India Tax Calculator FY2015-16

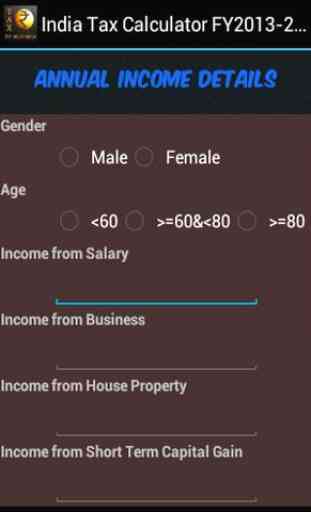

Calculate the Income Tax for the Financial Year 2015-2016 (Assessment Year: 2016-17) using this application. Advance Tax Calc, Quick Tax Calc and HRA Exemption Calc were provided in the application.

Here are the rules considered in the app:Income Tax Rates for Financial Year 2015-2016:

Case A: For Men (less than 60 years)Upto Rs. 2,50,000 NilRs. 2,50,001 to Rs. 5,00,000 10 per centRs. 5,00,001 to Rs. 10,00,000 20 per centAbove Rs. 10,00,000 30 per cent

Case B: For Women (less than 60 years)Upto Rs. 2,50,000 NilRs. 2,50,001 to Rs. 5,00,000 10 per centRs. 5,00,001 to Rs. 10,00,000 20 per centAbove Rs. 10,00,000 30 per cent

Case C: For resident individual of 60 years or above (Senior Citizens)Upto Rs. 3,00,000 NilRs. 3,00,001 to Rs. 5,00,000 10 per centRs. 5,00,001 to Rs. 10,00,000 20 per centAbove Rs. 10,00,000 30 per cent

Case D: For resident individual of 80 years or above (Very Senior Citizens)Upto Rs. 5,00,000 NilRs. 5,00,001 to Rs. 10,00,000 20 per centAbove Rs. 10,00,000 30 per cent

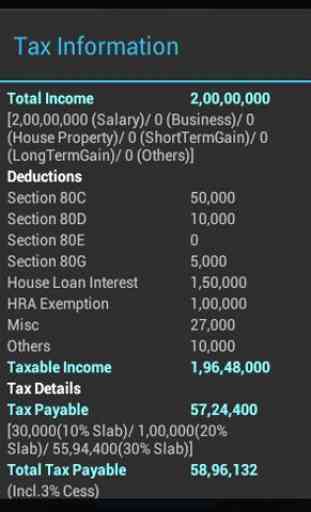

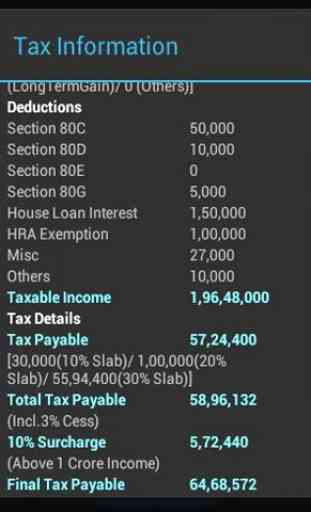

HRA Tax Exemption Calculation:Minimum of (40 or 50% of Basic, Annual HRA Claimed, Annual Rent Paid – 10% of Basic)Maximum allowed limits for tax exemption:

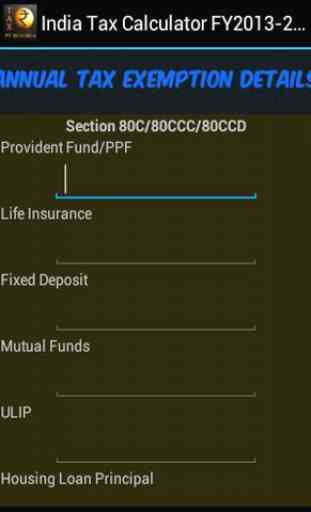

Section 80C limited to 1.5 Lacs.Section 80D limited to 35K.Section 80E limited to 40k.Section 24 limited to 2 Lacs.

Limitations of the App: 1. As all the values are considered as integers, the maximum value can be entered is (2^31

- 1).2. While doing calculations, each value is rounded to the nearest integer.

Suggestions:If any rules are violated or for any suggestions, please send an email to [email protected]

Category : Finance

Reviews (29)

The best one that I have seen and highly explanatory. Congrats!

Superb app Give it a try and you will be amazed at performance.

Very simple and user friendly app

Best to calculate income tax.

Great app, very easy to use.

Good and user friendly.

As per my own views this tax calculation app is appriciable. Super .

Sir I m not able to download the app it is downloading but not completing

Very good and quick

Correct professional tax maximum rebate is rs2500instead of Rs2400

calculation should be for current AY

Best app in others

Piece of s#it

Rent income shud be Less 30% is to be added Otherwise rest part is ok

Best

Income Tax Calculator AY 2020-2021

Give updates for current year 2017-18

I found it simple and can be used even by a layman

Very useful for calculate my personal it

What about rental income ? It is not income from house property. 30% rebate is given on rental income

It should have more features like school tution fee, agricultural income accordingly increase in business income in case of other business or salary income if one is not a farmer purely. Or as applicable in the ITR format

It should also have a feature to save data. Overall a very useful app

Very accurate and useful. Not updated recent changes

Very Usefully App. So easy.

Regular updates should be available.

Add save feature ..otherwise very useful app...:-)

I agree with Bhargav, You just add feature to save entered data and tips to save further tax.

Excellent application. I found it so easy to calculate my tax liability. Indebted to the developers

You have not replaced the travel allowance and medical reimbursement with standard deduction