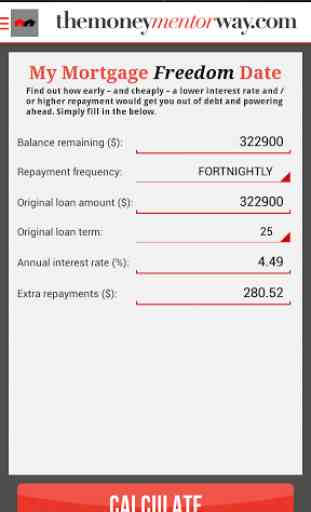

My Mortgage Freedom Date

Find out how early – and cheaply – a lower mortgage interest rate and/or higher repayment would get you out of debt and powering ahead.This free app from The Money Mentor Way (TheMoneyMentorWay.com) identifies TO-THE-DAY and TO-THE-DOLLAR your potential savings in both time and money. It also automatically calculates the massive, ‘free’ savings you could secure by moving to a cheaper home loan and then keeping your repayments at their existing level. A debt-busting masterstroke! If you are targeting a particular Mortgage Freedom Date, the unique Mortgage Freedom Date slider lets you see what rate/repayments are necessary to make it happen. And exclusive tips and tricks from Money Mentor Nicole Pedersen-McKinnon will help you hit your debt-free dream date.

DISCOVER WITH THIS APP…

- How much time and money you’d save from a lower interest rate

- How much time and money you’d save from a higher repayment

- How much time and money you’d save from a lower interest rate and keeping repayments the same

- The total interest you’d pay under every scenario

THIS APP WORKS FOR…

- New home loans

- Loans you’ve begun to pay off

- Loans of up to 40 years’ original duration

- Loans with monthly or twice-monthly repayments

Bring your Mortgage Freedom Date forward years and save a fortune!

Want more forecasting tools like this? Go to TheMoneyMentorWay.com to discover the date you could be entirely debt-free – NO mortgage, NO personal loans and NO credit card debts. PLUS find out how soon you could hit all your longed-for money goals, from the holiday of a lifetime to early retirement. Money Mentor Nicole Pedersen-McKinnon’s powerful and personalised forecasting system also captures your precise mortgage-busting boost from astute offset account use.

Visit TheMoneyMentorWay.com to model your best money move, lock in the optimal strategy and plot a path from debt to prosperity.

DISCOVER WITH THIS APP…

- How much time and money you’d save from a lower interest rate

- How much time and money you’d save from a higher repayment

- How much time and money you’d save from a lower interest rate and keeping repayments the same

- The total interest you’d pay under every scenario

THIS APP WORKS FOR…

- New home loans

- Loans you’ve begun to pay off

- Loans of up to 40 years’ original duration

- Loans with monthly or twice-monthly repayments

Bring your Mortgage Freedom Date forward years and save a fortune!

Want more forecasting tools like this? Go to TheMoneyMentorWay.com to discover the date you could be entirely debt-free – NO mortgage, NO personal loans and NO credit card debts. PLUS find out how soon you could hit all your longed-for money goals, from the holiday of a lifetime to early retirement. Money Mentor Nicole Pedersen-McKinnon’s powerful and personalised forecasting system also captures your precise mortgage-busting boost from astute offset account use.

Visit TheMoneyMentorWay.com to model your best money move, lock in the optimal strategy and plot a path from debt to prosperity.

Category : Finance

Related searches

Reviews (3)

Ale. S.

May 31, 2018

Good as a quick calculator for the currant year...but banks only.allow for a 10% payoff each year and after your fixed term the interest rate will change depending on your total deposit percentage which changes due to any over payment s

And. C.

Apr 28, 2014

Really useful application. Install and start saving now.

I am not sure what I was expecting, but this is a very simple calculator tool. It would be great if the extra payment label could specify whether the extra payment is monthly or yearly.