Stash: Invest. Bank. Save

Join 4+ million people on Stash, a personal finance and investing app where you can buy stocks and funds with any dollar amount, get online banking with benefits, save and budget smarter, and learn as you go.

We offer three subscription plans: Stash Beginner, Stash Growth, and Stash+. Each plan offers unique ways to save, invest, and reach your money goals. Pick the plan that’s best for you, and switch at any time.

Transparent Pricing

Stash Beginner ($1/mo.)**

• Includes: Personal investment account & bank account access

Stash Growth ($3/mo.)**

• Includes: Everything in Beginner + a retirement account

Stash+ ($9/mo.)**

• Includes: Everything in Growth + 2 custodial accounts, metal debit card†, 2x Stock-Back® rewards, & monthly market insights.

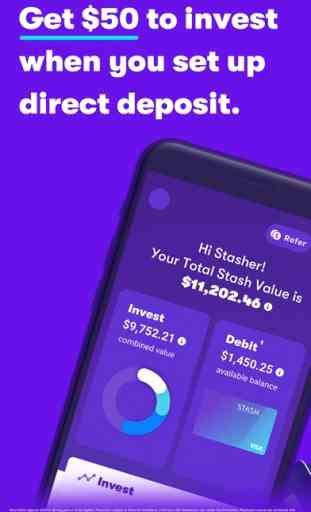

Get Paid Up to 2 Days Early§

All plans include access to the Stash debit card and an FDIC-insured banking account. You can get paid up to 2 days early with direct deposit. Plus, no overdraft‖, minimum balance, or hidden fees.¶

Earn Stock As You Spend

You can use the Stash debit card to earn stocks and funds on purchases through our Stock-Back® rewards program.#

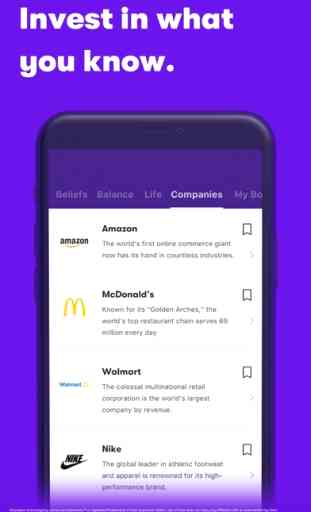

Invest with Any Amount

Unlike other apps, Stash lets you buy fractional shares of 400+ stocks, bonds, and ETFs—with no add-on trading commissions*. We offer personal, retirement, and custodial (for children under 18) investing accounts.

Unlimited Education

Stash can help you become a whiz on saving, budgeting, and investing through unlimited education and personalized advice.

Automatic Saving & Investing

Auto-Stash is always included. Save spare change with Round-Ups. Save effortlessly with Smart-Stash. Or try investing regularly with Set Schedule.

Disclosures

For investments priced over $1,000, the purchase of fractional shares starts at $0.05.

*Promotion subject to T&C. Limit one cash reward per user. Promotion can't be combined w/ certain other promotions. See T&C: http://bit.ly/2Tedjjt

**You’ll bear fees/expenses reflected in pricing of ETFs you invest in and may incur ancillary fees charged by Stash or its custodian not in monthly subscription price.

† Metal cards will start shipping Winter 2019. Plastic cards will be used until then.

§ Early access to direct deposit depends on deposit verification & when Green Dot Bank gets notice from employer. May vary between pay periods.

‖ Transaction is declined. No fee charged.

¶ Other fees apply to bank account.

# Stash Stock-Back™ Rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any respective affiliates. None of the foregoing has any responsibility to fulfill rewards earned in this program. To earn rewards, Stash Debit card must be used to make a qualifying purchase. T&C: https://bit.ly/2KLOqbN. Must also have a taxable brokerage account on Stash to be eligible for Stash banking account.

Debit Account Services provided by Green Dot Bank Member FDIC, pursuant to a license from Visa U.S.A. Inc. Investment products & services are offered by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. Securities offered through Apex Clearing Corporation, Member FINRA/SIPC.

For bonus offer, you accept T&C: bit.ly/2XyzcN1

Investing Involves Risk. Listed investments currently available but not representative of all. Full list: bit.ly/2XaZplv. Information shown is for illustrative/educational purposes & isn’t a recommendation. Product & company names are trademarks™ or registered® trademarks of the holder. Use does not imply affiliation with or endorsement by them. Preliminary information provided to prospective clients prior to Stash accepting a signed advisory agreement is not investment advice & should not be relied on as such. Stash Investments LLC ("Stash") is an SEC registered investment adviser. Must be 18+ to open a Stash account. Stash only available to US citizens, permanent residents & select visa types.

More:bit.ly/2XCMDM0

We offer three subscription plans: Stash Beginner, Stash Growth, and Stash+. Each plan offers unique ways to save, invest, and reach your money goals. Pick the plan that’s best for you, and switch at any time.

Transparent Pricing

Stash Beginner ($1/mo.)**

• Includes: Personal investment account & bank account access

Stash Growth ($3/mo.)**

• Includes: Everything in Beginner + a retirement account

Stash+ ($9/mo.)**

• Includes: Everything in Growth + 2 custodial accounts, metal debit card†, 2x Stock-Back® rewards, & monthly market insights.

Get Paid Up to 2 Days Early§

All plans include access to the Stash debit card and an FDIC-insured banking account. You can get paid up to 2 days early with direct deposit. Plus, no overdraft‖, minimum balance, or hidden fees.¶

Earn Stock As You Spend

You can use the Stash debit card to earn stocks and funds on purchases through our Stock-Back® rewards program.#

Invest with Any Amount

Unlike other apps, Stash lets you buy fractional shares of 400+ stocks, bonds, and ETFs—with no add-on trading commissions*. We offer personal, retirement, and custodial (for children under 18) investing accounts.

Unlimited Education

Stash can help you become a whiz on saving, budgeting, and investing through unlimited education and personalized advice.

Automatic Saving & Investing

Auto-Stash is always included. Save spare change with Round-Ups. Save effortlessly with Smart-Stash. Or try investing regularly with Set Schedule.

Disclosures

For investments priced over $1,000, the purchase of fractional shares starts at $0.05.

*Promotion subject to T&C. Limit one cash reward per user. Promotion can't be combined w/ certain other promotions. See T&C: http://bit.ly/2Tedjjt

**You’ll bear fees/expenses reflected in pricing of ETFs you invest in and may incur ancillary fees charged by Stash or its custodian not in monthly subscription price.

† Metal cards will start shipping Winter 2019. Plastic cards will be used until then.

§ Early access to direct deposit depends on deposit verification & when Green Dot Bank gets notice from employer. May vary between pay periods.

‖ Transaction is declined. No fee charged.

¶ Other fees apply to bank account.

# Stash Stock-Back™ Rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any respective affiliates. None of the foregoing has any responsibility to fulfill rewards earned in this program. To earn rewards, Stash Debit card must be used to make a qualifying purchase. T&C: https://bit.ly/2KLOqbN. Must also have a taxable brokerage account on Stash to be eligible for Stash banking account.

Debit Account Services provided by Green Dot Bank Member FDIC, pursuant to a license from Visa U.S.A. Inc. Investment products & services are offered by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. Securities offered through Apex Clearing Corporation, Member FINRA/SIPC.

For bonus offer, you accept T&C: bit.ly/2XyzcN1

Investing Involves Risk. Listed investments currently available but not representative of all. Full list: bit.ly/2XaZplv. Information shown is for illustrative/educational purposes & isn’t a recommendation. Product & company names are trademarks™ or registered® trademarks of the holder. Use does not imply affiliation with or endorsement by them. Preliminary information provided to prospective clients prior to Stash accepting a signed advisory agreement is not investment advice & should not be relied on as such. Stash Investments LLC ("Stash") is an SEC registered investment adviser. Must be 18+ to open a Stash account. Stash only available to US citizens, permanent residents & select visa types.

More:bit.ly/2XCMDM0

Category : Finance