New New Bank

APP Introduction:

New New Bank Service Features

1. Open an account online 24/7:

24 hours a day, 24 hours a day, no need to go out or visit the counter, prepare your mobile phone, dual certificates, natural person credentials and other information, and complete the account opening application online in 5 minutes.

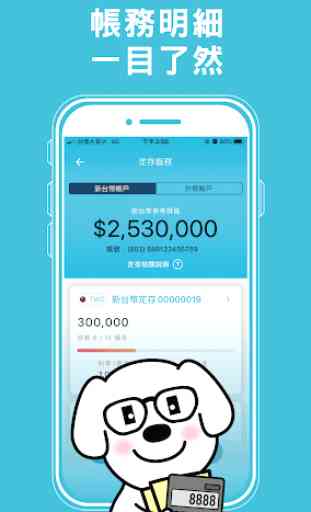

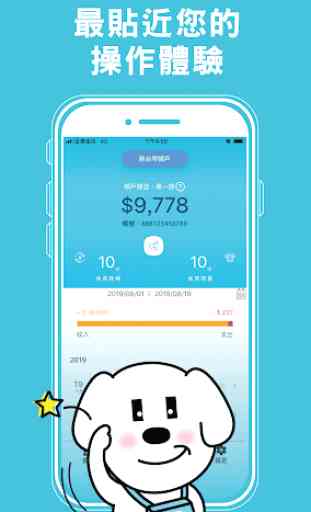

2. Digital financial accounting services:

Simple, convenient, fast and secure, a new digital financial service experience, balance inquiry, transaction details, and fast transfers can be done with one hand, and convenient account services are available anytime, anywhere.

3. Online Banking Services:

Taiwanese foreign currency fixed deposits, the minimum amount of deposits, the petty bourgeoisie has no burden to save money and can form a habit, absolutely does not extinguish your desire to save your dream fund; buy foreign currencies online, see the exchange rate, order immediately, transactions are more immediate, and There are popular currencies to buy and purchase preferential exchange rates online, and the discount is fast, killing two birds with one stone.

4. New New Bank exclusive services and offers:

For New New Bank customers, provide customer-specific services and provide user-defined account service benefits from time to time.

Some functions of the "New New Bank" APP need to use your mobile device permissions to run the application. You must choose whether to provide the following permissions. If you refuse to provide the necessary permissions for the application, you will not be able to perform related functions. The following is the description of the permissions:

1. Phone: Used to call our customer service phone.

2. Camera / Album / Multimedia File: Used to take photos and upload related attachments for online bidding business.

3. Wi-Fi connection / mobile data: You must use the New New Bank APP under the network connection environment.

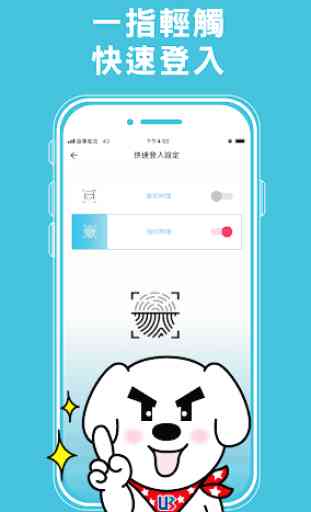

4. Password / Biometric: Used to confirm the identity of the user, perform login, and authorize various transactions.

5. Device ID / Notification: Used for mobile device binding. The user decides to enable or disable the function.

When you use the New New Bank APP, the following personal information may be collected, processed and used:

1. Basic information: This may include name, date of birth, ID card number, passport information, driver's license, health insurance card or second ID number, marital status, family status, education, occupation, contact information, account opening purpose, natural person Vouchers, financial payment instrument verification information, mobile banking login information ... and more.

2. Financial information: This may include the income information, account information, credit information, investment information, insurance information, debit card opening information provided by you, and the Bank's financial consortium of financial consortiums and Taiwan's clearing houses. Information found by the Bank, the United Credit Card Center, etc.

Remind you:

1. The New New Bank APP will no longer support the operating system versions below Android 4.0 (included), please update to the latest version of the operating system to provide you with complete and convenient services.

2. To protect the security of your account, we recommend that you install security software and do not log in to your account with a device of unknown origin or suspected of being compromised.

3. Since the first month of January, the volume is large, and some cards will be postponed. We apologize for the inconvenience.

4. You can still open an account online during the Spring Festival. Your account can be used after receiving the approval message. The financial card and password letter will be sent after the Spring Festival holiday.

Want to know more about New New Bank?

See New New Bank official website

24-hour customer service hotline (02) 2545-1788

New New Bank Service Features

1. Open an account online 24/7:

24 hours a day, 24 hours a day, no need to go out or visit the counter, prepare your mobile phone, dual certificates, natural person credentials and other information, and complete the account opening application online in 5 minutes.

2. Digital financial accounting services:

Simple, convenient, fast and secure, a new digital financial service experience, balance inquiry, transaction details, and fast transfers can be done with one hand, and convenient account services are available anytime, anywhere.

3. Online Banking Services:

Taiwanese foreign currency fixed deposits, the minimum amount of deposits, the petty bourgeoisie has no burden to save money and can form a habit, absolutely does not extinguish your desire to save your dream fund; buy foreign currencies online, see the exchange rate, order immediately, transactions are more immediate, and There are popular currencies to buy and purchase preferential exchange rates online, and the discount is fast, killing two birds with one stone.

4. New New Bank exclusive services and offers:

For New New Bank customers, provide customer-specific services and provide user-defined account service benefits from time to time.

Some functions of the "New New Bank" APP need to use your mobile device permissions to run the application. You must choose whether to provide the following permissions. If you refuse to provide the necessary permissions for the application, you will not be able to perform related functions. The following is the description of the permissions:

1. Phone: Used to call our customer service phone.

2. Camera / Album / Multimedia File: Used to take photos and upload related attachments for online bidding business.

3. Wi-Fi connection / mobile data: You must use the New New Bank APP under the network connection environment.

4. Password / Biometric: Used to confirm the identity of the user, perform login, and authorize various transactions.

5. Device ID / Notification: Used for mobile device binding. The user decides to enable or disable the function.

When you use the New New Bank APP, the following personal information may be collected, processed and used:

1. Basic information: This may include name, date of birth, ID card number, passport information, driver's license, health insurance card or second ID number, marital status, family status, education, occupation, contact information, account opening purpose, natural person Vouchers, financial payment instrument verification information, mobile banking login information ... and more.

2. Financial information: This may include the income information, account information, credit information, investment information, insurance information, debit card opening information provided by you, and the Bank's financial consortium of financial consortiums and Taiwan's clearing houses. Information found by the Bank, the United Credit Card Center, etc.

Remind you:

1. The New New Bank APP will no longer support the operating system versions below Android 4.0 (included), please update to the latest version of the operating system to provide you with complete and convenient services.

2. To protect the security of your account, we recommend that you install security software and do not log in to your account with a device of unknown origin or suspected of being compromised.

3. Since the first month of January, the volume is large, and some cards will be postponed. We apologize for the inconvenience.

4. You can still open an account online during the Spring Festival. Your account can be used after receiving the approval message. The financial card and password letter will be sent after the Spring Festival holiday.

Want to know more about New New Bank?

See New New Bank official website

24-hour customer service hotline (02) 2545-1788

Category : Finance

Related searches

Reviews (2)

KEN. L.

Jun 15, 2021

不支援 Android 原生臉部辨識登入

the worst bank app I have ever use