Tax Tuners-TDS Calculator 2016

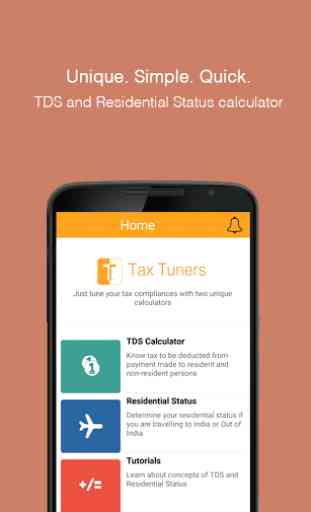

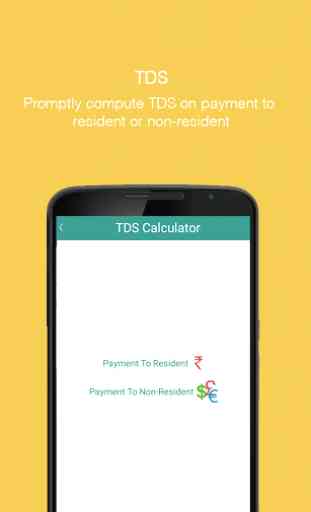

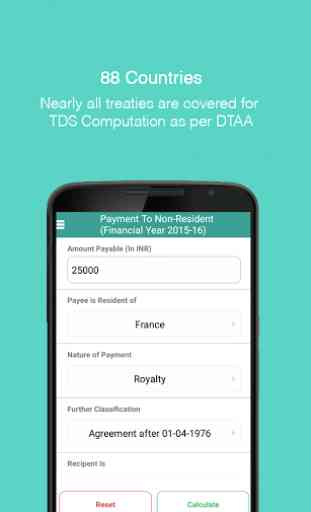

- TDS Calculator: A variety of situations have been covered to compute the TDS from sum payable to a resident or non-resident. Just enter the details about the nature of payment, who is a payee, etc., to know the accurate amount of TDS.

- Comparison: TDS is computed as per Income-tax Act and as per the Treaty. Both the rates are compared on the same page so that most beneficial provision for the payee can be determined.

- All situations covered: If tax is deductible at concessional rate in case of a prescribed payee, the application helps you to compute the TDS in case sum is payable to a payee other than the prescribed one.

- Summary: All relevant provisions of the Act and relevant articles of treaties have been summarized so that you can read the relevant statute on the result page itself.

- Residential Status Calculator: This calculator can be used to determine the residential status in India in case you are travelling to India or out of India.

- Travelling Schedule: Just enter your period of stay in India to determine the residential status. If you are not sure about the period of stay in India, you may enter your travelling schedule (dates of departure from India and date of arrival in India). The application will automatically compute your period of stay in India on basis of these dates.

- Tutorials: If you are not familiar with the tax jargons and tax concepts, the tutorials will help you to understand these concepts of taxation in a lucid way.

- Pause your calculations: It remembers your selection so that you can take a break in case of need. If you quit the app and go do something else, it would still be where you left off.The application will cater to most of your needs and ensure that your books of account are tax compliant. You can avoid the situation of disallowance of expenditure under Section 40(a)(i) and 40(a)(ia). Further, you can escape the consequences which may be invoked by the IT Department if you are deemed to be in default due to failure to deduct the right amount of tax from the sum paid to a resident or non-resident.Happy Tax Tuning!

- Comparison: TDS is computed as per Income-tax Act and as per the Treaty. Both the rates are compared on the same page so that most beneficial provision for the payee can be determined.

- All situations covered: If tax is deductible at concessional rate in case of a prescribed payee, the application helps you to compute the TDS in case sum is payable to a payee other than the prescribed one.

- Summary: All relevant provisions of the Act and relevant articles of treaties have been summarized so that you can read the relevant statute on the result page itself.

- Residential Status Calculator: This calculator can be used to determine the residential status in India in case you are travelling to India or out of India.

- Travelling Schedule: Just enter your period of stay in India to determine the residential status. If you are not sure about the period of stay in India, you may enter your travelling schedule (dates of departure from India and date of arrival in India). The application will automatically compute your period of stay in India on basis of these dates.

- Tutorials: If you are not familiar with the tax jargons and tax concepts, the tutorials will help you to understand these concepts of taxation in a lucid way.

- Pause your calculations: It remembers your selection so that you can take a break in case of need. If you quit the app and go do something else, it would still be where you left off.

The application will cater to most of your needs and ensure that your books of account are tax compliant. You can avoid the situation of disallowance of expenditure under Section 40(a)(i) and 40(a)(ia). Further, you can escape the consequences which may be invoked by the IT Department if you are deemed to be in default due to failure to deduct the right amount of tax from the sum paid to a resident or non-resident.

Happy Tax Tuning!

Quick, Easy-to-use and simple to understand.

Category : Finance

Reviews (30)

Edited review. Timely update to this app is not made. So it's rates for 2020-21 is not updated. Even DTAA updates not done. Original review. Good app and i have been using this app for quite sometime. Observe that all countries are not included, when we check for TDS for foreign remittance. Was looking forward to know the rate for Argentina.

Very worst app, didn't work at all after all saying problem still remained.

Disgusting app doesn't work at all. A complete time waste.

App keep crashing not able to get started

Thanks for providing such an amazing app... Very very useful..

I cann't imagine that like this aap also availabe on playstore ,!!!

Great app got my Query answered in less than a minute..

Useless the app only showing agree and get started

not able to register

Not able to Login

this is a total fruad app

why phone no & email required to calculate TDS

this is not for tds calculator

I'm Unable to Create Account

Utterly useless app. Where is deductions and other calculations???

Very useful app. It made easy to comply with withholding tax provisions.

The app is very precise and asks simple questions to answer your query on residential status and tds rates. Tutorials and notifications are brilliant.

Much unlike many other apps in our field, this app has a very beautiful UI and it is simple to use as well. Would recommend this app to everyone

TRC concept is not considered in the app. It would be wonderful once TRC will be considered

This app has certainly done half of my work!!! This app is certainly a blessing for all 15CB preparers! Thank you tax tuners. Moreover, this app can be used instanly to give advice also!

Nice application for easy calculation of tax

Income tax provisions not explaned completely

Nice app to get instant help to calculate tax. LOVED IT . 👍👌

It's really a great app..I was looking for something like this for so long...thanks for putting this up on play store !!!

Great work. Very helpful in advising clients instantly

Simplest way to calculate tax WELL DONE 👍

Best Application for Taxes guidance

Taxation simplified

It's OK

7th July, This app stack in get started page which required bus to key in the name, email and phone. I will always show some page when we keyin name email again and again. This looping prevent us to entering the app. Please check on that.. 1st Aug, Do something new user still stuck and keeping on looping at key in email and username page...