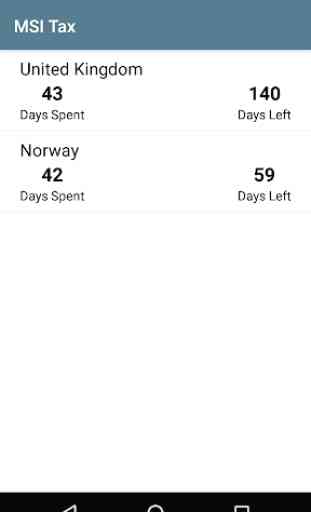

MSI Tax

Business travel carries significant tax and immigration risks, especially for frequent or multi-jurisdiction travellers. Even domestic travel can have adverse tax implications when individual states treat travelling employees differently for tax purposes. As well as the direct tax consequences for travellers and employees, business travel may also create business reputation risk if tax or immigration obligations are perceived to be unsatisfied, or even the risk of prosecution for breaches of local employment laws or failure to meet reporting requirements.

Category : Finance

Related searches