Retirement Planner

Features

- Fields for Current Age, Retirement Age, Life Expectancy, Monthly Expenses, Inflation, Rate of Return on investment Before Retirement & After Retirement, Years to Retire, Yearly Expenses at retirement, Retirement Corpus, Monthly Investment

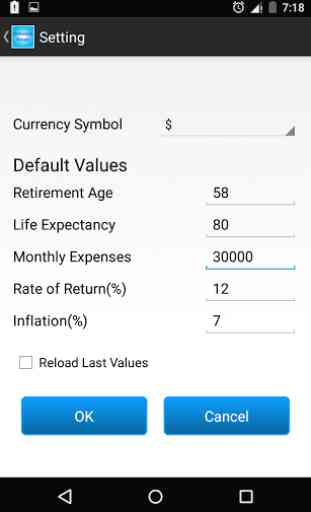

- Settings for Default Values

- Currency Symbol, Rate of Return, Inflation, Retirement Age, Monthly Expenses & Reload Last Values

- Chart showing Monthly Investment, Yearly Retirement Income and Balance at End of every year in Retirement Corpus.

- Chart Save Chart Menu to save chart file in SD Card folder which user can attach in email.

- Hindi and Korean language added

- Existing Investment field added

- Lump sum investment required

- Monthly investment required

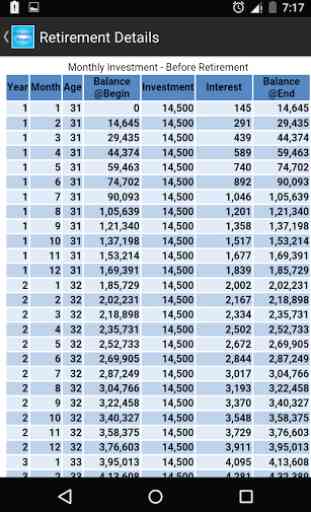

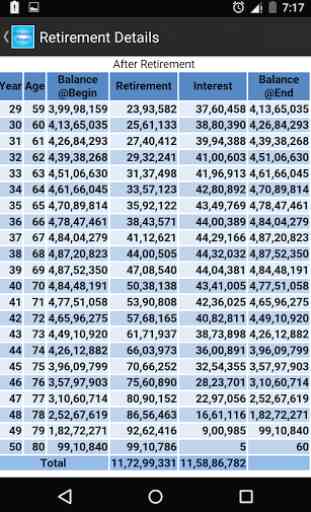

- Retirement Details Table with Investment required before retirement and Inflation adjusted Retirement Income after retirement.

- Number formatting is now based on device locale

Age (Years) : 30Retirement Age (Years) : 58Monthly Expenses : 30,000Inflation (%) : 7Rate of Return (%) on investment Before Retirement : 15Rate of Return (%) on investment After Retirement : 10

Year to Retire: 28Monthly Expenses at retirement : 199,465Yearly Expenses at retirement : 2,393,582Retirement Corpus : 39,998,159Monthly Investment : 7,719

Example: Suppose you are 30 years old who wants to retire at 58 and expect to live till 80. If your current Monthly Household Expenses (excluding expenses which will not be part of it post Retirement e.g. EMI, Insurance Premium, Education Expenses etc) are 30000, You expect inflation to be around 7% for next 28 years,You expect 15% return on your investments before retirement and During retirement you expect that your investments will return 10%.

So Number of Years left for your retirement are 28 years and at retirement you will require a retirement corpus of 39,998,159 for which I need to save 7,719 per month.

SupportPlease send your suggestion and issues to my E-mail address [email protected]

Category : Finance

Reviews (20)

I m having premium upgrade. But when I try to SAVE AS PDF, it exits that screen and again come to home page of calculator.

👏👏👏 Wonderful Sir It is really a great small and efficient app. Very small footprint. Excellent 🙏🌹

Very poor UI..more briefing required in the calculation area and in detail

Gave me the info i needed

PDF download and email does not work even after upgrading

The calculations are wrong

Satisfied

You could hv add multiple req and UI could hv been beter

A very straight and easy to use tool to help people getting an idea on how much they need for retirement. Parents should teach their children to use it.

Would be niceif app develooer can fix this.

Not very useful. Sometimes doesn't calculate and shows nan or null.

The future details were not calculated, which is what this is all about.

Fast n easy to operate

Good for new genration

whack

Thank you for this calculator

I recommend this app to those whose retirement is nearing.

Absolutely useless!

Needs even lumpsum investment and monthly investments also

Used only Free Version, Quite Good! Explored ,verified my personal details with MS Excel,Casio FC-200V FINANCIAL CONSULTANT. NO significant difference in results observed . All The Best,Sir