Tax Planning

Please be proud citizens of India and to continue on going development project in India, it is our responsibility to pay tax and it is also important that Every Individual should do tax planning. It has been witnessed that most of the tax payers at the end of financial year they rush of for their investments to reduce the tax liability

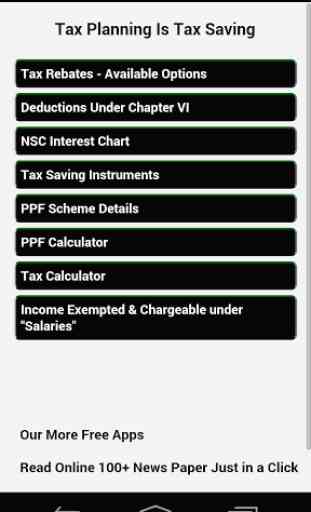

- in fact it does not count a good "Tax Planning".The purpose of this APP is to help individuals to calculate their tax liability by using Tax Calculator and plan his/her tax saving investments efficiently. The Tax saving Instruments are mentioned in the App, after taking into account the rebates available in various section and the incomes exempted under Income Tax Act. The main Feature of the app are:-1. Tax Deductions / Rebates

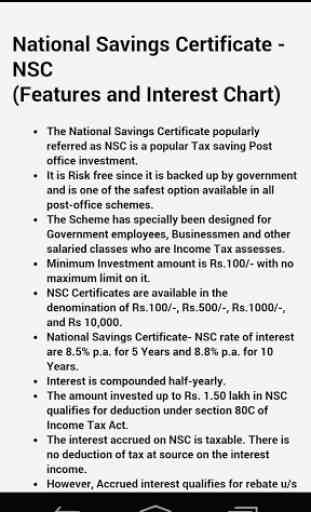

- Available Options2. Tax Saving Instruments 3. Income Tax Rates 4. Tax Calculator 5. Calculate HRA Chargeable for I / Tax6. Perquisite Value of Leased Accommodation 7. PPF Scheme Details8. PPF Calculator9. Income Exempted & Chargeable under "Salaries" 10. National Savings Certificate

- NSC

- Investment Scheme Details and Interest Chart

- Accrued interest qualifies for rebate

- in fact it does not count a good "Tax Planning".The purpose of this APP is to help individuals to calculate their tax liability by using Tax Calculator and plan his/her tax saving investments efficiently. The Tax saving Instruments are mentioned in the App, after taking into account the rebates available in various section and the incomes exempted under Income Tax Act. The main Feature of the app are:-1. Tax Deductions / Rebates

- Available Options2. Tax Saving Instruments 3. Income Tax Rates 4. Tax Calculator 5. Calculate HRA Chargeable for I / Tax6. Perquisite Value of Leased Accommodation 7. PPF Scheme Details8. PPF Calculator9. Income Exempted & Chargeable under "Salaries" 10. National Savings Certificate

- NSC

- Investment Scheme Details and Interest Chart

- Accrued interest qualifies for rebate

Category : Finance

Related searches

crashing and not opening after installation