PDF Form 1040 for IRS: Income Tax Return eForm

With this tax filing app, you get the opportunity to claim any deductions that you meet the requirements for. Keep in mind, that the number of deductions you can claim for depends on various factors - such as marital status, claiming children or dependent individuals, etc.

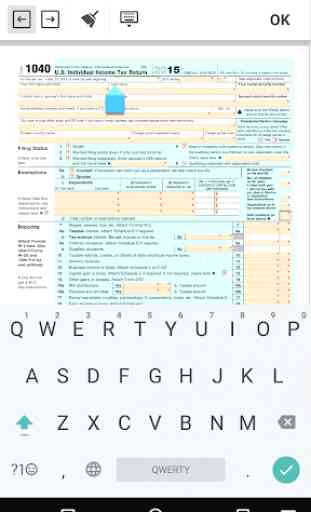

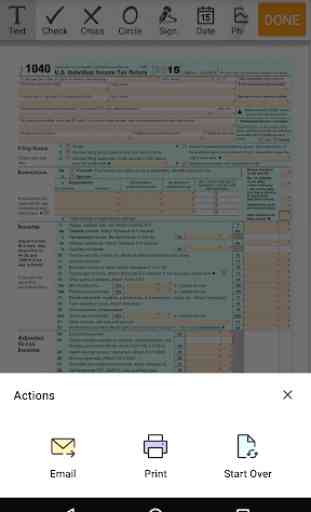

The application is equipped with various user-friendly tools, designed specifically for accelerating the form completion process.

They include:

✓ The possibility to add any textual or numeric data to the document;

✓ The opportunity of completing the form while being assured your confidential information is safe and protected;

✓ Adding the current filing date automatically or manually;

✓ Also, the sample can be filled out with additional symbols like checkmarks, images, cross signs, graphic lines etc;

✓ Certifying the template with a legally binding e-signature. Just click on the needed field and draw the signature on the screen of your smartphone or tablet with your finger. Once done, your initials will automatically fit the cell.

With this solution, your 1040 form will be completed easier and faster - saving you time for more important business tasks.

Basically, you will want to include the following information in the form:

✓ First of all, provide your filing status, as it presupposes the tax plan, applicable in your case;

✓ Next, add the general information about you and your spouse (if you are filing jointly), as well as your Social Security Numbers;

✓ If you have any dependants, list them while specifying their names, SSNs, and relationships to you;

✓ Additionally, include your full postal address including your ZIP code and specify whether your spouse can be claimed by someone as a dependant or not;

✓ Next, itemize the deductions you or your household is claiming for;

✓ It’s important to specify wages, salaries, tips, and refund information;

✓ If you owe some specific sum, then itemize it in a separate cell;

✓ Don't forget to certify the document with your legally-binding initials.

Category : Business

Reviews (18)

Awesome tax app that allows you to do years you missed doing your taxes

Finally an app that goes straight to it and you can print it excellent work love it

There is no way to sign the e-document

Considering my age I did quite well, I think.

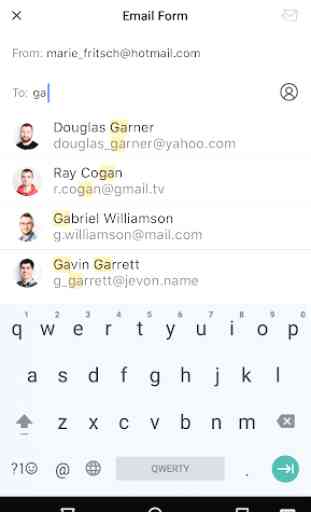

Easily filled in and delivered via email.

Really help made it easy..we shall see

This form keeps blanking out all of the information that I repeatedly type in.

Awesome app fun and educational

Awesome at did the job great

Cannot move to an email or Gmail after completed to send to a Certified Public Account, Accountant or IRS email or website!

Easy to fill

It's great

It's amazing

how does the form get to irs ?

Cant use

Love it

Only place where I could fill and print 2013 taxs without a problem. Fantastic.

Like the 1040x application this would work best if it was designed to work with a spreadsheet program. It too jumps around when you are trying to fill it out.