Wealthfront

Your Wealthfront personalized investment account is automatically invested into a low-cost, fully diversified, and periodically rebalanced portfolio – all with an account minimum of only $500 and no commission charges. Your first $10,000 is also managed entirely for free — create your account and download the app today to become the smart investor you’ve always wanted to be.

Here’s what the press has to say!

* Why trust your money to a Wall Street money manager who charges steep fees when well-designed software can do a better job for a lot less? **– CNET

* Wealthfront helps people invest their money in a more rational fashion than they might if they were left to their own devices. **– NYTimes

* Since 2011, Wealthfront has had phenomenal growth, reaching $1 billion in assets under management in less than two-and-a-half years. **– TechCrunch

With the Wealthfront Android app:

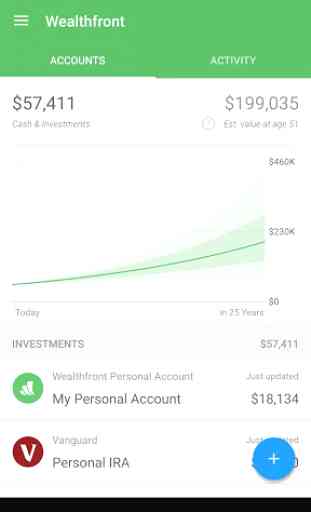

* Track all you financial accounts in one place

* See what you will be worth in the future

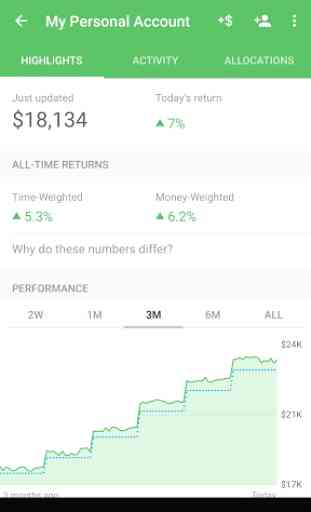

* Monitor your investment performance, review recent transactions, and receive financial advice.

* Keep an eye on your annual tax savings from our Tax-Loss Harvesting service.

* Invite friends to join Wealthfront, so both you and your friends get an additional $5,000 managed for free.

Wealthfront Inc. is an SEC registered investment advisor. This description was prepared to support the promotion of Wealthfront's investment services and products, and should not be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Financial advisory services are only provided to investors who become Wealthfront clients. Images of account performance are not based on actual trading and are provided for information purposes only. **Past performance is no guarantee of future results**. Actual investors on Wealthfront may experience different results from the results shown. For more information please visit www.wealthfront.com (http://www.wealthfront.com/). Visit wealthfront.com/legal/terms to see our Terms of Use.

Category : Finance

Reviews (21)

Pretty straight forward app. Puts all your finance in an easy-to-see format. I like the future projections of your money use makes you feel good when you see it tick up when you're saving money etc. Easy to link most banks to for a current financial view. Some banks though will only hold a current connection for a few hours days so you'll have to redo the login to refresh your bank accounts. No big deal since I mostly use for their high interest savings account. 9/10 would recommend

Nice. Modern and professional. My only beef is that it feels like a PWA, but very different from the desktop web UI, so going back and forth has a learning curve.

Can't do concurrent transfers on investment account, seriously? Cash account APY is meh. Investment returns haven't been good (even taking the market into account). The connections to external accounts will have to be reconnected frequently which requires you to repeatedly put in login credentials for everything or keep old balances. Frustrated that they list services like Robinhood and Venmo as linkable but never work. Nice-looking app, but I'd probably bank elsewhere.

I chose Wealthfront after my friend ran a performance test on its investing feature. I appreciate that more tweaks to preferences like green portfolios are becoming available. But, like a few other recent reviews, I have noticed that this service struggles with account linking. I was really appreciating seeing a full overview of my financial assets and a rough projection of wealth over time, and was fine with having to re-link accounts on occasion, but recently I am unable to complete one account link at all. Both Acorns and Mint can maintain or re-up a link to my bank account without fuss, but when I reached out to WF support, I got nowhere. I even contacted my bank about the issue and their tech support had no ideas about why this service can't complete the link Bottom line: I find this app great for investing, but it presents itself as a holistic financial tool yet falls short and does not take steps to resolve a replicatable issue.

Something has gone wrong with linking external accounts recently. Won't link up, doesn't let you sign in, constant error messages

Recommend to everybody looking for decent savings account. The only issue is that every few days you have to do a link update. It's okay though, I only check it once a month anyways...

I had $1,500 invested in this an individual investment account for about 6 months and had my risk setting set to 2. In total I lost $50. Maybe it was just bad luck, but I didn't expect to lose money with a risk setting of 2.

Simple and to the point. It's great to be able to put portfolio management and savings on autopilot.

I am very new to the investment world and at first had difficulty linking my bank with their financial institute because of security measures on my bank. I had to ask questions because I didn’t understand or had problems. After a few messages I received this reply which I consider to be insulting and offensive, “We have the option to deny an account application or close an account after it has been funded. We may elect to deny an account application when we feel our service might not be appropriate for a client’s needs. The most common reason is if we believe a client will require a lot of handholding from our client service team. Our service and associated fee have not been designed for a client who requires high touch.” I wonder if they really make the best decisions for us or is it for themselves.

Both the app and service are too notch. It's nice having a bank that is technically literate.

Have been using Wealthfront for a few years now and have always loved their interface. However the most recent update makes the UI worse, I preferred the previous UI. You can no longer see your deposits vs account value at a glance. Trying to see the information on the graph at the very edge of the screen causes the app to go back (swipe back on android), and my finger isn't small enough to get to the edge from the middle. The TWR & MWR have become paragraphs instead of numbers at a glance too.

I've downloaded a lot of different finance, banking, and investing apps. Most of them I always delete. This one, I'd never think of it! The ease of use and the intuitiveness is unmatched. Also, the products Wealthfront offers are great. One of the best if not the best online savings accounts. They're very transparent about the change in rates. Also, there's some great investing offers. I've yet to dive into those though. Overall, great app. Highly recommend.

I honestly have loved Wealthfront and it has become my primary money saving tool. The app was clear and easy to navigate. I say "was" because their recent update has made it difficult to find my money-weighted and no longer lets me easily view the amount I've deposited. Instead, I need to slide my finger on the graph to see information that was once readily available. I look forward to them fixing the app to improve the rating. This rating is only in regards to the app interface.

I gotta say, this app is pretty impressive. Now, I cannot say much about my experience with the investment service because I have just recently started using it. But definitely a good experience over the course of my first two weeks if you discount the mild frustration that came with getting my interest rate cut by .2 two days after I threw money into it... Oh well. Please introduce dark mode! It's basically mandatory at this point.

*Updated* It was easy to add my accounts; including credit cards, mortgage and even my CalPERS plan. The downside is that the app can't calculate a defined benefit plan. You have to guesstimate your earnings and add as "other income." Aside from that, the app is laid out well and easy to use. Automated investing seems to work, though idk how they select stocks. Wish it had an option to manually invest. Also, adding funds should be instant with electronic transfer but takes 3-5 days.

It was easy to set up the account and start the investing, but I removed a star because I think the interface could really use some work. I started a general investment fund but they treated it like a retirement account. I wanted to set a different withdrawal date and finally figured it out, but its not very intuitive. Also, I would love to see more stats, which stocks and bonds I'm invested in, how it does day to day, how much I've gained since inception, etc.

I've enjoyed my experience with Wealthfront. The app is well designed, and you are able to do a lot of things you can on their website. No complaints! This might be a nit, but it would be nice to have to setup a pin or fingerprint lock. I didn't notice the feature existed until I looked in the settings.

My discover account hasn't synced in the last 5 months. My credit union hasn't updated in the last one month. I couldn't even add etrade account even after confirming the right institution and disabling security id on etrade. Otherwise the app is great. I like the product overall. Earned me good returns. My tax filing for 2018 was not so bad either.

Pretty easy option to save long-term especially, asks all the right questions, put in what you can monthly, and watch your investments gradually rise! Also a great interface showing all of your accounts and investments in one go, which is nice to see how everything is doing and maybe move some money around so it's in the best place. Highly recommended!

Very helpful tool to manage your money, can manage all your accounts easily from one app, can set up budgets which is really helpful and start investing of you're new to it they have tools to manage it and teach you what to do. It's a good app super useful they have a debit card you can opt for also. Good return on your savings as well, make money while its sitting there doing nothing.

Have been using app for three years. Love the ability to see all of my accounts in one place and having the ability to easily calculate net worth. However the monthly re-linking of accounts has me on the hunt for a better app.