Tax Planning

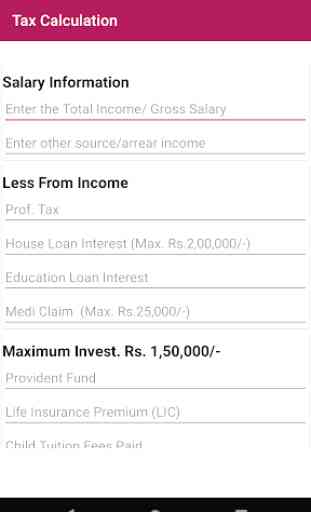

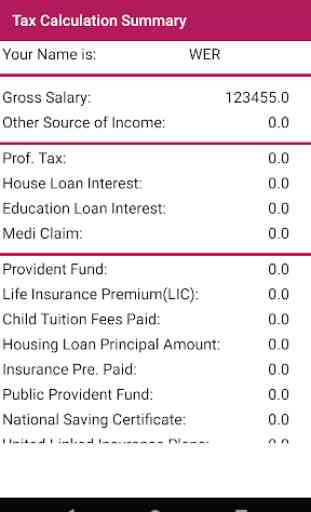

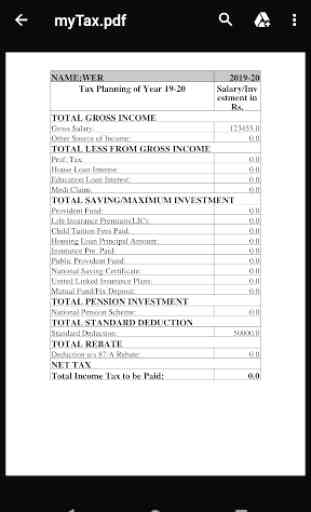

Tax Planning application is a quick and easy way to calculate tax in a single click and generate a PDF file which you can share with your HR department and keep it for your reference and do tax planning accordingly.

Generally, we face a problem that HR department cut the income tax from beginning of April month so with the help of this Tax Planning App you can control the tax deduction and start saving of your complete salary for your future.

Tax Planning is very crucial for salary persons. All we wish to save tax means we need to save money. This application will help you to do complete planning of your gross salary with different investment and saving plan available with you.

This application offers the many features like to calculate the tax on gross income, different saving options with detail explanation of each 80 sections and limit of investment in each sections. You can also get the details of How to apply for digital PAN card online as well as Income tax e-filling steps once you get form-16.

This application also redirect you to Income tax department website for online tax filling.

A very important feature of the application is to share the Tax Planning after the Tax calculation to your HR department or for your reference and do Tax Planning accordingly.

Tax Planning through this Income Tax Calculator is done with the following objectives:

To claim deductions under Section 80C to Section 80U,To reduce the tax liability and pay lower amounts of tax,To use legal methods for reducing the tax liability and not evade tax.

By using, Income Tax Calculator, you can calculate your taxable income, compute your income tax liability, and get the best means to save on taxes.

Generally, we face a problem that HR department cut the income tax from beginning of April month so with the help of this Tax Planning App you can control the tax deduction and start saving of your complete salary for your future.

Tax Planning is very crucial for salary persons. All we wish to save tax means we need to save money. This application will help you to do complete planning of your gross salary with different investment and saving plan available with you.

This application offers the many features like to calculate the tax on gross income, different saving options with detail explanation of each 80 sections and limit of investment in each sections. You can also get the details of How to apply for digital PAN card online as well as Income tax e-filling steps once you get form-16.

This application also redirect you to Income tax department website for online tax filling.

A very important feature of the application is to share the Tax Planning after the Tax calculation to your HR department or for your reference and do Tax Planning accordingly.

Tax Planning through this Income Tax Calculator is done with the following objectives:

To claim deductions under Section 80C to Section 80U,To reduce the tax liability and pay lower amounts of tax,To use legal methods for reducing the tax liability and not evade tax.

By using, Income Tax Calculator, you can calculate your taxable income, compute your income tax liability, and get the best means to save on taxes.

Category : Finance

Related searches

Reviews (2)

man. j.

Apr 30, 2019

it is very good app for tax calculation

This is not updated as per the latest Tax slabs.