T-Mobile MONEY

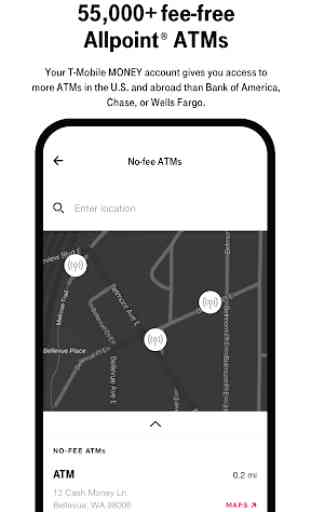

No account fees, no maintenance fees, and no minimum balances. Plus, access over 55,000 fee-free ATMs in the U.S. and beyond with the Allpoint® ATM Network – that’s more than Bank of America, Chase or Wells Fargo!

T-Mobile MONEY accounts are held at BankMobile, a division of Customers Bank.

All Rights Reserved. Member FDIC.

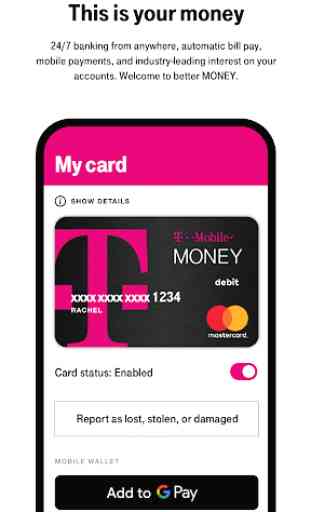

PAY THE WAY YOU WANT

Your T-Mobile MONEY account includes a debit card with EMV chip, plus it works with Google Pay and Samsung Pay.

HASSLE-FREE MOBILE BANKING

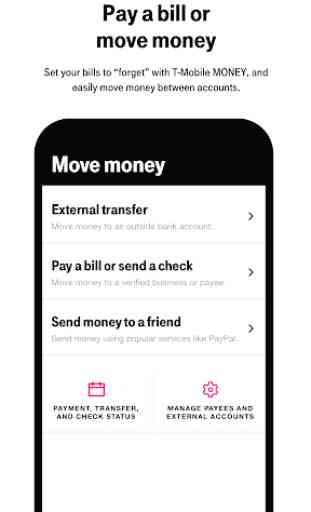

Easily transfer money to and from your external accounts. Send a check, pay bills, or direct deposit a portion or all of your paycheck to your account – all with just a few taps in your T-Mobile MONEY app.

STAY CONNECTED TO YOUR MONEY

Access your money anytime with the app and enjoy 24/7 customer support.

SAFE & SECURE

Prevent unauthorized account access with multi-factor authentication and log in with Fingerprint Scanner. Enable or disable your debit card remotely if it’s lost or stolen. Accounts are FDIC-insured up to $250,000. Plus, with Zero Liability Protection from Mastercard® you’re protected when fraud occurs.

------------------------------------------------------------

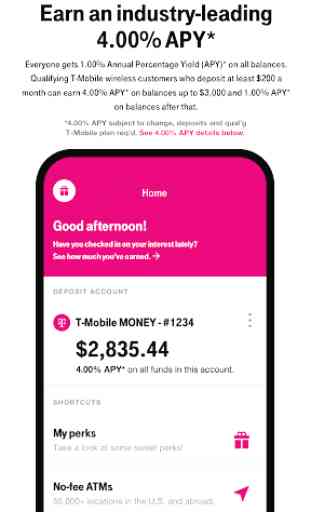

*How APY works and what it means for you: As a T-Mobile MONEY customer you earn 4.00% annual percentage yield (APY) on balances up to and including $3,000 in your Checking account each calendar month when: 1) you are enrolled in a qualifying T-Mobile wireless plan; 2) you have registered for perks with your T-Mobile ID; and 3) you have deposited at least $200 in qualifying deposits to your Checking account within the current calendar month. Promotional deposits are not eligible toward the $200 in deposits. If you meet this deposit requirement in a given month we will pay you this benefit in the subsequent month as an added value provided all other requirements are met. This added value is subject to change. Balances above $3,000 in the Checking account earn 1.00% APY. The APY for this tier will range from 4.00% to 2.79% depending on the balance in the account (calculation based on a $5,000 average daily balance). Customers who do not qualify for the 4.00% APY will earn 1.00% APY on all Checking account balances for any month(s) in which they do not meet the requirements listed above. APYs are accurate as of 10/21/19, but may change at any time at our discretion. Fees may reduce earnings. For more information, see Account Disclosures / Terms and Conditions or go to our FAQs.

Category : Finance

Reviews (30)

A bit different from my previous Banks app not as straightforward and user-friendly but once you find out where everything's hidden it makes it a lot easier... It took me four tries to add my T-Mobile phone account as an auto bill pay. The amount of interest I've gained is 10 times what I was making at my other bank. 3/22 update... This app really has changed for the better.. but saying that as with any virtual bank depositing sums of cash is hard to do, but for the interest rate they pay...

App is good, but needs more settings/services/options. Especially account alerts to help with real-time monitoring of your account. Ability to find ATM locations without having to login. Customer service numbers without having to log in. Etc. Things that all my other banking apps have had for years now, and make things much more user-friendly. Especially while away from home and having to use a mobile device.

The customer service is outstanding. They have your back when you really need it. Transferring money is a process that takes forever. had T-mobile money at a 5 star rating up until I caught 2 fraudulent charges on my account. Account will be closed if this ever happens again.

Works flawless, so far! Customer service is also great. I've had a few fraud instances and they've stepped right in and helped. Better than a regular bank. I do feel than the check processing should be quicker, 4 days isn't forever but it isnt that slow on their end. 2 days would be sufficient

The more you use the account and application the better and easier each transaction becomes. I like the application. I like the TOS. I don't like the live customer 😕 support.

04-2022 App has been working properly, interest is the best around. Issues I have are that only 3k can be transferred at once, also there's no way of setting up a beneficiary 06-2020 Love the interest and overall setup but for a couple days now, app is crashing when trying to open transactions

Have received awesome customer service from everyone i have spoke to. They pay me for having a checking account with them. I have not had my account in the negative, but they do cover $50, not sure what fees are involved if any. Have a suspecious/fraud on my account and they stopped it from happening. I was notified immediately. I also had a company charge my card twice, 2 different amounts. i called TMoney they set up dispute, sent me paper, returned, wrong amnt was credited back to me.

You can NOT beat the interest rate on this account! The app is also quite easy to navigate. My ONE request is to make signing in easier. Please remember the username, so we don't have to enter both the username AND password EVERY time I want to use the app. Otherwise, it's great!

So far everything it claims to be I really love using tmobile money easy reailable I would definitely recommend trying this to everyone, ok been using t-mobile for a few months and I love it if I had to say anything I would say that the atms in my area are few but so far haven't had any problems. If I do have any questions a real person will actually contact you , definitely would recommend to everyone at least give it a try. Ok had this for awhile and no problems definitely recommend. triple A

Great savings and the app works well. Haven't had an issue since opening a few months back. When I've had issues, customer service is quick to respond and fix as needed.

The interest rates are actually really nice. Straightforward and easy to use. I like that I could open a savings account and addition to the checking after a while. Easy card control. Bio login makes it fast to access.

Always quick to resolve any issues and very friendly service. The interest us also a big plus. I've had great experiences with T-mobile Money and easy bill pay and electronic deposits.

I love T-Mobile money I've had it for three years now and I will never switch up ever I love the fact that it will let you overdraft up to $50 if needed and it's no overdraft fees I also love the fact that I get my check 2 days early which is awesome and I love that it's an awesome card. It's many other things i can say good about this card. But I don't feel like writing a book so go get yours and find out the rest. Lmbo.. I would never change it ever

The fraud department is the best I've ever seen!! As soon as there was a fraudulent charge, I received a text immediately and a minute after that, an agent called me about it. I was notified via text about two charges, but when I spoke to the agent, there had been a total of eight fraudulent charges already!! They immediately took care of everything in less than two minutes!! I've had my identity stolen before and it always took months to resolve, but this was amazingly dealt with. Thank you!!

It is simple but too simple that is a little challenging navigating and is not complete. Update 2/24/22: after using it for a while becoming familiar with it. Good. Update3.27.22: love it now!

UPDATED My PW was not being accepted & it said one more attempt would lock me out of my account, so I changed my PW & tried to log in but it told me I had to enter a six digit code which was sent to text. Got PW change confirmation text, but never got the code text. I contacted customer service & it took a few days and a few phone calls to resolve the issue, but customer service was very responsive, worked hard & my issue did get resolved. They then took feedback from me for the future.

Used to be great, now it's just so so. I loved transferring money to use the account and get good interest. Now only way to use interest is to make a specific amount of purchases. They are forcing you to make this your main account. I'll pass.

This app drives me insaneeee. Once you're in it's fine but jeez it does NOT want you to login. Biometric login, no okay traditional login, oh just kidding that won't work back to biometric, but wait actually no back to traditional. It literally just cycles and teases you with a preview of your account. It seriously needs to be fixed good grief.

Well now after 4 years of use I have to admit, best account I have by far. Both checking and savings give a minimum of 1% which is way better than any brick n mortar. Because of this card I've saved over 10 grand... Excellent. Have no issues except for possible fraud so account froze unexpectedly when attempting to use it. Several months later and I couldn't be happier 😁. Loving the 4% interest.

I have used a lot of prepaid cards and none of them have the benefits this one has, 4% interest! I've already made almost 2$ in interest In just 2 mo., having my bill money in there to pay my bills etc.. Highly recommend giving the card a try I DON'T think you'll be dissatisfied.

Love this bank account and app loved it more when there was a minimum monthly deposit to earn the higher interest rate than now where one is required to make 10 purchases in order to receive the higher interest rate but hoping they change this up every so often. Still hoping to change the requirement to earn the higher interest rate. Please.

This is hands down the best checking account I've ever owned, and I'm a personal banker for a brick and mortar bank! I love this, I love T-Mobile, and I would recommend them to everyone. UPDATE - they now have a savings account with 1% APY!!! If you're a T-Mobile customer, you earn 4% on the checking after 10 purchases each period. No one has this, anywhere.

The worst bank I have delt with. Transactions and deposits take unreasonable amounts of time to post. I have an unauthorized transaction been pending on my account for over a week their solution cancel and replace my card ok. Transaction is still pending on my account. Transfer money from another and it will show the funds added to your account not pending but does it reflect on your balance NO. Want a joint account too bad want to deposit a check made out to you and your partner too bad.

Edit: 4/18 I've learned to love T-Mobile Money and just changed my rating from 4 to 5 stars. I like it but...there's still a few things I've found that I have to pre -plan ahead on. I do suggest opening an other account with an established bank or credit union if any of your income and daily cash withdrawls exceeds the $400 limit.

The mobile app is superior to the browser site. The security is great and the alert options are great when you are watching for activities. Like did that charge hit yet.

This app needs a transaction search option. Not just a statement, but a history search option. Trying to find a specific amount or transaction in the past is not user friendly. Mobile deposit images need to display back to user when checking deposit images are lear. No images or faulty images display prompting call, and takes more time to call customer service to make sure the deposit images are accepted, and not rejected, which would cause a delay in receiving funds.

Just received my card. The app is frozen and will not let me activate my card. A bit disappointing. Easy to use wants the bugs are out. I do wish the daily deposit limit was higher

Love 4% on 3000 dollars! Good customer service. A lot of unapproved UBER charges, I've never used an UBER. No problem getting them refunded. New card issued quickly. Love being able to turn my card off.

The biggest thing for me is they are on the allpoint atm network. The only disadvantage is they don't have instant messaging notifications when you use the card.

They automatically decline a transaction when I'm trying to use the world remit website even though I've done a transaction in the past. After back and forth waste of time messages, they finally explained the issue. I ask them to remove the automatic decline to which they say "no." I generally don't mind a virtual bank, but they really are useless at a certain point as a bank. If you have 3k to stash, this is a good place to put it. However, it's not a replacement for an actual bank.