Tally: Pay Off Debt Faster

Tally makes it easy to save money, manage credit cards and pay down balances faster. Tally members have an average lifetime savings of $5,300.

Tally is only available in certain states. You need a 660+ FICO Score to qualify. (Scroll down to see where Tally is available and which cards Tally supports.)

1. Download Tally

In under 10 minutes, Tally can help you get on the path to being debt-free. There’s no risk to sign up and it won’t hurt your credit score.

2. Scan your credit cards securely

Tally analyzes your credit cards and finds ways to help you eliminate debt and save money. Keeping your data safe is our top priority. That’s why all your information is transmitted through secure SSL encryption and is never stored on your phone.

3. Find your savings

If you qualify, Tally gives you a line of credit with a low APR, then uses the new credit line to pay your credit cards every month. The low APR helps save you money on interest. (Scroll down to see what Tally charges.)

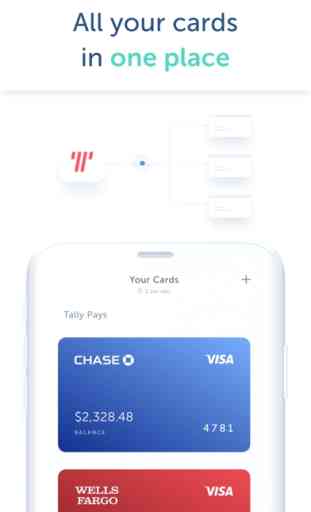

4. Organize your cards

Tally manages all your credit cards in one simple app. Tally keeps track of the balances, interest rates and due dates for each card. That’s how Tally makes the right payment to the right card at the right time. All you have to do is make one monthly payment to Tally.

5. Say goodbye to late fees

Tally’s late fee protection gives you the peace of mind of autopay without the fear of overdraft. As long as you’re in good standing with Tally, you never have to worry about late fees again. Plus, Tally never charges fees of any kind!

6. Be debt-free faster

That’s it. Tally helps separate the burden of credit cards from the benefits. Keep using your credit cards for the perks and rewards and let Tally handle the hard work. No tricks or gimmicks. Just a smarter way to manage your cards and a faster way to pay down debt.

FAQ

What does Tally charge?

To get the benefits of Tally, you must qualify for and accept a Tally credit line. Depending on your credit history, your APR will be between 7.9% and 25.9% and vary with the Prime Rate. (Information accurate as of January 2020.)

How does Tally estimate average lifetime savings?

We calculated this average in May 2019 and compared the interest users would pay with and without Tally. We evaluated users with a Tally line of credit between 11/2017 and 02/2019 and assumed they stay Tally users until their Tally and credit card balances are fully repaid. We excluded delinquent users, users who did not use Tally’s line of credit, and credit cards with APRs lower than the Tally APR (since Tally wouldn’t pay those cards, except for late fee protection). For each user, we assumed 1) an average APR weighted by the user’s initial credit card balances and APRs; 2) an average monthly payment based on the user’s payment history while using Tally; and 3) an average monthly credit card spend based on the user’s spend while using Tally.

How does Tally save me money?

Tally uses your Tally credit line to pay your high APR credit cards, saving you money on interest. Tally’s late fee protection also ensures you never miss a payment.

DETAILS

Tally is available to people in Arkansas, Arizona, California, Colorado, Connecticut, Florida, Idaho, Illinois, Iowa, Indiana, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Missouri, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington, Washington, D.C., and Wisconsin.

Tally supports most cards from American Express, Bank of America, Barclays, Capital One, Chase, Citibank, Discover, First Bankcard, Fifth Third Bank, US Bank and Wells Fargo, as well as cards from Amazon, Best Buy, Home Depot, Macy’s, Sears, Target, TJ Maxx and Walmart.

The Tally app and servicing is only available in English. If there is any discrepancy between translations, the English version prevails over other translations.

Tally Technologies, Inc. (NMLS # 1492782) https://nmlsconsumeraccess.org/

Tally is only available in certain states. You need a 660+ FICO Score to qualify. (Scroll down to see where Tally is available and which cards Tally supports.)

1. Download Tally

In under 10 minutes, Tally can help you get on the path to being debt-free. There’s no risk to sign up and it won’t hurt your credit score.

2. Scan your credit cards securely

Tally analyzes your credit cards and finds ways to help you eliminate debt and save money. Keeping your data safe is our top priority. That’s why all your information is transmitted through secure SSL encryption and is never stored on your phone.

3. Find your savings

If you qualify, Tally gives you a line of credit with a low APR, then uses the new credit line to pay your credit cards every month. The low APR helps save you money on interest. (Scroll down to see what Tally charges.)

4. Organize your cards

Tally manages all your credit cards in one simple app. Tally keeps track of the balances, interest rates and due dates for each card. That’s how Tally makes the right payment to the right card at the right time. All you have to do is make one monthly payment to Tally.

5. Say goodbye to late fees

Tally’s late fee protection gives you the peace of mind of autopay without the fear of overdraft. As long as you’re in good standing with Tally, you never have to worry about late fees again. Plus, Tally never charges fees of any kind!

6. Be debt-free faster

That’s it. Tally helps separate the burden of credit cards from the benefits. Keep using your credit cards for the perks and rewards and let Tally handle the hard work. No tricks or gimmicks. Just a smarter way to manage your cards and a faster way to pay down debt.

FAQ

What does Tally charge?

To get the benefits of Tally, you must qualify for and accept a Tally credit line. Depending on your credit history, your APR will be between 7.9% and 25.9% and vary with the Prime Rate. (Information accurate as of January 2020.)

How does Tally estimate average lifetime savings?

We calculated this average in May 2019 and compared the interest users would pay with and without Tally. We evaluated users with a Tally line of credit between 11/2017 and 02/2019 and assumed they stay Tally users until their Tally and credit card balances are fully repaid. We excluded delinquent users, users who did not use Tally’s line of credit, and credit cards with APRs lower than the Tally APR (since Tally wouldn’t pay those cards, except for late fee protection). For each user, we assumed 1) an average APR weighted by the user’s initial credit card balances and APRs; 2) an average monthly payment based on the user’s payment history while using Tally; and 3) an average monthly credit card spend based on the user’s spend while using Tally.

How does Tally save me money?

Tally uses your Tally credit line to pay your high APR credit cards, saving you money on interest. Tally’s late fee protection also ensures you never miss a payment.

DETAILS

Tally is available to people in Arkansas, Arizona, California, Colorado, Connecticut, Florida, Idaho, Illinois, Iowa, Indiana, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Missouri, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington, Washington, D.C., and Wisconsin.

Tally supports most cards from American Express, Bank of America, Barclays, Capital One, Chase, Citibank, Discover, First Bankcard, Fifth Third Bank, US Bank and Wells Fargo, as well as cards from Amazon, Best Buy, Home Depot, Macy’s, Sears, Target, TJ Maxx and Walmart.

The Tally app and servicing is only available in English. If there is any discrepancy between translations, the English version prevails over other translations.

Tally Technologies, Inc. (NMLS # 1492782) https://nmlsconsumeraccess.org/

Category : Finance

Related searches