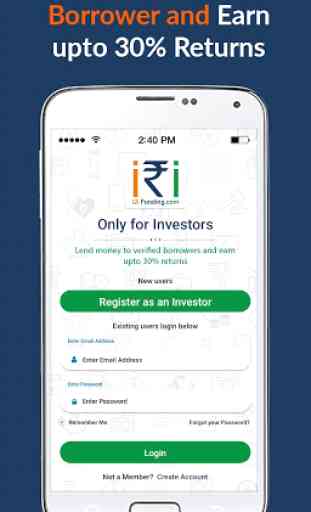

Investor's App - Peer to Peer Lending - i2iFunding

P2P Lending - An Opportunity to Earn High Returns

✔️ Earn up to 30% Returns on Investment

✔️ Diversify risk by lending money to multiple borrowers

✔️ Generate Steady Income Through EMI

✔️ Diversify your investment beyond traditional asset classes

About i2iFunding:

i2iFunding is a Fintech start-up, which was founded in Oct-2015. We are one of the pioneers of Peer to Peer Lending in India. Since inception, we have grown at a very fast pace and has become one of the safest, most trusted and innovative Peer to Peer (P2P) lending platforms in India. We have offices in Noida, Delhi, Bangalore, and Mumbai. We have applied for the P2P-NBFC license with RBI.

App Features:

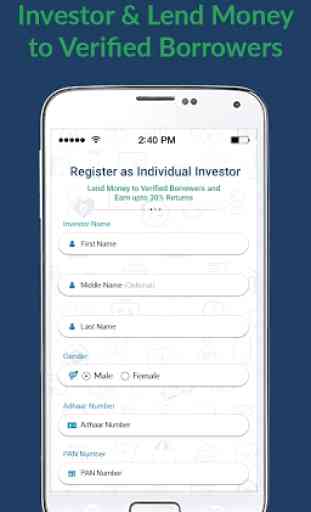

✔️ An investor can fill up the simple application form and become registered Investor at our platform.

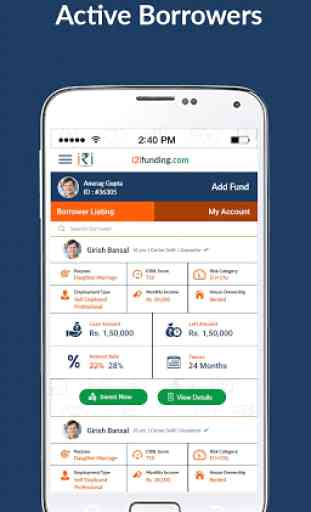

✔️ Registered investors would be able to view profiles of active borrowers who have been verified and approved by i2iFunding.

✔️ Registered investors would be able to invest in the profile of active borrowers and see the overview of their investments.

✔️Registered Investors will get an auto notification, as soon as a new borrower is made live.

Sign Up Process:

Fill up personal details, PAN and Aadhar number, mobile number and email address.

Pay registration fees of Rs. 500+18% GST = Rs 590.0 (Non Refundable)

Provide address and employment details.

Upload copy of PAN and Aadhar card.

Provide Bank details which will be used for transactions.

Investment Amount Limits:

After registration, investors would be able to invest up to Rs. 50,000 without paying any additional fees.

Minimum investment amount in a single borrower is Rs. 5,000 and the maximum amount is Rs. 50,000.

Overall investment limit is Rs. 10 Lakhs across all P2P Lending platforms.

Investment Process:

Create Investor's Account - To begin lending, investors should first create an ‘Investor Account’ by filling registration form either on the web or mobile app.

Review profiles of "Active Borrowers" - To start lending, an investor simply needs to browse the 'Active Borrowers List' and review the detailed profile of listed borrowers. Approved Loan amount, interest rate and tenure are mentioned along with the detailed profile of each borrower.

Commitment to Lend Money - Investors can select borrowers as per their risk appetite and investment preference and then make a commitment to lend money to those borrowers by clicking on "Invest Now" button and entering "Investment Amount".

Physical Verification of borrower and Documentation - Once loan proposal is fully funded; i2i conducts physical verification of the borrower. Post successful verification, a legally binding agreement will be signed between the investors and the borrower. (Feature available only on website)

Disbursal of Funds - Once loan agreement has been signed and physical verification process is successfully completed, investors need to transfer funds to the Escrow account for disbursal (Non-interest bearing) to complete the investment. Investors will have to add our escrow account as a beneficiary in their net banking only once. Investors can transfer funds through any of the following modes from an Indian bank – NEFT, RTGS or IMPS.

Repayments and Monthly Cash Flow –

Every month EMI/Due amount is auto deducted from Borrower's Bank Account to the Repayment Escrow Account of i2ifunding through NACH mandate. Total repayment amount collected from borrowers in Repayment Escrow Account is transferred to respective investors’ bank account every month on the first working day after 10th. Subsequent collections after 10th are transferred to investors’ bank account on the 1st working day after 20th and last day of the month.

Category : Finance

Reviews (26)

I want to appreciate your Technical Architect who designed and developed the site. As It's very complicated Application from backend but everything is clearly getting for a normal user with the attractive UI which is very very difficult. Kudos to your team.Keep it up same level at all the time. How much I loved concept of i2i, more than that I loved the Application architecture backend and UI responsive. As a Software Engineer I know the pain as well as I liked very much as a user. Al d best

The app is good but it is lacking search filters... So that is we are trying to search for specific type of loans it is not easy to find... If you can add that it will be very helpful to lend according to our risk appetite... Hope you can do that... Otherwise the app is very good.

Real good for investors...but referral link is missing from the app..we need to go to the website for this..plz include it in the app itself. I am not getting any notification when a loan is made live..notification setting is on in the app. There should also be some customizable setting to trigger a notification when selected categories of loans are made live..

It is a good app and good service indeed. When i open active borrows list, there must be a flag on individual borrower if i had already invested so that i can only look for new borrower. At present i can see the message poped up like "already invested" when i tried to invest on investment screen. Thanks

It would be very helpful if it is possible to add one more tab in the app for update the reason for the dealy of repayment and action taken from i2i. Also i am not getting proper update on the delayed repayment of some loans. Evertime customer care is saying that the borrower will make payment in this month and and every month it was not happening

Due date of credit of an emi or pre emi interest should be clearly mentioned in the investor page. One should be fully aware of his incomings as we shown a lot of faith on you. Transparency also helps an start ups to go up. Now the above issue has been resolved but recently it has been noticed that repayment is made after 2 to 3 days after the due date. This should be avoided and settlement should be made on real time basis.

Kudos i2i! This is one of the best apps I can certify. The layout, design, content and the speed of the app everything is just superb! Keep up your good work. I'm your fan

I2ifunding app have a very long way to go. Delhi ish app k liya bohot duur hai. Buggy af. Crashes a lot. I am using just for checking if any new borrower has arrived or not. My primary investing tool for I2ifunding is still their web platform. This app need a lot of testing and development. Most importantly looking at the website & the app it looks like it was developed in the early 2009-10. At the moment they need a big VC. Hope someday they become like lending club or mintos!

I have been using this portal for last 2 years. The most visible bit of their feature is they keep changing their rules. Emi comes most on time. But data on lenders profile about own or rented or parental is wrong sometimes. Sometime these things matters. Cannot trust any rules will stay in place for a long time.

Do not use i2i for investing. It's a legal platform to lose your hard earned money. Recovery rate is 0. Defaulted rate is 90%.

Good app.for p2p investment. Investment start with as low as RS 1000. There are lot of new borrowers added every day. Only thing is that there should be some personal flag with different colour indicaticating that investment done or rejected for investment or to be consider for investment.. Also more detail required for NBfc guarantor like their income etc

Here is why i changed the rating from 5 to 1 1) When i try and open any item PM the app - escrow / borrowers etc it just says please wait and keeps me waiting 2) Once in a while when the damn thing opens - when i see delayed loans and call up support to get some colour on whats happening - the lady says "collections" would call me and that call never comes - happend twice. Updates against overdue accounts are repetative & eyewashy-like informed borrower's references seem robotic and pure BS.

can you change the notification sound please or give us the option to choose one. The default notification sound is very irritating and we cant even change it.

Beware: This is a scam. They will get money from you promising high return. You will get payment for a few months initially so you give more money in new loan. Then all the payments will stop. Customer care will day it is delayed. It has been 2 years for me and not even a single loan is paid back in full. Do not be greedy.

Very reliable app. Clean interface and lets you perform all functions without going to the site. Love it.

It's a fraud company I have not received even the principal amount forgot about interest. It is same for almost all peer lending company. Once you invest they will stop taking calls and donot response on whatsapp. The default ratio mentioned on their website is false.

Every 10 days you people are releasing update, and without update app is not opening, but even after update we are not able to open app, update message does not go even after updating.

This app doesnot have any login security. This is a financial app security login should be a must (fingerprint or pin based). The app design is not that intuitive, need to update yourself to material or flat design both website and app like we are in android 9 age.

Very irritating!!!! High sound notification, even when my phone is on silent or vibration mode. Please fix issue.

App not working. Site is also not working. What is wrong with it? Where is all my money invested Nice resolution, app got fixed thank you. Still giving 4 stars because I believed this app would be secure enough. I hope you best of luck.

Experience is good, default rates are getting high, corrective steps need to be taken ASAP. And if you're investor centric, remove the "Investment limit" need to top up/Increase limit frequently, Instead charge some portion percentage at the time if investment itself becomes easier and makes things hasslefree.

Dont invest your money in this fraud App. I invested 1K only just to check what actually this app is. They paid Emi's first two months only and now its pending from more than 1 year. I again saying, better to invest your money somewhere else rather than falling for high rate of interest in this fraud.

Customer service number and WhatsApp both number does not exist. I invested and there is no repayment since 4 months. There is no way to contact customer support and please don't fall for this scam.

For past 2 days App has been behaving slow and weird. It asked to login multiple times! And still it failed after login.

Forget about interest I lost my principal amount also. Received only 25% of amount invested. Thank god I tested the app from small amount. Do not fall in their trap.

I have been using the app since 2020. I am very happy to say that I am continuously generating Income with this application. It has been a very good experience. Gives the options to choose the profile based on risk and it gives the credit score of the borrower. I am having a very good experience on G Category, Group loans. I would suggest people who are starting to invest money for high rate of return which is 18% to 20% this is the best option. How ever the risk is also moderate. Auto Investment option is very good. Improvements Required from the software development team to reduce the time taking while loading the pages. some times it will take more time to load the page, It will test our patience.