Sweldong Pinoy

Computations of the deductions are based from BIR Revised Withholding Tax Table (ftp://ftp.bir.gov.ph/webadmin1/pdf/1601_c_tax_rates.pdf), PhilHealth Circular No. 27 s.2013 (http://www.philhealth.gov.ph/circulars/2013/circ27_2013.pdf), SSS Circular 2013-010 (http://www.sss.gov.ph/sss/uploaded_images/circular/Circular2013_010_Hi.pdf), Republic Act No. 9679 (http://www.pagibigfund.gov.ph/faq.aspx), and Republic Act No. 8291 (http://www.gsis.gov.ph/default.php?id=86)

Install and try the app and help us improve it by giving feedback and suggestions.

Note: Internet connection is not required to use the app. You will only need it when you share the results online.

Category : Tools

Reviews (30)

I hope you can make it more general. It can really help a lot of Human Resource associates in terms of payroll making. It would be great if all the inputted data can be save for future references.

There is an overlap of text after performing computation. Please look into it. But overall. It gives a great idea of how much to expect from a salary. Kudos to you.

The application is good, but i wish it's also have the content of absent or number of working day so it will compute accordingly, deduction for late thank you

Not very flexible app. Just doing the very basic computation.

Very useful, please include holiday pay

Should have the ability to edit the amount of contributions and loans

Thanks for keeping the app up-to-date. :-)

very helpful for the mass laborer

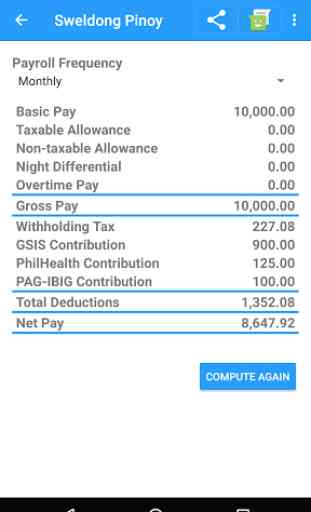

Please change the PAG-IBIG mandatory contribution from P 100 to 2% of the employee' salary for government employees. The P 100 contribution is actually the employer share, not employee share.

Apps needs to update the contribution, Philhealth, pag-ibig and SSS matrix.

The app is now updated with the New SSS Contribution Table which is really helpful. Thank you so much for this app!

Lacks 13th month pay for annual computation.

Excellent app thanks

Yes it is good

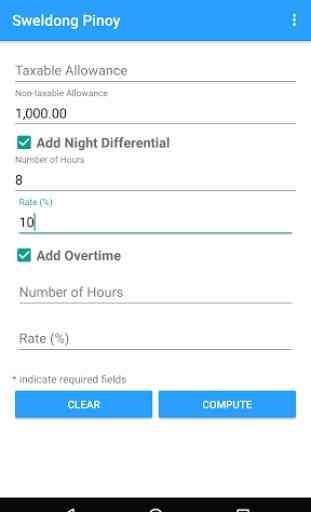

It almost computes precisely except for the sum of deduction for government employee type. Hence, wrong net pay. Edit 2021/10/15: This is a very handy and accurate app. The only issues I see are the text overlaps (Pag-IBIG and PhilHealth Contribution) because of word wrapping when in portrait mode. Next is the input for night differential and overtime hours. It only accepts whole numbers (integer). It should accept decimal numbers.

Hi! I would like to ask what is the computation or formula for night diff?

If selecting ROHQ/RHQ employee, the computation seem to show the same result as that for "private employee".

It is a helpful app but I hope you can add holidays and an option to add overtime with different percentage at least. For special holidays, rest days, overtime for such days and double holidays. Thank you!!!

App is simple, intuitive and well formatted. Great app! Helped me a lot with my recent increase.

As a HR, I usually use this thru website and so thankful that you have app already even without data/wifi.. good job.. ✔✔✔💯💯💯

Some employer deduct the mandatory government benefits on a particular cut off. Adding that option really helps

Did not tallies with the computations in taxcalculator.ph but still impressive.

Hi Jomar, this is a nice app with updated tax computation on TRAIN law. One suggestion though, can you please add: Incentive (taxable & non-taxable), De Minimis, and # of days of Regular and Special Holidays per cut-off (semi-monthly & monthly). Thank you and Kudos to you!

Hi Jomar! Very helpful app indeed. Btw, can you check, there's a. 09 diff on the tac versus manual computation. Thanks!

Nice app! Can you update the tax calculator to include the tax status (single, married with dependents, etc..)? Thanks!

Updated!

This app is really helpful for those just starting in their career. But there are a few things you need to add: - option to add absences or tardiness - option to add other salary deductions (e.g. office contributions, etc.) Keep up the good work! :)

i always get wrong output for overtime computation. i already used the format: 25%, 0.25%, 1.25% and 125% but it always give me a wrong answer. .. and other commentators are also right. there should also be a room for other OT rates like special OT, holidays etc. and 'Other' customizable deduction slots.

Make it possible to add decimal in number of hours for OT. There are also different rates for regular OT and rest day OT. Not possible to add different rates. It is also better to add Union Dues

This app is highly under rated, it deserves more exposure. It is constantly updating with the new government mandated benefit rates. One thing that i would like to recommend for feature update is the ability to add other deductions (e.g. sss/personal loans) and the ability to compute the daily and hourly rate based on user input. Great app! Kudos sayo dev!