Varo: Mobile Banking

Welcome to mobile banking that charges no monthly fees, lets you get paid up to two days early with direct deposit^, offers easy automatic saving tools, and gives you new ways to manage your money. Forget everything you know about banking. This is banking that actually helps.

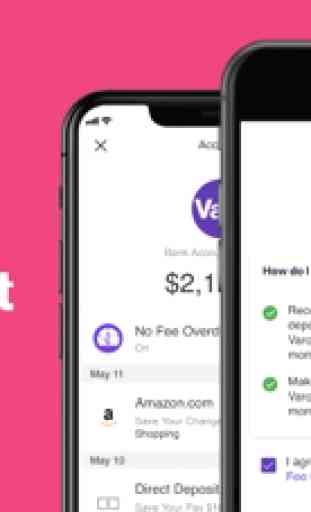

LET’S DITCH THESE FEES

Your Varo Bank Account comes with a Varo Visa® Debit Card — which you can safely lock in your mobile banking app — but none of these fees:

- No Fee Overdraft up to $50 (see requirements below)

- No fees at 55,000+ Allpoint® ATMs worldwide

- No foreign transaction fees

- No monthly maintenance fee

- No ACH transfer fee

- No debit card replacement fee

Plus:

- No minimum balance requirement

- Get paid up to two days early with direct deposit^

MANAGE YOUR MONEY EASILY

Your Varo Bank Account helps you stay in control of your money.

- Instantly send money to anyone who uses Varo

- Deposit checks in the app

- We’ll mail checks for you for free

- Track spending and account activity with instant alerts

- Link external accounts to see all your outside finances in one place

- Transfer money to and from external accounts

SAVE AND EARN MORE

Save and earn money easily and automatically. First get a Varo Bank Account, then set up your high-yield Varo Savings Account.

-Automatic savings tools let you save money without thinking

-No minimum balance requirement to earn interest

-Start earning 1.92% APY*, then earn 2.80% APY* if you meet these three requirements each calendar month:

Keep a savings balance of $50,000 or less

Make at least five qualifying Varo Visa Debit Card purchases each calendar month, AND

Receive total direct deposits of $1,000 or more in the same calendar month

NO FEE OVERDRAFT REQUIREMENTS

LET’S DITCH THESE FEES

Your Varo Bank Account comes with a Varo Visa® Debit Card — which you can safely lock in your mobile banking app — but none of these fees:

- No Fee Overdraft up to $50 (see requirements below)

- No fees at 55,000+ Allpoint® ATMs worldwide

- No foreign transaction fees

- No monthly maintenance fee

- No ACH transfer fee

- No debit card replacement fee

Plus:

- No minimum balance requirement

- Get paid up to two days early with direct deposit^

MANAGE YOUR MONEY EASILY

Your Varo Bank Account helps you stay in control of your money.

- Instantly send money to anyone who uses Varo

- Deposit checks in the app

- We’ll mail checks for you for free

- Track spending and account activity with instant alerts

- Link external accounts to see all your outside finances in one place

- Transfer money to and from external accounts

SAVE AND EARN MORE

Save and earn money easily and automatically. First get a Varo Bank Account, then set up your high-yield Varo Savings Account.

-Automatic savings tools let you save money without thinking

-No minimum balance requirement to earn interest

-Start earning 1.92% APY*, then earn 2.80% APY* if you meet these three requirements each calendar month:

Keep a savings balance of $50,000 or less

Make at least five qualifying Varo Visa Debit Card purchases each calendar month, AND

Receive total direct deposits of $1,000 or more in the same calendar month

NO FEE OVERDRAFT REQUIREMENTS

Category : Finance

Related searches