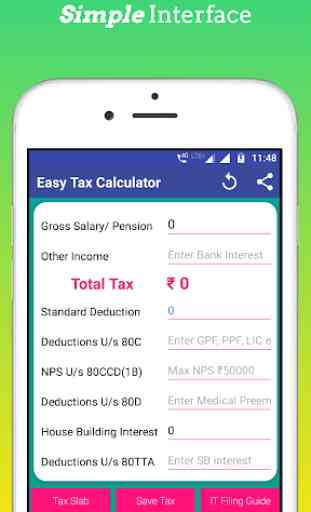

Income tax calculation formula will consider the following parameters for deductions while calculating the Payble Tax:

√ Deduction under 80C.

√ Deduction under 80CCD(1B).

√ Deduction under 80D.

√ Deduction under 80EE.

√ Deduction under 80TTA.

√ Deduction under 80TTB.

Category : Finance

Reviews (30)

Hi Rs Team, This very good aap for salary calculation of income tax. One observation like to share" while sharing tax calculated pdf should also covering input data which has arrived Tax calculation".I mean to say Tax calculation working also with final Tax payable. Thank-you!!

Very simple way to calculating tax.. love this app.

Very easy and user-friendly

Excellent app Easy to see and operate

I downloaded this app and saw that the tax is not being calculated correctly in this app, for example, the tax of 3Cr but surcharge amount is not coming correctly. Through this review, I want to say to the developer of the app that once you make this app more accurate, so that everyone can get the benefit of it.

App is very good. 15G/H to be incorporated. Secondly exemptions under Donation to be shown. Thirdly option to save in card can be provided. Last but not the least sharing the file to e mail and in whatsapp also is required.

Excellent app,very easy to calculate tax under old and new scheme. However details of income from salary da,hrs etc should be shown in the format so that it would be easy for every one without tax knowledge.

Nice app, it's Very usefull for calculation of tax

When you use New Tax Regime All Rebate are disable so please disable all catagory which is not rebate under New tax regime

Good to use and to layman people who don't have idea of calculation

Nice one. But if the taxable amount is updated as soon as we enter the deduction values it would be helpful. Currently, taxable amount is updated if I tap on another field. May be event like onChange() can be used.

In your updated app ,3 corrections to be made to make it more easy and user-friendly for taxpayers with old tax regime.They are -1. All the limits(max/min) with respect to exemptions & rebates under different sections should be displayed on screen of the calci. 2.Though figures regdg sec24(HBA Int) appear on the screen, calci does not consider it for calculation.3.Though the figures are fed in Sec.80TTB (SB&FD interst), they don't appear on the screen& not considered for calculation. Respond.

Wonderful and the most easiest process applied in this short cut calculator. It is time/year tested and trusted calculator for all salaried persons.l recommend it to others.

App is good but lack some features: 1. It does not have "Tax paid in advance" option. 2. After generating the pdf, it does not show in detail under which section what deducted or else. ......Otherwise it is the good app. 👌👌

App is designed well but lacks basic inputs. There is no provision for advance tax paid,Self assessment, TDS(If 15G/15H not submitted). Actual tax can only be calculated after taking into consideration the tax paid. Also, LTCG & STCG are not shown in other sources of Income.

Easy to use ,but there seems no option how to delete saved files.The form given to fill details of rebate items under various section of ITR Act. does not have column for 80E(interest paid on education loan).Please add this . Thanks for quick response.

Very good practically and accuracy calculation in both regime without any other information feed. Thanks to your all team members.

Excellent App Very easy to calculate Tax. Just include some videos for e-filing properly.

Awesome app. It would be more effective if expenditure on medical ground in different criteria is added.

Easy but requires lot of upgradation.It is not clear whether this App could be purchased and its cost per year or so

This application is very useful and income tax can be calculated very easily. I want to insert some items for exemption like 80DD, 80DDB and SCA .

There is no emplyer NPS contribution option in this application.

Its a very easy tax calculator as its name.I am using it last 2yrs. TDS calculator may kindly be added.

A very useful and user-friendly app. I recommend it for all salaried employees and pensioners.

Very easy app for all of us to calculate tax lot of thanks

Excellent app. However the detail page can be improved further by displaying details as per prescribed format of incom tax.

The app is Perfectly useful and easy to calculate the tax on salary n pension income only.But nowadays investment in shares, mutual funds and other assets by the pensioners n salaried is very common. Hence I request you to include the capital gains/loss in the system designed n deviced by U.With this the app become more users friend ly . Please respond.

Verymuch usefull.Can be used by one and all if amendments from time to time are updated.

Very simple and very very best app to understand tax calculation in old or new tax slab. Best wishes.

Beautiful App. really simple. If you can add some knowledge materials, explaining details of different sections could be more better. Thanks team