UK payroll calculator 2016/17

This is a very simple UK payroll calculator for the 2016/17 tax year.

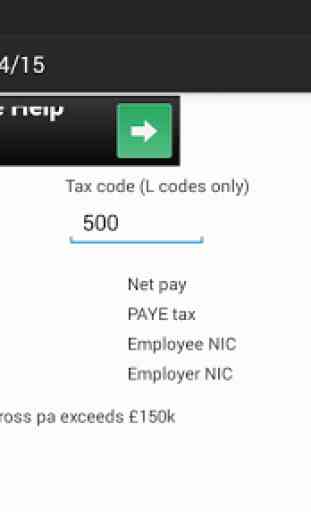

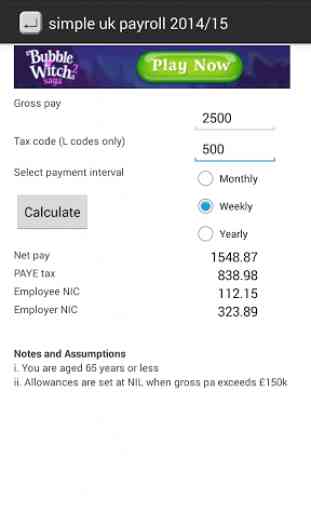

Simply enter your gross pay, your tax code (eg., if your tax code is 1100L enter 1100 in the tax code box) and select the payment interval before clicking the calculate button.

Only tax codes with the "L" suffix are supported at the moment. Other tax codes/suffixes/prefixes (BR, K, DO etc) will follow depending upon how this application is received.

National Insurance calculations are based on Table A

Allowances are set to NIL when gross p.a. exceeds £100k (and not tapered by £1 for every £2 that gross p.a. exceeds £100k).

Simply enter your gross pay, your tax code (eg., if your tax code is 1100L enter 1100 in the tax code box) and select the payment interval before clicking the calculate button.

Only tax codes with the "L" suffix are supported at the moment. Other tax codes/suffixes/prefixes (BR, K, DO etc) will follow depending upon how this application is received.

National Insurance calculations are based on Table A

Allowances are set to NIL when gross p.a. exceeds £100k (and not tapered by £1 for every £2 that gross p.a. exceeds £100k).

Category : Finance

Related searches

Reviews (2)

Dav. H.

Jul 16, 2014

quick and easy way to check what's going where

L codes only not useful when on an M code