Bank of Scotland Mobile Banking

You want to stay on top of your money. Our app means you’re always in touch. It’s packed with features to make banking with us fast, convenient and more secure than ever. Built-in security technology keeps your banking details safe and private. And you may be surprised by what you can easily do on the move:

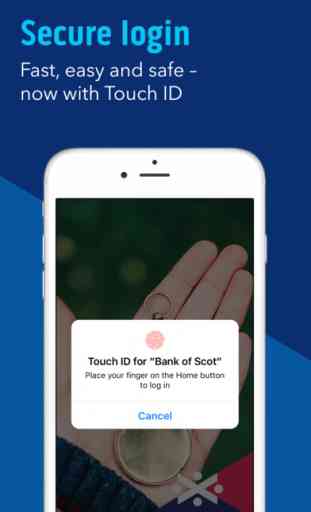

- Log in with just 3 taps or Touch ID

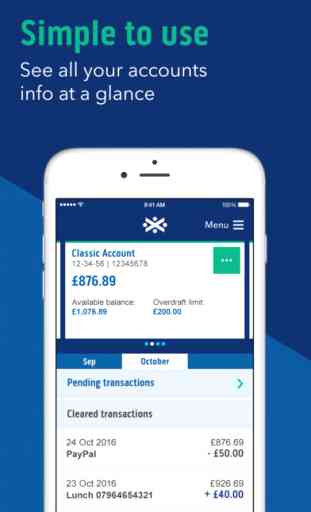

- View your account balances and statements

- Check payments going in and out

- Add new recipients

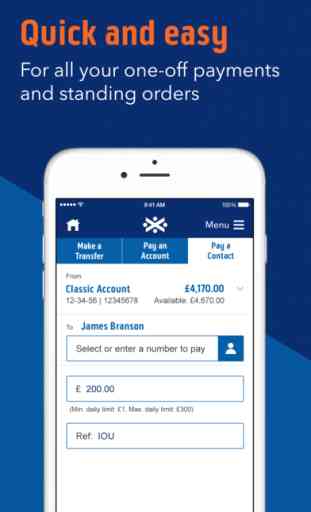

- Make transfers and payments home and abroad

- Set up standing orders

- Pay your loan or credit card bill

- Register contactless cards with Apple Pay

Had a mishap with your purse or wallet?

Don’t worry. With the app you can report lost or stolen cards and order replacements.

Going abroad?

Tell us with the app, so we know to expect overseas transactions on your card.

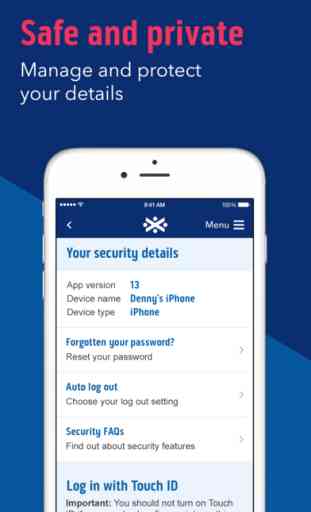

Cautious about your personal details?

Reset your Internet Banking password, contact phone number or email address, securely in the app.

With the app you can also:

- Apply for loans, savings, cards and more

- Earn as you spend with Everyday Offers

GETTING STARTED

New to this app? You’ll need to set it up by registering your device first. You’ll need:

- An up-to-date phone number registered with us

- Bank of Scotland UK personal account

- Internet Banking username, password and memorable information

KEEPING YOU SAFE ONLINE

We use the latest online security measures to protect your money, your personal information and your privacy. We also have an online banking guarantee, you can find further information about our fraud guarantee by checking the Security FAQs in this app or by visiting http://www.bankofscotland.co.uk/securityandprivacy/security/what-we-are-doing/

CONTACTING YOU

We won't contact you any more than normal if you use the app. But please stay alert to email, text messages or phone calls that appear to be from us. Criminals may try to trick you into giving them sensitive personal or account information. We'll never contact you to ask for these details. Any emails from us will always greet you personally using your title and surname and either the last 4 digits of your account number or the last part of your postcode '*** 1AB'. Any text messages we send you will come from BANKOFSCOT and quote the last four digits of your account number.

IMPORTANT INFORMATION

Mobile Banking is available to our Internet Banking customers with a UK personal account. Services may be affected by phone signal and functionality. Terms and conditions apply.

Everyday Offers is available to Bank of Scotland current account customers with a debit/credit card aged 18+ who bank online. Terms and conditions apply.

Device and card restrictions apply to Apple Pay.

* Touch ID requires iPhone 5s or above running iOS 9.0 or above.

We collect non-personally identifiable location data when you use this app. We use this for fraud and security purposes, to help us fix bugs, and improve the services we can provide in the future.

The Branch/ATM finder uses location based services. We, LINK Scheme, Google and/or Apple may access data about your location (i.e. GPS signals from your mobile device) which can be used to approximate your location (such as your mobile ID). Cashpoint® is a registered trademark of Lloyds Bank plc and is used under licence by Bank of Scotland plc.

Apple, the Apple logo and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries.

Bank of Scotland plc, Registered in Scotland No. SC327000. Registered Office: The Mound, Edinburgh EH1 1YZ. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Eligible deposits with us are protected by the Financial Services Compensation Scheme (FSCS). We are covered by the Financial Ombudsman Service (FOS). Please note that due to FSCS and FOS eligibility criteria not all Bank of Scotland customers will be covered. This app is intended for UK residents unless otherwise stated.

- Log in with just 3 taps or Touch ID

- View your account balances and statements

- Check payments going in and out

- Add new recipients

- Make transfers and payments home and abroad

- Set up standing orders

- Pay your loan or credit card bill

- Register contactless cards with Apple Pay

Had a mishap with your purse or wallet?

Don’t worry. With the app you can report lost or stolen cards and order replacements.

Going abroad?

Tell us with the app, so we know to expect overseas transactions on your card.

Cautious about your personal details?

Reset your Internet Banking password, contact phone number or email address, securely in the app.

With the app you can also:

- Apply for loans, savings, cards and more

- Earn as you spend with Everyday Offers

GETTING STARTED

New to this app? You’ll need to set it up by registering your device first. You’ll need:

- An up-to-date phone number registered with us

- Bank of Scotland UK personal account

- Internet Banking username, password and memorable information

KEEPING YOU SAFE ONLINE

We use the latest online security measures to protect your money, your personal information and your privacy. We also have an online banking guarantee, you can find further information about our fraud guarantee by checking the Security FAQs in this app or by visiting http://www.bankofscotland.co.uk/securityandprivacy/security/what-we-are-doing/

CONTACTING YOU

We won't contact you any more than normal if you use the app. But please stay alert to email, text messages or phone calls that appear to be from us. Criminals may try to trick you into giving them sensitive personal or account information. We'll never contact you to ask for these details. Any emails from us will always greet you personally using your title and surname and either the last 4 digits of your account number or the last part of your postcode '*** 1AB'. Any text messages we send you will come from BANKOFSCOT and quote the last four digits of your account number.

IMPORTANT INFORMATION

Mobile Banking is available to our Internet Banking customers with a UK personal account. Services may be affected by phone signal and functionality. Terms and conditions apply.

Everyday Offers is available to Bank of Scotland current account customers with a debit/credit card aged 18+ who bank online. Terms and conditions apply.

Device and card restrictions apply to Apple Pay.

* Touch ID requires iPhone 5s or above running iOS 9.0 or above.

We collect non-personally identifiable location data when you use this app. We use this for fraud and security purposes, to help us fix bugs, and improve the services we can provide in the future.

The Branch/ATM finder uses location based services. We, LINK Scheme, Google and/or Apple may access data about your location (i.e. GPS signals from your mobile device) which can be used to approximate your location (such as your mobile ID). Cashpoint® is a registered trademark of Lloyds Bank plc and is used under licence by Bank of Scotland plc.

Apple, the Apple logo and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries.

Bank of Scotland plc, Registered in Scotland No. SC327000. Registered Office: The Mound, Edinburgh EH1 1YZ. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Eligible deposits with us are protected by the Financial Services Compensation Scheme (FSCS). We are covered by the Financial Ombudsman Service (FOS). Please note that due to FSCS and FOS eligibility criteria not all Bank of Scotland customers will be covered. This app is intended for UK residents unless otherwise stated.

Category : Finance

Related searches