The Baby Steps

Track your debt payments, build your emergency savings, and follow your Baby Steps. Learn from world-class teachers along the way. Our approach is simple, but effective. Plus, it’s a heck of a lot of fun.

Stuffy personal finance app? Nope. That’s not us. If that’s what you’re looking for, keep moving. Basically, we teach common sense and we really care about helping you get out of debt and save for the future. Our Baby Steps and debt snowball method have helped nearly 6 million people go from, “I can’t do this,” to “I just did that!”

Take your money to the next level:

• Learn and apply Dave Ramsey’s Baby Steps method.

• Determine which Baby Step you’re on.

• Work each Baby Step until you are completely debt-free.

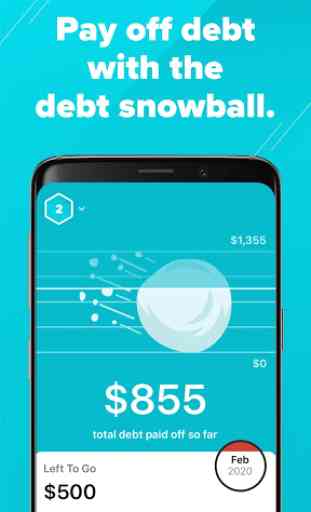

Track your debt payments using the debt snowball method:

• Discover how soon you could be debt-free.

• Watch your debts shrink when you pitch a snowball at them. It’s a little aggressive, but

hey, it feels good to hit back. And we’re here for it.

• Set attainable goals.

Track your savings:

• Learn from experts who give inside tips on how to save money faster and establish an emergency fund.

• Throw some coins in your piggy bank. Literally. It’s a ball.

• Find the motivation to keep going when you see how much you’ve increased your

savings.

Expert in-app coaching from world-class teachers:

• Watch the best of Dave Ramsey’s money rants.

• Rachel Cruze gives on-point budgeting tips.

• Ken Coleman dishes career advice you can’t live without.

Category : Finance

Reviews (30)

There are a few things I would like to see improved, but otherwise it's great. • The "Help & Support" and "Send Feedback" links inside the app both do the same thing as the "Share Ramsey+ with a Friend" link. • There's no option to sort debts so the highest interest rate can be paid off first. • Paying off your home is supposed to be step 6, but the mortgage shows with it's balance included in non-mortgage debt to be paid in step 2.

This part of the Every Dollar Plus app use to work flawlessly. I've noticed recently that it's crashing all the time! When I try to go into it, there's a message to download it. I have to take these extra steps in order to use this. This is so frustrating and wasting my time!!! I'm paying $100 per year for this which is included with the Dave Ramsey Financial Peace University Program. I already emailed Ramsey support and waiting back for a reply.

I love this app because it helps me track and stay motivated on debt payoff, but with the most recent update has made it so the amounts paid off on a debt in everydollar moves seamlessly as the amount paid off (of debt), but never takes into account the interest rate of the debt so I have to go back and update the balance to a higher amount which is the accurate amount. This is very frustrating and now I never can throw the snowball which was very satisfying and have to lower the amount paid off

Would love to see a free version of this, even if it doesn't have all of the premium features. What would be even more helpful is if a small version of this was just incorporated into the EveryDollar app in the "Debts" section so that you wouldn't have to go to multiple apps - you could simply add a "beginning total balance" into the EveryDollar debts section for each item & have it just automatically change the running total when you paid that monthly pmt. I really love the tools & teachings!

Really cool app and it works well! It's an awesome visual tool and I love throwing the little snowball at my debt! However, making this freemium, like every dollar, would be SUPER nice and is the only thing keeping me from giving it a 5 star rating. I'm going to have to reluctantly delete the app after the 14-day free trial of FPU. I took FPU before all this and my membership is out. I'm not paying another $120 just for this app. FPU is DEFINITELY worth it, but I don't need a second run through

I was really disappointed to see that you HAVE to sign up for the $130 subscription to even see the rest of this app...no home screen, menus, nada. Really bothersome that there isn't a free version with paired down capabilities from a multimillionaire financial guru who is trying to help people rid themselves of debt. Sounds contradictory/idiotic to pay for something to then rid yourself of debt instead of just paying $130 towards your debt.

I really do like the Every Dollar and Baby Steps app and I know they've helped us pay down debt, but the Baby Steps app crashes pretty frequently. It's got some neat features but I won't use them on the phone because it crashes. Things like the "Crush My Debt" feature after reducing debt will freeze or crash the app, then you need to log in again.

App works well most of the time but have noticed several video links in some lessons no longer seem to be available. Kinda disappointing when I've used Ramsey materials for several years and find it all really helpful. Hopefully they'll get it back in working order soon!

I enjoyed this app during the free trial. I wish they would make this one free or split the apps up so you can pay one price upfront. They are big on becoming debt free but expect us to pay so much for an app. Back to spreadsheets I go!

The app is great for keeping track of my debt. A glaring flaw, however, is the constant logging me out. If I switch apps to check a balance, I get logged out. If I close it out and get back in, sometimes I'm logged out. It's pretty frustrating.

was really excited to try the app until I saw it would cost $129.99 for a bundled subscription. I don't need FPU, & EVERY DOLLAR PLUS. I downloaded this simply to help me track my steps. I would be willing to pay a few bucks for the tracker but its worth no more than that . what a shame ill just go ahead and uninstall . I expected better from Dave 😔

They make it very clear this app is for those who pay for the course and materials. Sorry, but Financial Peace University is worth every penny and then some, and complaining about the cost is rather shortsighted. What you learn ends up saving so much more than you spend. For some, it prevents bankruptcy and saves marriages. Sometimes you need to invest in yourself to 10x your life, esp an area where you struggle and could use help. This is the best budgeting system I've ever used.

Just downloaded the app and it keeps crashing and signing me off. Kind of frustrating cause it happens when I am in the middle of typing my numbers in. I love the concept and the layout looks great and I was excited to use it for tracking my process but if its not working I cant use it...

I'm sure this is a great app as so many people say it is, unfortunately I'm unable to use it due to the cost. I understand that there is a 14-day free trial, but that isn't near enough time for a busy Mom to work through and learn how to utilize the methods this app likely provides to aid in financial help. This is also a problematic price for low income families. I'd feel more secure purchasing this app if a free limited access version was available along with other payment options.

Just downloaded and I really like the app but won't be able to keep it. $129/year for a basic tracker is crazy and I don't need EveryDolllar or FPU so I'll have to cancel. I could see paying up to $5 for a one time fee for the app but not more.

Very frustrating app. I bought Ramsey+ but I can't even use the app because every time I switch tabs or go to the home screen it logs me out! I'll update this review if I get the problem taken car of but as of now, I can't use the app.

This app is very nice. The thing people dont understand is that it doesnt just keep track of the baby steps. It also has lessons and helpful videos. This app is to go with a couple other ones that go with financal peace. So when you sign up you also are getting extra content that helps you in doing the steps. If your really ready to change your life for the better. You'll be willing to spend the money to help get on the right track to living like no one else.

It keeps logging me out and it's getting really really annoying. I'm in the middle of trying to input something and it kicked me out of the App and I've lost everything, I had to start ALL over again. It's very frustrating.

App is SLOW. Takes a minute to catch up everytime you click one button. Would like the ability to arrange these in the order i will pay them off. Doesnt allow for active paying debts vs innactive like dave teaches.

Edit: updated to 4 stars now that I know they're going to make this synch with EveryDollar. Will update again once I can test it out 🎉 This would be 5 stars if they could make it synch with the Every Dollar app. It is a good motivation tool for the debt snowball though

I like having the Baby Steps in my back pocket. This app will help hold me accountable. I just wish I was able to sync the app across all my devices. Sadly, I have to add the updated information in each app separately.

Nice app with room to grow over time. Tracks my baby steps and helps me stay on course! I like being able to see progress in each step, especially baby step 2 (paying off debt).

I was charged on my old account, and not given 14 day trail. I have not been able to make these aps work for me the last year and now I'm paying for 2 years without any success! I don't recommend this and more disappointed now.

I know BS3b is not part of the Official baby steps, but many of us are on it. I don't see the point on having this app when I can't see my savings towards a downpayment. It puts me right on BS4 and I'm not there yet. For those that are on other steps it, looks promising. Uninstalling

Please sync with the bank! On EveryDollar you have the option to sync your debts with the bank to pull your balance. On here you have to manually update. It'd be easier if the bank balance could still sync to EveryDollar and have EveryDollar sync the balance to BabySteps.

The app keeps on crashing. Imagine trying to follow the baby steps and paying over $100 for an app that doesn't work. I can't hardly enter anything on the app.

This app is great.. The only downfall that we don't like about it is that it only updates once a week. There for it is difficult to keep up with. We wish this could be an update coming soon??!

I miss the old debt snowball where when you pay something off you hit it with a snowball and crush it!!! Paid off debt #4 today. #babystepswork

Unlike the Every Dollar app, you can't use a free version of this app. Only a 14 day trial is available for free. Very disappointing. A company based on helping people financially, charges users for the app that other companies produce for free.

Great way to track using Snowball. The video links seem to be broken though. I started watching when I first installed the app, but now just get a blank screen. Over a year since bug fix, maybe needs an update. Also reading help files, sounds like this should share data with every dollar budget app, but I don't see how to link the two apps together. I have Ramsey+ account but still can't get it to work as described in help section.