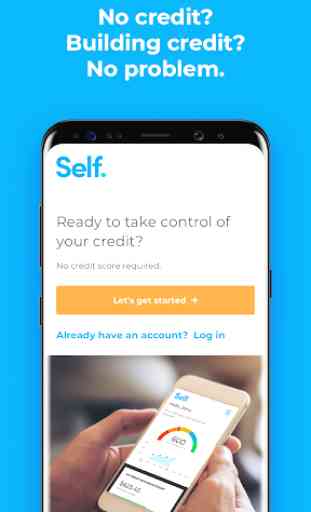

Self - Build Credit While You Save

Over 500,000 people have used Self’s Credit Builder Account to build credit and save more than $300 million. With the Self Visa® Secured Credit Card, you have even more opportunities to build credit after you get started.

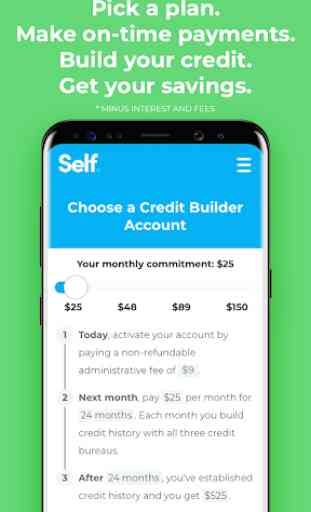

How does it work? Think of it as a plan that builds credit while you save, starting at $25** per month.

1. Apply for a Credit Builder Account. Your money is safe and secure in a bank account.***

2. Pay off your Credit Builder Account in 12-24 months.** You can choose the payment term and dollar amount that best fits your budget.

3. Each on-time monthly payment builds credit history and adds to your savings*. Your monthly payments are reported to all three credit bureaus while the principal gets saved in a bank account.***

4. Unlock your savings. Once you’ve paid off your Credit Builder Account, your money unlocks and comes back to you (minus fees and interest).

BUILD CREDIT. SAVE MONEY*

With an active Credit Builder Account, your payments are reported to all three credit bureaus.

CREDIT SCORE MONITORING INCLUDED****

With the Self credit app, you can check your credit score at no cost. The mobile credit tracker!

NO HARD CREDIT PULL

Self does not do a “hard pull” credit check when you create an account. In fact, no credit score is required at all!

SECURE ACCOUNTS

All accounts use two-factor authentication, 256-bit encryption, and fraud detection to protect your money and private information.

UNLOCK THE SELF VISA® SECURED CREDIT CARD

Have an active Credit Builder Account in good standing, make at least 3 credit builder account monthly payments in full and have $100 or more in savings progress and you could unlock access to a secured credit card – no extra deposit and no hard credit check needed.

WHY PEOPLE LOVE SELF

“Love love love this program and this app! In eight months my credit went up a hundred and nine points Super happy and can't wait to renew once the first year is up” - customer Debbie G. Individual results may vary.

Featured on ABC News, USA Today, Newsweek, TechCrunch and NerdWallet

TERMS

When you download and use Self, you agree to the Terms of Service at: https://www.self.inc/terms-of-service

PRIVACY POLICY

You may review Self’s privacy policy at: https://www.self.inc/privacy-policy

*Savings are minus fees and interest. Results are not guaranteed. Improvement in your credit score is dependent on your specific situation and financial behavior. Failure to make monthly minimum payments by the payment due date each month may result in delinquent payment reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report.

**Sample products are $25 monthly loan payment at a $520 loan amount with a $9 administration fee, 24 month term and 15.92% Annual Percentage Rate; $150 monthly loan payment at a $1663 loan amount with a $9 administration fee, 12 month term and 15.91% Annual Percentage Rate. Please check the pricing page in the Self mobile app or www.self.inc for current pricing.

***Credit Builder Account — proceeds are held in a deposit account until maturity

****Credit scores will only be available to customers who our third-party vendor is able to validate.

All Credit Builder Accounts are issued by Lead Bank, Member FDIC, Equal Housing Lender, Sunrise Banks, N.A. Member FDIC, Equal Housing Lender or Atlantic Capital Bank, N.A. Member FDIC, Equal Housing Lender. Subject to ID Verification. Individual borrowers must be a U.S. Citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to ID verification. All loans subject to approval.

The Self Visa® Credit Card is issued by Lead Bank, Member FDIC, Equal Housing Lender.

Category : Finance

Reviews (30)

Self has definitely helped me kick my credit building into overdrive! When I started this journey I was honestly getting affairs that I had procrastinated over for far too long back in order. (Student loans, old credit cards, etc) but when I started noticing my score gradually creeping up I wanted to see how far I could go. Self has made a huge a difference and I think it's awesome that at the end if my payments I'll have a nice little chunk of change. Definitely recommend!

Since using it it's been amazing. I am a newbie. Haven't had any issues with it at all within the first few months. So far no complaints. Quite that simple and I'm starting to build my credit at the moment. The user interface should definitely be recommended to any and all. Self is definitely good. No question if there are drawbacks they aren't noticeable nor are they impactful. If there are any

This has really helped, my credit score has went up 200 points with just this app. I used the $50 amonth option which also gave me a credit card about 6 months in. You use the money you pay in to up the card limit. About a month from my last payment, I was able to get an unsecured credit card. This is a very helpful app and I recommend it to anyone trying to rebuild or build their credit.

Very easy to use and pretty much explains every step to help you keep control of your account and credit. Paying two payments each month and the first payment only details interests paid on the account and the extra is entirely applied as principle, other similar products aren't so generous and will continue to collect the interest. Credit builder works well and the credit card is a real bonus! no overload from ads either.

They charge $10 administration fees and also charge a percentage fee based on how much you're paying (i.e. I pay $35/month, they take almost $10 of that), I don't have a credit score because my history isn't long enough yet they claim my score is 610. I know for a fact that it's not, so the score they show is meaningless, always trust the original source. I'm just ashamed I'm stuck with this for 2 years, that's how long you have to wait to get some of your money back

Credit builder is good, AVOID the credit card completely if you travel frequently outside of the US because it is completely worthless & that's buried deep in the fine print which most miss. 42 point jump since joining the program. Just now opened the app after being in the program for two months. Update credit builder is okay. Again, miserable experience using the credit card. Is received on the day the bill was due. All small charges and seven declined $2.18 purchases finally 😴 approved.

I have been so excited since I have started mybership plan with Self.Y credit has changed more than I thought possible in the last 4 months. I didn't have a lot of debt but have always used cash or was dependant on a spouse for years. Never established ANY credit. Just signing up and having a small draft taken out of my checking monthly has established me some good credit, and it keeps getting better!

TOTAL SCAM!! I've had this for 5 months, got the credit card and everything. All payments made on time and I keep a low credit usage percentage, and pay my Self "loan" on time, even early every month. Yet, my credit score has decreased EVERY MONTH since signing up. There are no other factors affecting my score like this, because I haven't missed any other payments anywhere else, etc. This trend started when I signed up for this app. Stay away!!!!!

It is now 5/30/2022 and my score is up over 100 points in a year with a credit card and helping catch up Dr. bills. And has eliminate much of my stress. Like everything it takes time to recover from any issues, medical or financial. Slow and steady and you can do it. My first post over a year ago. In about 2 months my credit score went up 36 points. Give it a try.

Honestly when my family told me about this app I thought it was a full on scam that would never get my credit score up🙄 but they tested it out for by making an account and after a year proved it was not a scam at all. I gave it a try and created an account and honestly it is so much easier now and my credit is really going up and getting better each time!

This app is good for the first couple months and then when you get close to our goal it starts charging you extra money or will stop taking your payments. If you choose to use it do it for like 3 or 4 months after that your going to get taxed, get your credit score hit and possibly lose out on your money you had save.

Don't get the credit card. It takes at least 3 days for transactions to be complete. Due to an emergency I had to use a little more than I'd like. While waiting for the payment to settle my credit score dropped 17 points!! And I still haven't gotten a response to my email that I sent Self over 48hrs discovering the drop. Just make the monthly payments on the loan but please save yourself and DONT get the credit card.

So far so good, buy only my transunion score has gone up. But its simple and ill see if it works. But they do charge you a fee plus a % if you use a debit card instead of linking your checking account. Also, when you make a payment, you have to make sure nothing else comes out of your account because they don't take it out immediately which is a pain because if you forget to make sure it's in there it won't process and it will be a missed payment...

My credit score has gone up 127 points, up to 684, since using this app. As soon as my credit was high enough with this app, I got a Sephora credit card. The combination of these two things has boosted my credit higher than I thought it could get in 6 months! I have recommended this to everyone!

Good for beginners building credit. Don't fall into their attempts to open new loan accounts after you complete your first one, as you should be able to get a secured credit card from them at that point and other credit cards in general. Take your time building credit if you want to maintain it, don't try to rush to 800.

This is a great app for building your credit back up when you have had problems in the past, or if you are new to credit and just starting out and want to build your credit score!! I would strongly recomend Self. Update my score has went up almost 200 points in about 8 months useing this app. Thank you!

Self is one of the best ways by far to build your credit. I've been using it for about a year and my credit has raised significantly more about 40 points within the past few months. The credit card and credit builder loan are great ways especially if you need the extra money when you need it. Paying these two things are almost always priority to me because they're helping me grow. I would recommend this to a responsible person who is ready to build credit.

This app is great. I only had this app for 2 & a half months so far, and (self) already start improving my score. I couldn't believe how much they boosted my score, and I have 7/half months to go, I recommend this app to anyone who's credit isnt in great shape. They have reasonable monthly plans. Thank you!!! (SELF)

So far I love it. Want better credit, and they said yes when everybody else said no. I missed my first payment and am late right now but my credit score somehow went up with them in the picture anyway and they don't nag me for my payment I can't give them until my next check. But they do have a slick way of handling getting your score and a real credit card in your hands if you really want one bad enough to pay in advance (through manageable payments) and I feel like it's a good novel way.

Customers can't get a hold of a person. Not even on chat. The payout doesn't come for over 3 weeks. (Processing for 2 weeks... Paid 3 business days after processing and thats for immediate payout...) The secured deposit doesnt come unless you cancel the card... Basically they get to keep your money because no one building credit wants to close an account.

So far I am extremely disappointed in this app. Two factors credit bureaus look at is new accounts and credit age. By opening this new account #1 it has lowered my credit age #2 and drop my credit score by 32 points. This is the most truthful review you'll ever see. I will give an update if I notice a significant improvement. At the end of the day I jumped on this program to build up my credit score not lower it 32 points. This is a terrible feeling let me tell you. Wish something could be done

So my credit is pretty bad. ive been slowly building it back up, thanks to Self, the app is easy-to-use can see what is on you're report and keeping you updated with you're payments, only problem i have with this app is that they nag alot about the credit card they offer you. It might be a better way to build more credit, But credit cards is part of the reason im here now. I understand they need to make money too. Ask for tips instead.

The people who give it one Stars don't seem to understand the point of credit builders. It's not to make you money. This app is for people with no credit or bad credit who can't get a credit card, and no lender will touch. No credit is worse than bad credit. You will be hard pressed to find anything that will help your credit go up where they give you any thing up front. The only cards I could get were secured. The purpose of this is to help your credit score not make money.

It is a pretty good way of boosting credit a little bit. You can set everything up to be automatic draft and it gets the job done. I'm giving it three stars because it is very difficult to get any customer service when you need it. I've sent emails with no responses and I've tried chat but that does not seem to work. I don't know of any customer service phone number so if you need to contact them just know that it is going to be hard to obtain it. Otherwise I am very happy with Self.

Before, I had a 5 star but now a 3. The app was perfectly fine, literally, until you guys changed the expedited svc payment to speaking with someone in the chat first before you can. The app keeps crashing after I confirm I want to do an expedited payment. I've tried 3 times and I'm annoyed.

Love this app it has helped boost my credit score and my account mix. Will definitely keep using self after my term is up. Such a great way to save but also have access to your funds with the credit card. Most of the other credit builder apps you can't touch the money until the end of the term which is fine and I use 2 of them. However, self beats all of them hands down.

This is awesome. It almost seems too good to be true, but it's actually true! They're giving you the opportunity to save money and raise your credit score, with one low monthly payment! honestly they're just offering an incredible service to us for next to nothing. My credit's already gone up, and I've only made three small payments (one per month). 🌟Shocker is, you get most of it back at completion!! Best financial decision I've ever made 💯

It's a fast, easy & very beneficial loan. Will increase your credit significantly. Just as long as you make your payments on time. But the earlier the better. Once you have made all the payments, you receive the loan back in full. The only thing I didn't like was once the loan gets paid out and self closes the account, it drops your credit score. Significantly, if you are me. Down 20 points. 🤨 Aside from that I for sure rate it 5 stars.

Great company since I have had the self card. I have been able to get 4 new credit cards with over $10.000 in combined limits. My credit was below 500 and now it's between 682 and 713 depending on which credit bureau. My only complaint is it's the only secured card I have which limits any financial loss to the institution but their the only card I have an annual fee on.

It only took me 35 years to start caring about my credit score, and when I did, it wasn't fantastic. Ive used Self for 18 months & apparently, good credit is a thing! Imagine that. They slowly help you help yourself, track your score and offer a credit card option secured by your savings, which was a big help for me. Limits increase as you show positive habits & its really nice to get those regular "attaboys" for building your credit, no matter how old you may be! The app is very user friendly.