W-4 PDF Form for IRS: Sign Income Tax eForm

Basically, the application looks exactly like an IRS Form W-4 with fillable fields.

When you open the app, you can select the version of the form you need and immediately start editing it. There are arrows that help navigate you through the process of filling out the document. The arrows will also show you what fillable fields have to be completed with your information. You will not be able to submit the document until all of the required fields (which are marked with asterisks) are filled out. There is also a Wizard tool that shows the whole list of required fields and crosses them out when they are done.

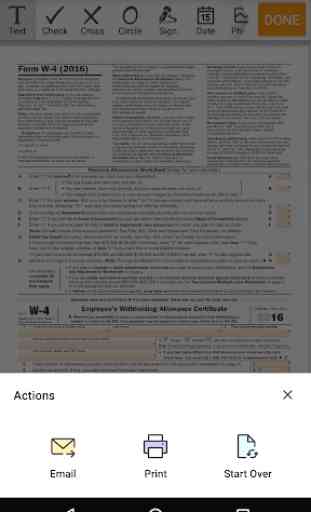

The application has a whole set of unique editing features for your mobile version of Form W-4.

✓ You can tap on any part of the document and type the text or draw anything using a touchpad or stylus.

✓ Add checkmarks, dates, textboxes and graphical objects such as lines and arrows and even attach a picture.

✓ Make annotations by using sticky notes.

✓ Redact the text: erase unnecessary text, highlight what is important and blackout the parts you don’t want to disclose.

There are other fields which will include the calculations that have to be provided in order to establish the correct amount of income tax.

Completion of this eForm also requires you to indicate the following personal information:

✓ Name;

✓ Address;

✓ Social security number;

✓ ZIP code;

✓ Details of your employer.

When the digital form is done, it has to be signed - otherwise, it will not be considered valid.

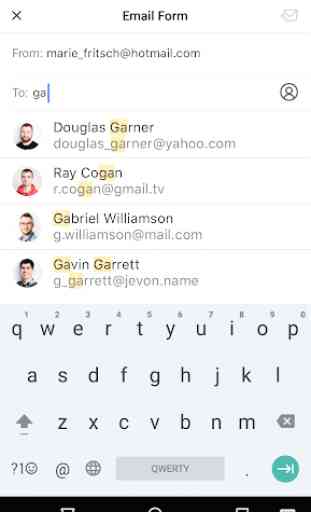

To sign the blank, tap the signature icon on the panel and draw it on the touchpad with your finger or stylus. Confirm your signature and file the tax eForm by sending it to the relevant email address.

Category : Business

Reviews (21)

Signature does not work. Tried drawing it and tried typing it. Big waste of time 0 stars

Awesome app really easy and effective. No hiccups

Is good but a little complicated

great app. easy to use. recommend to all employers.

Nice convenient and useful app

super easy to use

finally found a free and convenient way to fill out my w4

Flawless and simple

Does what it should with no ads! Tanx a milli

Excellent and handy app!

Very easy to use

5 stars completely!! Awesome app

easy to use👍

Signature saves in the wrong place....

i have spent 24 yasin a box and this appmade thiis eazy

Nice app informational

Great thanks

It's Convenient but I don't like how Small the first signature is. Makes it obvious it's done on app.😞

Seems to work well. Will see when my employer opens my email

I liked it. Fast simple and easy to figure out.

Works just as it is supposed to. Even capable of sending an email from within the app. A+